What is FinOps?

FinOps -- a combination of the terms finance and DevOps -- is a framework for managing operational costs across an organization, often in conjunction with cloud computing. An important goal of FinOps is to help engineering, finance, business and technology teams within the same organization achieve business value, maintain financial accountability and manage operational expenditure for cloud services.

The FinOps Foundation, a nonprofit trade association, developed the best practices for FinOps. FinOps goes beyond the goal of simply saving money and strives to drive revenue by helping cross-discipline teams collaborate to make the best decisions in the context of technology investments and cloud usage. The idea is that a business makes the best investment decisions, not just the lowest cost decisions.

What is the FinOps Foundation?

The concept of FinOps is closely tied to the FinOps Foundation. Though it doesn't set business or technology directives -- there's no correct way to execute FinOps -- the foundation promotes guidelines, best practices and training designed to help distributed teams running in the cloud take advantage of the economic benefits offered by cloud deployments. FinOps supporters seek to create strong communication between an organization's IT and finance teams so stakeholders can quickly and easily determine which cloud services are providing business value and which are not.

Today, the FinOps Foundation includes more than 23,000 individual members from more than 10,000 companies. The Foundation provides various FinOps training and certification programs, such as the FinOps Certified Practitioner certification, as well as the FinOps Certified Platform and FinOps Certified Service Provider recognitions.

This article is part of

What is cloud management? Definition, benefits and guide

History of FinOps

It's hard to cite a single timeline for FinOps because of its rapid emergence and diverse industry project involvement -- many organizations and contributors have influenced the recent emergence of FinOps. But it's worth considering its basic historical origins.

The fundamental premise behind FinOps is to help a business make the most efficient and beneficial technology investments. This might involve centralizing procurement, buying resources in volume and negotiating the best deals. However, this isn't a new idea, as businesses have sought cost management efficiencies in some form since the age of industrialization.

The dawn of the digital age saw the emergence of computing as a new type of manufacturing where data centers and computers took the place of traditional physical manufacturing equipment. Today, computing is often the very nature and product of the business itself, such as Google. Businesses systematically applied the concepts of basic finance and financial efficiency to data center facilities and IT infrastructure to ensure computing capital was procured and deployed in the most strategic, useful and cost-effective manner for the business.

The rise of cloud computing in the 21st century put a new emphasis on cost and cloud financial management. Cloud computing provides computing as a utility, enabling businesses and business leaders to access cloud infrastructure and services on demand through platforms from third-party cloud providers, such as Amazon Web Services (AWS), Google Cloud and Microsoft Azure. The loss of centralized procurement, gaps in financial accountability and complex cloud pricing structures rapidly led to financial waste in excess, redundant or unnecessary cloud computing usage.

The idea of FinOps arose as a means of applying traditional financial sensibilities to cost and resource management for outside services -- particularly cloud computing and multi-cloud usage within a variable budget -- while supporting dynamic business efforts such as DevOps. The idea is simple; rather than let every department manager or application stakeholder make their own cloud decisions, gather a collaborative cross-discipline group to achieve the following tasks:

- Evaluate workload needs.

- Create the most efficient cloud architecture for the application.

- Centrally negotiate the most efficient cloud pricing.

- Utilize cloud resources from a common pool.

- Apply best practices for budgeting, procurement, reporting, monitoring and management.

The FinOps Foundation was formed by the Linux Foundation on August 20, 2020. The purpose of the foundation is to advance the discipline of cloud financial management through best practices, education and standards. According to the Linux Foundation, the FinOps Foundation launched with strong support from several industry organizations, including Apptio, Cloudeasier, Cloudsoft, CloudWize, Contino, Kubecost, Neos, Opsani, ProsperOps, Timspirit and VMware.

