Top 7 NFT use cases for business

NFT adoption remains in its infancy despite a wealth of potential applications. Knowing the most common business use cases can help in planning an NFT deployment strategy.

When the hype surrounding non-fungible tokens rose to a fever pitch in 2021, many potential investors wondered if NFTs were a boon or a bubble. Although some of the buzz has fizzled, and it is unclear whether NFTs will achieve niche or mainstream status, they remain promising for many applications. Understanding the early examples and potential use cases of this new technology is important for gauging their value and sustainability.

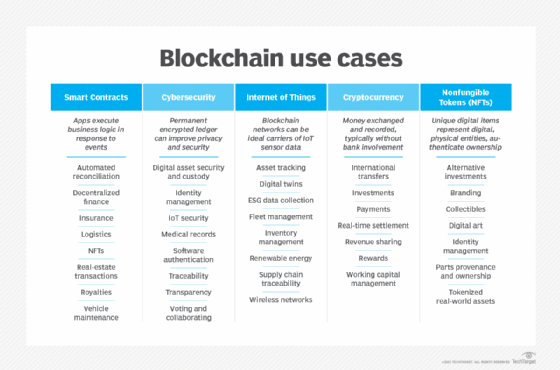

Theoretically, NFTs -- digital tokens of virtual and real-world assets -- can be applied to any item. Digital art and collectibles have been the primary applications, but the list of potential applications is long and covers a broad assortment of industries, from fashion and sports to finance and real estate. Although they're experiencing growing pains as a technology and financial instrument, NFTs nonetheless offer a means of making money from digitizing assets, monetizing intellectual property and verifying the authenticity of physical assets on the internet. They are useful for establishing the authenticity of unique, collectible and valuable items.

What are non-fungible tokens (NFTs)?

NFTs are one-of-a-kind cryptographic assets that exist on blockchain technology. Due to their uniqueness, NFTs are non-fungible, which means they are not mutually interchangeable. This contrasts with fungible assets -- such as a one-dollar bill, a piece of gold or a bitcoin -- each of which can be interchanged with like items. NFTs are based on decentralized finance (DeFi), in which assets and market players interact on a decentralized, peer-to-peer basis. DeFi eliminates the involvement of intermediaries.

Converting a real-world asset into a digital asset can make processes more efficient and provide easier verification of the originality and scarcity of information on digital platforms. A key characteristic of NFTs is exclusivity: They can restrict the rights of individuals to specific assets.

The allure of NFTs lies in their digital representation of physical assets combined with unique identification as well as tamper-resistant blockchain smart contracts. Thanks to blockchain, the tokens generally cannot be copied, removed or destroyed. Blockchain also enables NFTs to be tracked back to their owners and eliminates the need for third-party verification. Blockchain protects the ownership of the NFT, giving the owner the exclusive right to conduct transactions and transfer the token. Even the issuer of the NFT cannot replicate or transfer it without the owner's permission.

NFTs also play an important role in Web 3.0, which many vendors and observers are promoting as the next version of the internet. Web 3.0 will likely be built on blockchain and rely heavily on cryptocurrency and NFTs for commerce. The same goes for the metaverse, a slowly emerging 3D, virtual world based on the Web 3.0 technologies.

As the NFT market develops, buyers and sellers should proceed cautiously. Potential challenges include scalability limitations, price volatility, legal and regulatory restrictions, and lack of standardization. Plus, while NFTs offer some security benefits, the decentralized wallets in which they are stored aren't hacker-proof. Another concern is the energy used in the minting of tokens. However, the NFT industry is studying ways to make the technology more environmentally sustainable.

Economic factors are another obstacle.

The late 2022 collapse of the FTX cryptocurrency exchange clobbered demand for NFTs, even though the two markets are unrelated, said Avivah Litan, an analyst and vice president at Gartner, adding that turmoil in the global economy and banking community hasn't helped. "We're definitely in a crypto winter, but there are some solid use cases."

Mike Bechtel, chief futurist at Deloitte Consulting, concurred. "We were in a bit of a trough of disillusionment and headed back to a plateau of opportunity," Bechtel said. "Smart contracts, a superset of NFTs, are still in discussion. There continue to be a lot of pilots, prototypes and early action. I do think we'll see a gradual rebound of attention to smart contracts and NFTs."

