Rymden - stock.adobe.com

6 remote work legal risks to consider

Since the workforce shifted to remote during the pandemic, companies are finding new legal considerations with remote employees such as taxes, permits and reimbursement laws.

The pandemic showed that some people could work from home, but the shift to remote work also comes with some legal risks that employers need to consider.

As the dust settles following the shift of forced remote work during the pandemic, there have been class action lawsuits from remote employees seeking reimbursement for business-related expenses. Some states even have laws mandating reimbursement. Many companies are continuing to navigate issues they may not have been aware of prior to switching to remote work.

There are some remote work legal risks -- along with reimbursements -- that businesses must address to help their employees.

1. Payroll and tax requirements

If employees work from home in a different state than where a business is located, there are some unique considerations for payroll. Employees pay taxes to the state in which work is completed -- also known as the physical presence rule. Even if the company does not have a physical office in that employee's state, the company should still withhold both state and local taxes from the employee's home state.

But taxes can be more complicated if an employee works a hybrid position and in two different states. Some states -- such as New York and New Jersey -- have reciprocal laws where an agreement is made between states to withhold money from the employee's home state. So if an employee lives in New Jersey and works in New York, the employee pays taxes to New Jersey.

Some states also require employee withholding for local taxes -- city, county and school district income taxes -- according to the American Payroll Association, if employees live in one of these states:

- Alabama

- Colorado

- Delaware

- Indiana

- Kentucky

- Maryland

- Michigan

- Missouri

- New York

- Ohio

- Pennsylvania

- West Virginia

Local taxes are typically withheld from the employee, but there are some taxes employers may need to pay.

For hourly employees, companies also need to consider how to track time. Be sure to address work hours and how to handle overtime.

Businesses should talk to an accountant or a tax adviser to make sure the classification and withholding are correct for the remote workforce if there are any questions.

2. Home office and expense reimbursement

Employers need to consider reimbursement policies for equipment that employees use to work from home. Businesses should put this policy in writing so remote employees know exactly what the company will reimburse.

There are some hidden costs of working from home to get the needed equipment and space to work. The following expenses are frequently reimbursed:

- internet

- postage

- phone use

- office supplies

- ergonomic desk and chair

- printer and printing supplies

- subscriptions for services such as Zoom

Many companies supply a computer and smartphone for remote employees. The reimbursement applies to the usage and necessary apps.

Nearly one in four Americans has a disability, according to the CDC. For remote employees with disabilities, companies may be required to reimburse or provide equipment and services for digital accessibility to work remotely. Failure to comply with these laws may leave a company at risk of lawsuits claiming disability discrimination. The Americans with Disabilities Act states that any employee disclosing their disability can request reasonable accommodations to complete their jobs.

When an employer reimburses home office equipment, this equipment is the company's property. Businesses should add a disclaimer to the employee handbook explaining what an employee should do if they leave their job -- such as how to return the equipment.

There are no federal laws requiring employers to reimburse remote workers. However, the Fair Labor Standards Act does require companies to reimburse employees making minimum wage, or employees whose earnings drop below the state minimum wage after paying expenses.

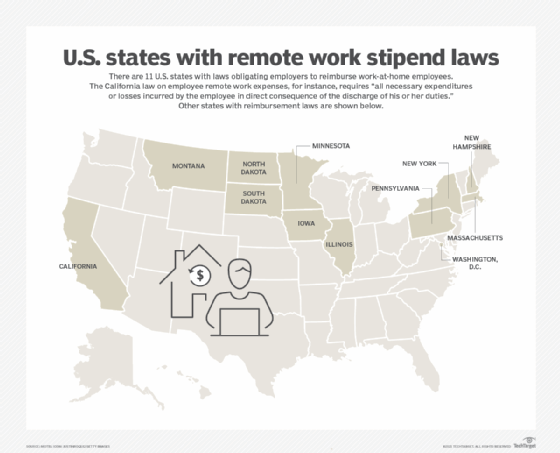

There are 11 states -- along with Washington, D.C. -- with reimbursement stipend laws including the following:

- California

- Illinois

- Iowa

- Massachusetts

- Minnesota

- Montana

- New Hampshire

- New York

- North Dakota

- Pennsylvania

- South Dakota

The requirements are not the same in each state, so be sure to check with the state labor office.

3. Permits for remote employees

Several municipalities require remote workers to get a home occupation permit. Even if the employee does not operate the business from their residence, companies may still need to get a license or permit. Since the lines can be blurry and depend on the type of business, businesses should contact the employees' cities or counties for zoning and permit laws to ensure compliance.

Some of the states with the strictest permit and regulation laws, according to global business researcher Wolters Kluwer, include the following:

- Alabama

- California

- Florida

- Tennessee

- Virginia

4. Workers' compensation insurance coverage

Most states require businesses to cover employees with workers' compensation coverage. However, the rules may not be as clear for remote workers injured on the job. Remote workers can claim benefits if they are hurt on the job, but state laws differ on the definition of a work-related injury.

Companies should set clear guidelines on both the job duties and work hours for remote employees to help determine what is a work-related injury.

Some employees may not be able to have a formal workspace, so they work from a couch or kitchen table. If employees sit in these positions frequently, they increase their risk of injury. In addition to providing workers' compensation insurance, businesses should train employees on how to work ergonomically in various scenarios to prevent eye and back strain.

Ergonomic tips include the following:

- Take breaks throughout the workday.

- Use natural lighting.

- Stand and walk periodically.

- Follow the 20/20/20 rule, which is looking away every 20 minutes at something 20 feet away for about 20 seconds.

- Ensure the computer screen is at eye level.

5. Company 'on-the-clock' policies

One of the biggest advantages of working from home is flexibility, but that doesn't mean employees shouldn't respect company time. No matter what a company's physical office policies are for employees, it's important to make sure that remote work policies are similar. For example, if a company has a no alcoholic beverages policy in the office, the same should go for remote employees.

When staff members are on company time, they represent the company. For policies such as the employee code of conduct, it's vital to set company times to be upfront with remote employees to know which behaviors are not tolerated. Let the remote staff know that they should follow the same rules as office employees during this time.

6. Foreign qualification to do business in other states

For companies formed as a limited liability company (LLC) or corporation, they must consider employees working in an additional state other than the one where the corporation was formed. Depending on the type of business and how long employees are doing work in that non-registered state, companies may need to qualify the LLC or corporation in that foreign state.

Basically, businesses need a state's permission to conduct business. To qualify, businesses need to register in the new state and show they are in good standing with their current states.

After the business receives foreign qualification, the LLC or corporation will need to follow other compliance obligations, such as filing an annual report and maintaining a registered agent, which provides a physical address within the state to receive documents.