FinOps phases

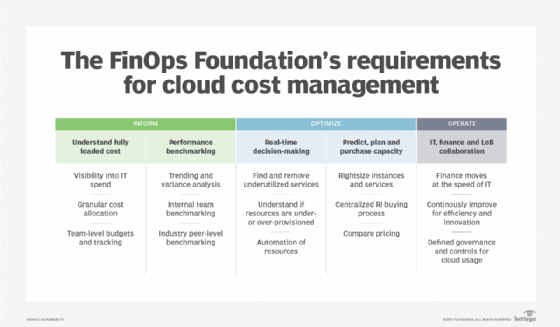

The FinOps Foundation recommends an iterative approach to managing the variable cost of cloud services. Best practices include the following three phases that should be continually managed:

- Inform. Cost allocation and management can't exist without accurate and timely information. Such visibility is the key to benchmarking, budgeting and forecasting, and is essential for determining return on investment and other business benefits. Information can include mechanisms such as resource tags and business mappings so that each cloud consumer can be readily identified and monitored. This phase is essential for setting a baseline for analysis, building benchmarks for key performance indicators and ensuring all stakeholders understand the financial implications of their cloud usage.

- Optimize. This FinOps framework analyzes the data gathered in the first phase to discover areas where spending can be reduced without sacrificing performance. Cloud cost optimization involves both cost and resource use. In some cases, optimization can rely on cost savings, such as reserved instances or committed use discounts, to save money for long-term instance use. In other cases, optimization can rely on scaling back or turning off underutilized or unneeded resources. Yet other optimizations can focus on workload performance; scaling up vital resources to ensure adequate workload performance in response to increasing or variable demand.

- Operate. This phase involves the ongoing use of FinOps metrics to evaluate the performance, quality and cost benefits of workloads in the cloud. This phase enables business, finance, technology and engineering staff to collaborate and negotiate with other stakeholders about workload activity and governance.

It's important to note that these three phases of FinOps can exist simultaneously for different cloud projects or workloads across the business.

FinOps principles

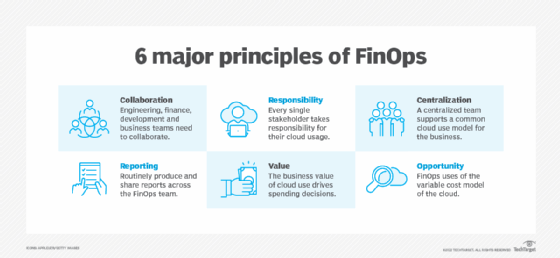

FinOps is built on a series of practices or principles that underscore the major goals of a FinOps environment. The following are general guidelines that can be adapted to fit the specific needs of individual organizations:

- Collaboration. FinOps teams need to collaborate, which requires input and constructive support from business, finance, technology and engineering teams. Good collaboration requires removing traditional silos and encouraging parts of the business to adapt to changing dynamics of cloud use.

- Ownership. While a FinOps team can provide a business with a centralized cloud center of excellence (CCoE), FinOps principles encourage direct visibility and stakeholder ownership of their cloud use against the established budget. Each workload owner or department understands and takes responsibility for their portion of cloud utilization.

- Real-time data. Having timely and accurate data is essential for making informed decisions. Organizations must prioritize real-time reporting and analytics to grasp cloud costs and usage trends effectively.

- Centralization. The FinOps team can provide knowledgeable professionals capable of centralizing important resource and cost elements of cloud use. The FinOps team can negotiate and manage issues such as committed use discounts, reserved instances and volume discounts. This alleviates cost concerns from other cloud stakeholders and can enable the most cost-effective cloud resources available for workload deployment.

- Reporting. FinOps teams rely on accurate, complete and timely reporting so the team and workload owners receive prompt feedback and make critical decisions as quickly as possible. Reporting can also help visualize trends and enhance forecasting.

- Value. The business value of the cloud drives decisions -- not simply cost. The main premise here is that FinOps relies on quality data, such as benchmarks and reporting, to establish a meaningful balance of performance, quality and cost of cloud use for the business.

- Cost. FinOps teams use variable cost models of the cloud to the organization's advantage, enabling teams to optimize instances and services to appropriate levels and find the best pricing by comparison shopping.