NFT use cases

Although broad-based application of NFTs has not yet occurred, the groundwork is being laid for more widespread uses, proponents of the technology assert. NFTs generated a lot of attention and became a reality in the arts and entertainment worlds. Yet, beyond these early applications, many real-world business use cases -- from licensing and certifications, to real estate and finance, to supply chain management and logistics -- are still at an early stage.

Here's where things stand.

Art, luxury brands, sports and memorabilia

Applications for NFTs initially took off primarily in the collectibles, art, gaming and virtual worlds. In art, early use cases include Cryptopunks, which are algorithmically generated pixel images, and Cryptokitties, a virtual game. Other examples include the following:

- The NFT associated with "Everydays: The First 5000 Days," a collage of images created by artist Mike Winkelmann (better known as "Beeple"), sold for $69.4 million in one of the most expensive NFT transactions.

- Also among the most expensive NFTs ever sold, Wikileaks founder Julian Assange and anonymous artist Pak's Clock NFT went for $52.7 million in February 2022. Clock shows a timer that counts the number of days Assange has spent in prison.

- Bored Ape Yacht Club (BAYC), a collection of thousands of NFTs in which art acts as a collector's item and club membership card, has also made big money. These NFTs, which represent cartoon-like apes, follow a template, but their metadata includes different clothing, accessories and backgrounds.

Like artwork, digital fashion can be authenticated and traded on blockchain but not copied. From major fashion houses -- including Gucci, Louis Vuitton and Dolce & Gabbana -- to companies like Adidas and Forever 21, the fashion industry can use NFTs to boost brand awareness. The NFTs come in the form of virtual garments customers can put on in virtual environments, digital content with which owners can interact and digital twins of real-world creations.

NFT fashion applications include the creation of digital collectibles and wearables as well as fractional token ownership. With fractional ownership, many creators can contribute their work to a single virtual article of clothing, and every time the NFT is sold, they share the royalties.

Customers can "wear" a digital asset they've purchased using augmented reality (AR). Combining NFT and AR technology enables customers to collect, wear and trade clothing. Examples include the following:

- DressX and XR couture brands, which are selling extravagant digital garments people can "try on" using AR.

- Nike Dunk Genesis Cryptokicks, a collection of 20,000 NFT sneakers that owners can visualize through a Snapchat filter.

Some fashion retailers, including Coach and Gap Inc., have experimented with selling limited-run NFTs to select customers. Businesses in other retail industries -- for example, Starbucks -- are testing loyalty programs that use NFTs.

Sports tickets and other collectibles are also being tokenized. Examples of sports collectibles include "Moments," video clips of game highlights sold on NBA Top Shot, a blockchain-based trading card system.

Sports NFTs can be the trading cards that have long been popular with sports fans and investors, as well as the following:

- Highlights in which fans can watch video clips of their favorite moments.

- Team kits, which might include socks, hats and other memorabilia of favorite teams.

- Autographs, trophies and other memorabilia.

Crypto-art, sports NFTs and other entertainment applications derive most of their value from the ability to provide digital verification of their authenticity and ownership, a huge benefit in markets for art and luxury brands that are plagued by fraud and counterfeiting.

NFTs for art and other applications cannot be altered or copied, which is important in preventing plagiarism and theft and helps artists monetize their work. Additionally, NFTs give digital art the qualities of being original and rare, similar to physical art. They can be tracked from their origin with an artist or seller, and they enable anyone to see the selling price as well as how many times the artwork has been sold.

Preventing plagiarism and fraud are also crucial in the media and film industries, which are still-emerging markets for NFTs. Files can be appended to the blockchain as an NFT to prevent them from being copied or shared without the owner's permission.

Identification, certification and documentation

Although personal identity management is one area in which NFTs can shine, it's still early days for this type of application. Because NFTs contain code with a unique set of information, they can be used to tokenize documents, such as degrees, academic certificates, licenses and other qualifications, medical records, birth certificates and death certificates.

The identity or certification can be issued directly over the blockchain as an NFT that can be traced back to the owner. Employing NFTs to digitally store and protect medical histories, personal profiles, education and address details gives users better control of their data and can help prevent identity theft.

Organizations exploring NFT applications in identification, certification and documentation include the following:

- Romania's National Institute for Research and Development in Informatics set up an NFT marketplace for individuals to access, transfer and store government documents on a digital ledger.

