Getty Images/iStockphoto

Rolling recession explained: Everything you need to know

Talks of a looming recession and tech layoffs dominated the news in 2022 and 2023, but job and spending reports have outpaced predictions. Enter the term 'rolling recession.'

During a recession, an economy's overall output starts to decrease in at least two consecutive quarters. Some recessions are one large financial impact, while others are a gradual slowdown, and a rolling recession describes a hybrid scenario.

In a typical hard-landing recession, thousands of jobs are lost, consumers slow down spending and the economy shrinks. In a soft-landing recession, the economy slows down to a steady pace with limited labor market cuts, while waiting for inflation to decrease. Gross domestic product (GDP) is a key indicator of a possible recession and measures economic growth.

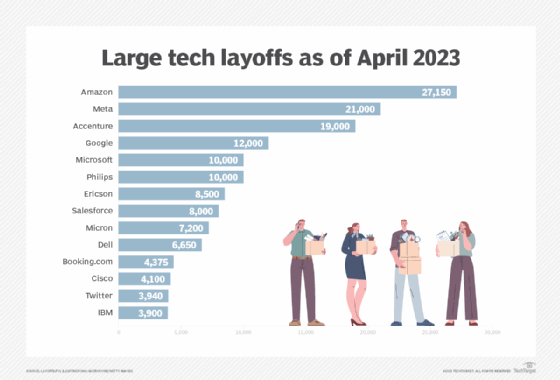

In 2022 and 2023, news about a recession was met with some contradicting statistics. Despite mass tech layoffs saturating the news, the U.S. unemployment rate of 3.4% in January 2023 is at its lowest since May 1969, according to the U.S. Bureau of Labor Statistics (BLS). Other employment sectors remained strong.

Economists are using the term rolling recession to describe economic conditions in 2023. A rolling recession may not describe all economic turns, but there are patterns with various contractions going through different sectors.

What is a rolling recession?

A rolling recession describes an economic downturn that only affects some sectors at a time. With a hard recession, most sectors are hit at the same time with layoffs and financial struggles. During a rolling recession, various sectors take financial downturns at different times. After those sectors recover, the slowdown "rolls" to other areas.

The overall economy never takes a large dip. Typically, the job market stays relatively strong in a rolling recession. A rolling recession is in constant motion, so it prevents a large-scale market crash.

Rolling recession indicators

Housing was the first sector to take a hit in 2022. Property prices increased during the COVID-19 pandemic when demand was high. The Federal Reserve started increasing interest rates in March 2022, which also continued to drive up the price of homeownership. Some consumers can no longer afford housing with the higher costs.

In 2022, existing home sales receded for 11 straight months and were down 34% from 2021, according to a National Association of Realtors report. The report also stated that this was the first annual drop since 2009.

New home construction went down for the fourth straight month in December 2022. The U.S. Census Bureau announced that new home construction was 26.6% lower in December 2022 than in December 2021.

After housing started to fall, manufacturing started to decline over five months due to a decrease in consumer spending and lower demand for U.S. exports.

The tech sector laid off thousands of workers in late 2022 and early 2023. The industry is seeing a slowdown from the pandemic and is returning to pre-pandemic sales. Large tech companies, such as Amazon and Meta, hired a significant number of workers during the pandemic when demand was high. As demand for tech falls, companies are downsizing staff. Moreover, during an economic downturn, some companies are turning to tech innovation to plan for the future, such as AI technology.

Outside of tech, other job markets have been strong, and nearly 517,000 jobs were added, beating economist predictions, according to the BLS January jobs report. Industries with large gains in employment include hospitality, leisure and healthcare, showing economic strength. The tech sector is not all doom and gloom as some areas are still hiring beyond the larger, well-known companies.

Normal recession vs. rolling recession

A typical recession has concrete causes and is set off by one major event. An economic downturn can be caused by different scenarios, such as high interest rates, low consumer confidence, an asset bubble bursting or a stock market crash. The 2008 subprime mortgage lending crisis is an example of an asset bubble bursting to cause a recession. When several subprime loans defaulted, some banks faced financial issues. In another example, the stock market crash of 1929 was one of the main causes of the Great Depression in the 1930s. The crash was due to previously overpriced stocks and overconfidence that turned to fear and bank runs for money that banks couldn't fully liquidate.

The causes of a rolling recession may be more complicated because smaller events can lead to a domino effect and only hurt certain industries. The COVID-19 pandemic slowed down service demands, but goods were in high demand because many people were stuck at home and working remotely. Now, as more people start moving away from pandemic life, demand for services is expanding, while manufactured goods are not purchased as often.

When consumer confidence is low, spending decreases and causes economic growth to slow. In June 2022, prices for everyday essentials, such as gas, eggs and groceries, hit an all-time high of 9.2% compared to the typical 2% increase, according to the Federal Reserve.

In addition to higher prices, high interest rates make it harder to borrow money as it becomes more expensive to take out a loan. Due to the rise in cost, consumers and businesses are less likely to make bigger purchases. This can also be seen in the downturn of the housing market -- not only because of higher interest rates, but also because more people are working remotely.

Reduced spending leads to decreased demand for both services and goods, affecting business revenue. The lower demand then causes cutbacks in production, so businesses hire less and may also decrease the number of employees. Because businesses are also looking for ways to lower expenses during inflation, employee cutbacks are typically first because wages are one of the largest expenditures.

When spending goes down, inflation starts to decrease. If the interest rates are too high and the economy slows down too much, a recession begins.

History of rolling recessions

This is not the first time the U.S. has seen a possible recession like in 2022 and 2023. In the 1960s, the automobile industry was globalized, hurting domestic auto sales and production. The recession lasted 10 months, GDP declined around 2.4% and unemployment hovered around 7%. However, cumulative GDP almost doubled after this brief slowdown.

Another example of a rolling recession was in 2016 when the U.S. dollar price ran high and hurt U.S. exports because of the increased cost to other countries. The manufacturing sector saw a downturn, and commodity prices also decreased farm revenue and oil prices. However, other sectors, such as housing and technology, were not affected.

What does a rolling recession mean for consumers?

The idea of a recession has been in the news for much of 2022 and into 2023. Some industries are laying off workers, and some people are struggling to pay bills as inflation continues.

GDP tracks the economy and was higher than expected in the fourth quarter of 2022. However, some portions of the economy are starting to slow down, so the mixed signals are pointing to signs of a possible rolling recession. Consumers faced higher prices in 2022, but they continued to spend.

A recent BLS report announced the Consumer Price Index showed that prices grew 0.5% in January. The largest contributor to this price increase was housing. In addition, nearly half of other monthly use items, such as gasoline, food and natural gas, increased.

Even with higher inflation, some industries have seen growth. For example, travel spending increased in December above 2019 levels, according to a U.S. Travel Association report.

The pandemic brought pent-up demand from consumers on services. Parts of the economy are still strong, and retail spending was up 8.8% from January 2022 to January 2023, according to a report from Mastercard.

Economists are still unsure if the U.S. will hit a soft or hard recession in 2023; however, signs are pointing to a possible rolling recession.