What is the triple bottom line (TBL)?

The triple bottom line (TBL) is a sustainability-focused accounting framework that includes social, environmental and financial factors as bottom-line categories. Businesses, nonprofit organizations and government entities use the TBL to evaluate not only their financial performance, but the overall economic value they create and their social and environmental impact.

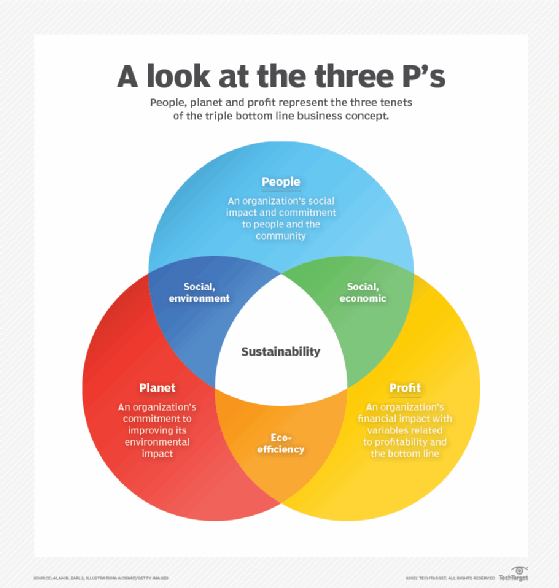

Rather than only focusing on the standard financial bottom line, the TBL adds broader economic, social and environmental concerns to help measure how an organization affects its employees, the surrounding community and the environment as a whole. This is typically measured using the three P's: people, planet and profit.

The idea behind the TBL is to gauge an organization's commitment to business sustainability and corporate social responsibility. Large organizations in particular tend to have a big effect on communities and the environment, so expanding their typical bottom-line considerations can help improve people's lives and the planet's well-being. TBL results can also be factored into environmental, social and governance (ESG) initiatives that focus on the adoption of sustainable and ethical business practices.

The three P's

The term triple bottom line was coined in 1994 by John Elkington, a British author and business consultant who focuses on sustainability issues. He articulated the three P's as the TBL's measurement components the following year. Although there's no single established way to measure them, the following common methods are typically used:

This article is part of

ESG strategy and management guide for businesses

- People. This measures an organization's social impact, including its commitment to not just shareholders but all stakeholders: employees, suppliers, customers, the residents of local communities and more. The impact on future generations of people can also be considered. Factors that can be used to measure this bottom line include a safe working environment; fair pay; diversity, equity and inclusion initiatives; the use of small and minority- or women-owned businesses as suppliers; support for human rights; volunteer efforts; and charitable donations.

- Planet. This measures an organization's environmental impact and efforts to operate in a sustainable way. A key metric is reducing carbon footprints by cutting greenhouse gas emissions through steps that include lower energy usage, reduced consumption of and reliance on fossil fuels, improved waste management, streamlined shipping practices and the use of ethically sourced materials. The IT department can play a big role by implementing green computing initiatives that make data centers and IT systems more energy efficient.

- Profit. Organizations commonly use their financial results to gauge business performance. But as part of the TBL, this bottom line goes beyond simple profit measurements. For example, it can include factors such as ethical business practices and fair treatment of customers and suppliers. The added economic value a company creates for business partners and communities can also be included. Because of those considerations, this is sometimes called prosperity instead of profit to reflect that it doesn't only involve how much money a company makes.

Why is the triple bottom line important?

The triple bottom line is an important part of sustainability efforts in many organizations. It's a management concept that was designed to prompt business leaders to look beyond standard measurements of profit and loss and to think more deeply about how their company operates. For example, the TBL encourages executives to consider everyone who is affected by the organization. As a result, it can help drive business transformation within companies.

The TBL could also help mitigate some of the effects of climate change, especially when it's used by large businesses that consume substantial amounts of energy and other resources and often contribute heavily to air and water pollution. Through its environmental aspects, the framework points toward a more sustainable future for the climate, at least to the degree that it drives changes in organizations.

From a high-level business perspective, the TBL framework provides the following opportunities for organizations:

- New ways to generate revenue and profits, such as attracting new customers who want to lessen their own impact on the environment.

- A healthier work environment for employees.

- An improved standing in surrounding communities.

Business benefits of the triple bottom line

Organizations that use the triple bottom line can also gain tangible business benefits, such as the following:

- Lower energy consumption and costs, plus reduced CO2 emissions and carbon footprints that can be highlighted in corporate marketing efforts.

- Higher employee retention rates and an increased ability to attract new hires.

- Enhanced brand perception and reputation that can lead to higher sales.

- Improved productivity and reduced operating costs through operational efficiencies.

- Increased transparency and accountability in business operations, potentially attracting new investors.

Challenges and criticism of the triple bottom line

However, the triple bottom line also comes with its share of criticism. This includes the following:

- Because it's a general framework, there are no specific guidelines on how to accurately measure the TBL. It can be challenging to quantify the people and planet bottom lines to the same level as the profit bottom line.

- The lack of a measurement standard also means business leadership can engage in a minimal effort to follow the framework, while trying to reap the branding benefits of claiming to do so.

- Operational costs can increase, at least initially, because of the need to invest in new technologies and processes. In turn, that could require customers to pay more for products if an organization raises prices to cover the higher costs.