- Duke University used NFT certificates for students in a program about the fundamentals of blockchain technology.

- University of Georgia's New Media Institute was among the first to offer degrees as NFTs, along with the option of paper certificates.

A similar concept could be applied to NFTs representing driver's licenses, visas or passports. While NFTs could help eliminate forgeries, details about the technology -- which will possibly include a mobile app -- have yet to be worked out.

Additionally, NFTs can be used for vaccine passports to prove whether an individual has been vaccinated or tested for a disease. The Republic of San Marino tested the waters in 2021 with the adoption of COVID-19 passports. Despite NFTs' potential for authenticating vaccine documents and reducing counterfeits, NFT applications in this area are minimal, partly because requiring vaccine passports -- even paper ones -- has been a political and ethical minefield in the United States and other countries.

Healthcare and medicine

Although NFTs in healthcare are still an emerging trend, they can be used to store medical information, including patient history as well as lab and imaging results. Patients would have easier access to their own health information and data transparency in clinical care, and medical research would be improved. Unique genetic information can also be stored on NFTs to help researchers and pharmaceutical companies improve treatments. Additionally, NFTs can store information on the ownership and attribution of medical research and discoveries, which would help protect intellectual property rights and facilitate licensing and royalty agreements.

However, NFTs in healthcare will require a robust infrastructure, such as a blockchain-enabled "biodata" platform. The new systems must be interoperable with existing ones, and steps must be taken to keep the data secure and eliminate risks such as theft, which has hit some commercial NFT platforms. Other concerns that healthcare NFTs raise relate to regulatory requirements, compliance and privacy.

Despite such challenges, some startups are using NFTs in healthcare:

- NFT marketplace Aimedis lets patients process their data as NFTs and forward it to their healthcare providers.

- Enjin, a provider of services for Ethereum blockchain developers, teamed up with digital platform Health Hero to create Go, which enables users to create a well-being NFT of their health and activity requirements.

Real estate

NFTs have applications for selling real estate in both the virtual and real worlds. In the virtual world, digital real estate applications have gained ground in games such as Decentraland, where participants create and purchase areas in a virtual world. Using NFTs ensures that the objects' original producers and owners can be identified.

Another early example of virtual real estate is the digital Mars House, which represents a home framed in glass and surrounded by neon lights. Although the "home" sold for $500K in 2021, the owner cannot go inside because it is virtual. Other examples of virtual real estate include a Twitter page selling virtual properties and real estate transactions in virtual role-playing games like Superworld.

Virtual real estate NFTs are exchangeable on NFT marketplaces through transactions that are more efficient and transparent than real-world real estate transactions. Ownership of virtual real estate is recorded on a decentralized ledger through an NFT, rather than using a traditional deed or title. Holders are the perpetual owners of their digital items.

While there are already several examples of virtual real estate sales, real-world applications of NFT are in their infancy. In the future, NFTs and blockchain could provide an efficient way to check titles and verify ownership history. However, this type of application raises security concerns. Although blockchain helps make NFTs more secure, they can still be hacked. Other issues need to be ironed out. For example, if a private key to an asset on blockchain is misplaced, access to the asset could be lost.

A physical real estate NFT is produced by registering a real-world asset, such as a house, office or business premise, on a blockchain. The result is a record of ownership and related transactions now and in the future. Asset transfers can be faster and more secure. The deed can be broken into multiple NFTs for joint or shared ownership. Fractional ownership NFTs act like stocks, since they are share-based investments.

Another application with the potential to alter the real estate landscape is NFT-based mortgages, which are more traceable and transparent than traditional ones. This type of NFT stores mortgage metadata, such as information on liens, borrower data and transactions, on a blockchain. As NFTs are made to be unique digital assets that users can't copy or exchange, it is more difficult for cybercriminals to forge or alter mortgage materials.

However, a number of challenges will need addressing. NFTs are more difficult to sell than a traditional home, and the value of an NFT-based home can fluctuate significantly. Additionally, it may be difficult to enforce terms and conditions, as storing NFTs on decentralized platforms is not under the purview of traditional financial institutions.

Finance

The financial community, which has long considered high-end physical collectibles part of investors' portfolios, is exploring NFTs as "assets, tech solutions and marketing tools," according to market researchers at Insider Intelligence. Banks such as Goldman Sachs, JPMorgan and Nomura are looking into NFTs.