FinOps stakeholders

There are no set requirements for team size or composition, but The FinOps Foundation defines the following five major stakeholders -- dubbed personas -- that typically collaborate in a FinOps environment:

- Executives. Business-side concerns are typically represented by one or more executives such as a chief information officer, chief technology officer or a head of the CCoE. Executives generally focus on team efficiency, accountability, budget management and transparency.

- Product owners. Similar to executives, product owners generally represent the department heads or project leaders directly responsible for creating, deploying and managing cloud workloads for the business. These can also include a director of cloud optimization, a cloud analyst or a business operations manager.

- Engineering. FinOps needs individuals who understand and use cloud technology such as software developers, systems engineers, cloud architects and engineering managers. These are the FinOps team members who translate budgets and requirements into actionable cloud environments where workloads are deployed. Engineering team members also handle much of the troubleshooting, automation and scaling needed to optimize a cloud workload.

- Finance. A key aspect of cloud use is cost, and finance professionals such as procurement specialists, financial planners and business financial advisors can help to establish budgets, handle accounting and set up cloud forecasting. This typically involves using ongoing billing to create more accurate cloud cost models. Finance specialists can also handle price negotiations with cloud providers.

- Practitioners. A FinOps practitioner is a relatively specialized or dedicated role intended to facilitate FinOps environments and initiatives, effectively leading collaboration and guiding FinOps team members through prescriptive activities and best practices.

Benefits of FinOps

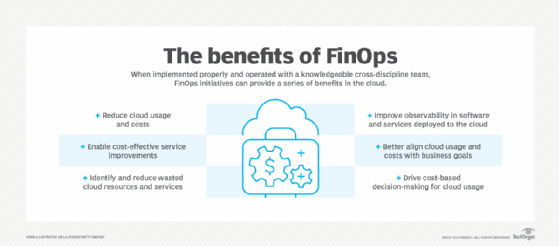

When properly executed, FinOps practices and guidelines can provide numerous benefits to the cloud-based business, including the following:

- Cost savings. The business can save money by lowering cloud spend, reducing wasted or unused resources, or by making more effective investments in cloud resources, such as securing reserved instances for long-term workloads rather than using instances on demand.

- Cost visibility. Stakeholders and financial teams can use detailed cloud reporting to see how the budget is being spent in the cloud by department or workload.

- Scalability. FinOps is highly scalable and is suitable for organizations of all sizes. It enables businesses to manage their cloud expenditures effectively as they grow, ensuring that spending remains proportional to their operational needs.

- Cost accountability. Costs are allocated to stakeholders or project owners who are directly responsible for cloud spending and its effect on the business.

- Cost optimization. By understanding resource utilization and corresponding costs, technology teams can potentially seek ways to optimize and enhance workload performance to save money or maintain performance through workload growth.

- Enhanced decision-making. FinOps delivers real-time, detailed data on cloud usage and costs, enabling organizations to make quick, informed data-driven decisions about their cloud investments. This results in more effective resource allocation, better project prioritization and strategic decision-making.

Challenges of FinOps

Despite the compelling benefits, FinOps can pose several potential challenges for unprepared organizations, including the following:

- Tool challenges. Businesses require numerous tools or platforms suited for FinOps planning, such as cost optimization tools for specific cloud providers and even tools with multi-cloud support.

- Collaboration challenges. FinOps works best when the FinOps team includes engineering, technology, finance and business representation. This can pose challenges for businesses with traditional silos or those lacking the incentive to work collaboratively.

- Management challenges. FinOps relies on best practices, policies and processes to achieve cost and technological efficiency. If not properly executed, a FinOps initiative can fall short or fail.

- Complexity of cloud-pricing models. The complexity of cloud pricing -- featuring numerous structures and countless stock-keeping units -- makes it challenging to aggregate charges and understand costs across multiple clouds. This complicates evaluating procurement decisions and the overall value of cloud investments.

