What is market concentration?

Market concentration refers to how a market is distributed among competing companies. Also known as seller concentration or industry concentration, market concentration plays a vital role in determining the level of competition in a market.

A highly concentrated market indicates limited competition and more control by fewer companies; a low concentration reflects a competitive landscape with many players.

How market concentration is measured

Market concentration can be expressed using either the concentration ratio (CR) or the Herfindahl-Hirschman Index (HHI).

Concentration ratio

The concentration ratio, a common method of calculating market concentration, shows the combined market share of the top N companies in the market:

- CR4 refers to the market share of the four largest companies.

- CR8 measures the top eight companies.

A higher concentration ratio indicates less competition. If the CR4 is over 70%, it means the top four companies control most of the market -- suggesting oligopolistic or monopolistic conditions.

Herfindahl-Hirschman Index

The Herfindahl-Hirschman Index, also widely used, is calculated by summing the squares of each company's market share. The HHI gives more weight to larger organizations. Regulatory agencies like the U.S. Federal Trade Commission (FTC) and Department of Justice (DOJ) favor it when assessing mergers. HHI indicates the following:

- Under 1,500: unconcentrated or competitive market.

- Between 1,500 and 2,500: moderately concentrated market.

- Over 2,500: highly concentrated market.

Understanding these measurements helps to identify the types of market structures commonly influenced by concentration.

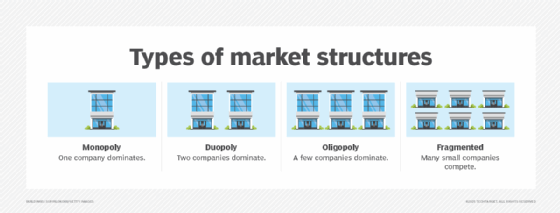

Types of market structures

Market concentration influences and reflects these market structures:

- Monopoly. One company dominates the market entirely, e.g., some utility providers.

- Duopoly. Two dominant companies control most of the market, e.g., Boeing and Airbus in commercial jet manufacturing.

- Oligopoly. A few companies hold significant market share, potentially leading to limited competition, e.g., smartphone manufacturers.

- Fragmented market. Many small companies compete, making the market highly competitive and dynamic, e.g., local restaurants or retail boutiques.

Why market concentration matters

Market concentration plays a crucial role in business strategy, economic policy and consumer welfare.

Business implications

For entrepreneurs and startups, knowing how concentrated a market is helps determine entry barriers and competitive risks. High concentration could require differentiation, innovation or niche targeting for the business to succeed.

Government regulation

Governments and antitrust authorities monitor market concentration to ensure fair competition. High concentration can lead to the following:

- Price fixing and collusion.

- Reduced innovation.

- Fewer choices for consumers.

- Barriers to market entry.

Agencies like the FTC, DOJ and European Commission use concentration metrics to evaluate mergers, acquisitions and anticompetitive behavior. The FTC's Merger Guidelines were updated in 2023 to more closely scrutinize deals that could stifle competition.

In recent years, rising digital market consolidation has brought market concentration back into the spotlight, especially in tech and healthcare.

Examples of market concentration

Here are several real-world examples of varying market concentration:

- Search engines. Google holds over 90% of the global market share, indicating a near monopoly.

- Mobile operating systems. Android and iOS together account for almost 100% of the mobile OS market -- a classic duopoly.

- Airlines. In the U.S., the top four airlines control nearly 70% of the domestic market, making it an oligopoly.

- Streaming services. While Netflix, Disney+, Amazon Prime Video and a few others dominate, the market is still evolving and could be considered moderately concentrated.

Although some concentrated markets arise naturally due to efficiency or innovation, unchecked dominance can lead to unfair practices. To address these risks, governments and regulatory bodies implement measures aimed at preserving competition and protecting consumers.

Negative effects of high market concentration

To address the risks, governments and regulatory bodies implement measures such as the following:

- Stronger antitrust enforcement.

- Increased scrutiny of mergers and acquisitions.

- Support for small businesses and startups.

- Laws that prevent predatory pricing or exclusive contracts.

In summary, market concentration is a key indicator of an industry's competitiveness. Understanding whether a market is fragmented, oligopolistic or monopolistic helps businesses plan strategically and helps regulators protect consumer interests. Tracking market concentration is more important than ever to prevent unfair dominance and make sure that innovation thrives.

The stronghold that major tech companies have on cloud computing is poised to extend to the AI market, as they possess the financial and computational resources necessary to scale this technology effectively. Explore how Big Tech's cloud oligopoly risks AI market concentration.