They have potential in the financial sector because they aid in recording and transferring virtual assets on a blockchain network while helping keep sensitive information private and secure. They also help manage royalties: With NFTs, it's clear who owns an asset and who should be paid.

NFT banking is an emerging application in which users create an account on a platform that supports the technology. This type of banking is designed to be more secure and private than traditional banking because NFTs are built on blockchain, which uses cryptography and usually can't be altered or reversed. Only the asset's sender and recipient can access the transaction details.

However, for NFT banking to be more widely adopted, security and scalability concerns must be addressed. Also, the technology must be more user-friendly and accessible.

Another type of financial system is DeFi, which gives users access to financial services without relying on traditional financial institutions like banks or brokerages. According to cryptocurrency exchange Binance, NFTs in DeFi can be used in the following ways:

- As collateral for obtaining loans on DeFi platforms.

- For borrowing and lending on DeFi platforms.

- For forecasting how an event such as an election or sports event will turn out. These NFTs would be traded in prediction markets.

- To represent and manage portfolios of assets like real estate or artwork.

NFT crowdfunding platforms have potential for future entrepreneurs as Web 3.0 emerges. Crowdfunding campaigns encourage individuals to participate by contributing money to help an enterprise reach its goals, such as building a prototype, launching a product or creating a marketing campaign. NFTs are used to document the contributions, and those who invest in the fundraising campaign own these NFTs. Not-for-profits, such as UNICEF and the World Wildlife Fund, have used NFTs for fundraising.

By formulating their own rules for fund allocation and use in the smart contract, creators gain increased flexibility and control over their projects. With this type of crowdfunding, creators can raise funds by selling digital assets to supporters, who can buy NFTs to invest in digital assets and support creators they believe in. These NFTs offer a way to verify ownership and monitor the distribution of funds, which can then be distributed fairly and transparently among project creators and contributors, avoiding potential scams.

NFT crowdfunding platforms offer the following benefits:

- As unique, scarce assets, NFTs cannot be replicated.

- Because NFTs are on blockchain, they are transparent and auditable.

- Since NFTs are automated using smart contracts, their distribution and funds can be handled automatically, based on predefined rules.

- NFTs are decentralized and not controlled by one entity, so censorship and other interference can be avoided.

Supply chain and logistics

The main function of NFTs in the supply chain lies in authenticating products, ensuring their quality and verifying their origin. Although in the early stages, NFTs are suitable for logistics applications because of their immutability and transparency, which keeps supply chain data authentic and reliable. In food and other perishable industries, knowing where goods have been, for how much time, is crucial.

NFTs eliminate counterfeiting, help trace the movement of goods along the supply chain and assure uniqueness, all of which are applicable to supply chains for luxury fashion brands. For businesses like the auto industry, NFTs can also provide information about each material and component in a particular product, which could help with cost control. NFTs would also be useful for industries looking to track the use of ethically sourced, recyclable and sustainable materials.

NFTs offer the promise of faster, more efficient supply chains, Deloitte's Bechtel said, adding that "for items moving from China to the U.S., or vice versa, one trusted handshake feels pretty good, rather than potentially hundreds."

Domain name ownership

With a blockchain domain system, owners can control their domains using private keys. In contrast, the Internet Corporation for Assigned Names and Numbers controls the standard domain name system, and there is limited oversight of domains. This raises concerns about censorship and security. In contrast, NFT domain names are decentralized, recorded permanently in a public registry and impervious to deletion or alteration by a third party.

NFT domain names are similar to traditional top-level domains that end in .com but have endings like .crypto and .eth. NFT domains are also referred to as Web 3.0 domains, decentralized domains or crypto domains.

According to cryptocurrency publication CoinCentral, Web 3.0 domains are usually one-time purchases, unlike the fee-based Web 2.0 domains that must be renewed annually. NFT domains are also user-owned, so centralized entities like GoDaddy or Google Domains can't censor or repossess a domain whenever they want. Domain NFTs can also serve as cryptocurrency public addresses, so the domain can send and receive other compatible cryptocurrencies and tokens as payment.

NFT domains marry cryptocurrency, digital identity and internet infrastructure in a way that could be the early wave of the metaverse era, according to CoinCentral.