- Executive buy-in. Gaining continuous support from executives can be difficult, especially if they are skeptical about the cost-saving potential of FinOps initiatives. To secure their backing, it's essential to showcase the financial benefits and align FinOps goals with broader business objectives.

FinOps tools

FinOps tools are essential for organizations that want to optimize their cloud financial management. Common FinOps tools fall into the following categories:

- Cost management platforms. These tools help organizations manage and optimize their cloud spending by providing detailed insights into costs and usage. They often include features for budgeting, forecasting and reporting.

- Budgeting and forecasting tools. These tools assist in setting budgets and predicting future cloud costs based on historical data and usage patterns.

- Cloud provider native tools. Major cloud providers such as AWS, Google and Microsoft offer their own cost management tools, which can be integrated into broader FinOps practices.

- Third-party options. Many organizations also use third-party FinOps platforms that provide specialized features for cost allocation, governance and optimization.

The FinOps Foundation lists numerous tools and services on its website, including the following:

- Anodot. This cloud cost management platform is designed to enable proactive monitoring of business metrics so companies can safeguard revenue, manage costs and offer enhanced analytics.

- CloudBolt Software. The CloudBolt cloud management platform is designed to help organizations optimize and manage their multi-cloud and hybrid cloud environments. It provides automation of cloud deployments to help improve consistency and reduce cost.

- CloudFix. CloudFix is a self-service platform for AWS cost optimization. It continuously scans AWS accounts to identify cost-saving opportunities and automatically applies fixes as well.

- CloudMonitor. CloudMonitor tracks Azure cloud consumption costs and identifies opportunities for savings, ensuring that users only pay for what they need. It detects oversized resources and unused services, and recommends best practices based on real-time utilization patterns.

- Deloitte CloudBilling 360. This generative AI (GenAI) FinOps tool is designed to help enterprises effortlessly visualize, optimize and manage their cloud spending.

- Fairwinds Insights. This all-in-one configuration validation platform is designed for managing Kubernetes workloads. It assists engineering and DevOps teams in running apps securely, efficiently and reliably. It offers tools for monitoring, auditing and optimizing Kubernetes configurations.

- IBM Cloudability. This tool helps organizations track, manage and optimize cloud costs. It comes with features such as AI-based anomaly detection, dashboards, customizable allocation rules, budgets and forecasts.

- Neos CloudVane. CloudVane is a multi-cloud cost management and automation tool that consolidates multi-cloud cost and usage data.

Future of FinOps

The future of FinOps is shaped by the following key trends that organizations must navigate:

- Reducing waste and unused resources. With tighter budgets, prioritizing the reduction of cloud waste and maximizing discounts through commitment-based offerings, such as reserved instances and savings plans has become crucial. This shift highlights the growing need to extract the greatest value from cloud investments. Reflecting this shift, the 2024 State of FinOps survey conducted by the FinOps Foundation highlights that reducing waste was a top priority for practitioners across all spending levels.

- Increasing adoption of multi-cloud and hybrid-cloud environments. Organizations are increasingly adopting hybrid and multi-cloud strategies to maximize flexibility, resilience and cost-efficiency. By combining on-premises infrastructure with various cloud providers, organizations can take advantage of each platform's unique strengths while optimizing cloud spending.

- GenAI and automation. According to Gartner, global end-user spending on public cloud services is set to rise 20.4% in 2024, driven by advancements in GenAI and application modernization. The integration of machine learning, AI and automation into FinOps practices is becoming more prevalent, enabling organizations to analyze large data sets for better decision-making and cost management.

- Focus on data and analytics. An increased focus on data and analytics is set to be a major future trend in FinOps. To optimize financial operations, organizations are relying on data and advanced analytics to gain insights into cloud usage, spending patterns and resource management. This approach facilitates more informed decision-making, uncovers cost-saving opportunities and enhances overall efficiency in managing cloud resources.

Creating a successful cloud FinOps team demands careful planning and execution. Discover these best practices for building an effective FinOps team.