Elkington himself has criticized the way the TBL is used by many companies. In an article he wrote for Harvard Business Review in 2018, he said the framework "wasn't designed to be just an accounting tool." Far beyond that, it was intended to drive changes in capitalism as a whole. But, he added, the TBL "has been captured and diluted by accountants and reporting consultants." He also said there was too much focus on the financial performance of organizations instead of on their broader economic value.

For more on ESG strategy and management, read the following articles:

ESG audit checklist: Steps for success

ESG materiality assessments: What CIOs, others need to know

ESG metrics: Tips and examples for measuring ESG performance

Real-world triple bottom line examples

Oil company Shell was one of the first organizations to adopt the triple bottom line concept. It initially applied the elements of the framework in a company report published in 1998 that posed this question on its cover: "Profits and Principles -- does there have to be a choice?" Shell went on to create a TBL-influenced sustainability plan and has continued to release a report on its efforts annually.

Some examples of other organizations that use the triple bottom line framework include the following:

- Novo Nordisk. The Denmark-based pharmaceutical maker has built the way it does business around the TBL, going so far as to incorporate the framework's principles into its company bylaws in 2004. Novo Nordisk has said the three pillars of the TBL "inform everything we do and guide every decision we make."

- Covestro. A maker of polymers based in Germany, Covestro also applies the TBL as part of its everyday business operations, with an overarching focus on sustainability. "Our decisions and activities must take account of the 'three Ps' with impact on at least two of them needing to be positive and at the same time not harming any one of them," the company states on its website.

- Unilever. The London-based consumer goods conglomerate has infused TBL ideas into the Unilever Compass, a business strategy it states is designed "to help us deliver superior performance and drive sustainable and responsible growth." The strategy includes various environmental and social goals for the company to achieve, plus a set of 10 "responsible business fundamentals."

- Ben & Jerry's. The South Burlington, Vt.-based ice cream maker combines a sustainable financial growth strategy with a focus on the environment and a "social mission" that seeks to help improve the quality of life locally and around the world. The company, which is currently parting ways from Unilever, has an independent board of directors who oversee its social aspects, brand integrity and product quality.

- Southwest Airlines. Dallas-based Southwest uses a TBL approach that it refers to as "people, performance and planet." The airline publishes an annual "One Report" on its TBL initiatives and associated ESG efforts, which include a 10-year environmental sustainability plan and longer-term goals. The report also contains yearly data on various environmental, employee, customer and community metrics.

- Patagonia. The Ventura, Calif.-based outdoor apparel company's business strategy focuses heavily on TBL principles. For example, Patagonia says it considers the social and environmental practices of external factories "equally with quality standards and business requirements." Also, the company is now jointly owned by a trust and an environmental nonprofit group, and all of its profits are distributed to the latter.

- Better World Books. Based in Mishawaka, Ind., Better World Books sells used books online and has a TBL-based business strategy of "doing well by doing good." That includes an annual grant program for literacy and educational nonprofits and libraries, plus practices such as donating books to people in need for each book purchased and offering carbon-neutral shipments to customers through an "eco-shipping" option.

- Lego. The Denmark-based toy maker uses a TBL approach as part of the sustainability efforts it details in an annual progress report. For example, Lego has invested in renewable energy sources that generate more power than it consumes and is aiming to make all of its core products from sustainable materials by 2030. The company also has partnerships with organizations such as the World Wildlife Fund and several LGBTQIA+ groups and donates Lego sets to needy children through its Build To Give charity campaign.

Future of the triple bottom line

The TBL framework is well aligned with the increased emphasis on ESG, sustainability and corporate social responsibility in organizations, a trend that has been driven partly by the expansion of ESG investing practices. That alignment could lead to wider use of the TBL in the future, as more organizations look for ways to measure and document their ESG and sustainability efforts.

Continued growth in the number of benefit corporations and Certified B Corporations should also drive further adoption of the framework because they both use its principles as a defining element.

B Corporations, or B Corps for short, are certified by B Lab, a nonprofit organization that measures the social and environmental performance of companies based on an impact assessment they fill out online. To get the certification, businesses are also legally required to consider the impact of business decisions on all of their stakeholders, not just shareholders. B Lab states that more than 8,000 companies have been certified as B Corps worldwide. Ben & Jerry's, Better World Books and Patagonia are three examples.

While B Corp is a voluntary designation, a benefit corporation is a legal business structure with corporate governance requirements that commit companies to consider all stakeholders and provide some type of public benefit as part of their operations. Benefit corporations can be registered in more than 30 U.S. states, as well as the District of Columbia and Puerto Rico. A company can also be both a benefit corporation and a B Corp -- for example, Patagonia is registered as a California benefit corporation.

New rules and regulations could also push more companies to use the TBL. For example, the European Union's Corporate Sustainability Reporting Directive, which went into force in January 2023, will require approximately 50,000 companies to report annually on their business risks and opportunities related to social and environmental issues and the effects their operations have on people and the environment. In March 2024, the U.S. Securities and Exchange Commission (SEC) adopted a rule that would require publicly traded companies to report on their climate-related risks and greenhouse gas emissions. The following month, the SEC issued a temporary stay after six federal appellate courts received challenges to this rule.

However, there's a backlash against ESG initiatives among some politicians, primarily Republicans, at both the federal and state levels in the U.S. For example, Congress in March 2023 approved a Republican-driven resolution to block a federal rule that enables retirement fund managers to consider ESG factors in investment decisions, although President Biden vetoed the measure. It remains to be seen whether anti-ESG legislation could negatively affect such initiatives and use of the TBL.

Editor's note: This article was updated in August 2024 to improve the reader experience.