Capex (capital expenditure)

What is Capex?

A capital expenditure, or Capex, is money invested by a company to acquire or upgrade fixed, physical or nonconsumable assets. Capex is primarily a one-time investment in nonconsumable assets used to maintain existing levels of operation within a company and to foster its future growth.

Capex is used to buy or invest in tangible capital assets, such as real estate; raw materials; and plant, property and equipment (PP&E). These assets benefit a company beyond one fiscal year. Intangible, nonphysical assets, such as patents and licenses, also qualify as Capex.

Money spent repairing and maintaining existing equipment is not considered a capital expenditure. These costs are reflected in a company's income statement as repair and operating expenditures, or Opex.

Capital expenses are frequently used to fund improvements to existing resources. However, it is more often seen as an investment in a company's growth potential. This is why investors often look at Capex to gauge a company's interest in growth and bullishness on its future.

How Capex depreciation works

Capex spending is often financed with the cost of an asset spread over its life. This is known as depreciation.

In the United States, the length of an asset's depreciation is based on the number of years it is likely to be used. For example, if a company buys servers for its data center, the value would depreciate over five years. For capital expenditures, the depreciation period on a financial statement is known as the asset's useful life. Depreciation begins as soon as the asset is in use and lasts through the period it is predicted to be useful.

Capex investments and purchases are not fully tax deductible in the year they are made. Capex spending is reported on a company's balance sheet under a cash flow statement instead of being expensed on an income statement. In the cash flow statement, Capex is listed under the single PP&E line item.

Types of Capex

There are several types of capital expenditures:

- Acquisitions. These are new tangible and intangible assets, including real estate and patents. The acquisition of an existing business and the launching of a new one are considered acquisition Capex.

- Upgrades. This is an expenditure on improving existing assets, such as equipment.

- Renovations. This is when old or obsolete assets are made functional in ways that adds long-term value to them.

- Adaption. This is when an asset is modified for a new use.

Examples of capital expenditure

Examples of capital expenditure fall into two categories: tangible and intangible assets.

Tangible Capex assets

- real estate, such as land or a new building for an organization;

- machinery and equipment used in a company's operation;

- computers and other equipment that makes up a company's IT infrastructure;

- vehicles, such as cars and trucks, used by company employees and to transport goods;

- furniture, such as office chairs, desks and couches, employees use; and

- acquisition of another company.

Intangible Capex assets

- patents used for product development; and

- licenses for products and services with value that extends beyond a single year.

Negative vs. positive Capex

Negative and positive Capex refer to how capital expenditures appear on a cash flow statement.

Negative Capex

A negative Capex entry on a cash flow statement indicates money is leaving the company for these expenditures. This means the company is investing money to drive future growth. Investing in long-term capital assets, such as acquiring a new business or purchasing real estate and equipment, would result in negative Capex cash flow. However, such capital outlays often reflect an optimism and aggressiveness on the part of company management and are seen as healthy for a company rather than negative.

Positive Capex

Positive Capex on a balance sheet indicates that money is coming into a company from sales of existing capital assets. A company might have positive Capex when it is divesting of assets. Potential investors might see this as an indication that management lacks confidence in the future of the business. It can also be a sign that a company is not spending enough to maintain current operations and drive growth.

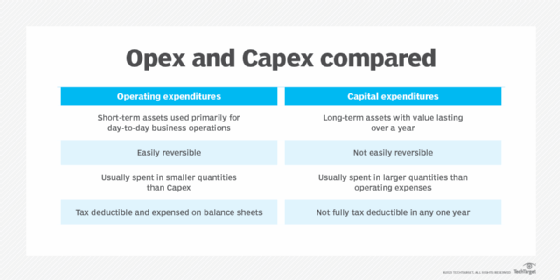

The difference between Capex and Opex

Capex is investment in and purchases of assets that affect a business's long-term growth and prospects. These expenditures include the purchase of other companies, real estate and equipment.

Capex is characterized by the following:

- long-term with useful life lasting more than a year;

- reported on income statements as a depreciation expense;

- not easily reversible, meaning companies are not likely to recover the initial value of an asset should they decide they no longer need it;

- usually spent in larger quantities than operating expenses and require careful cost management, planning and forecasting; and

- not tax deductible and reported as capitalized assets on a company's balance sheet.

Opex refers to short-term expenses used for a business's day-to-day operations. Examples of Opex include the following:

- payroll

- benefits

- debt interest

- software licenses

- equipment leases

- rent

- utilities

- property taxes

- business travel

Opex payments are characterized by the following:

- short-term and used primarily for day-to-day business operations, such as rent, wages, license fees and utilities;

- generally used during the fiscal year in which they are purchased;

- expensed on income statements;

- easily reversible, meaning companies can more easily recover the initial value of a purchase through cancellation; and

- fully tax deductible.

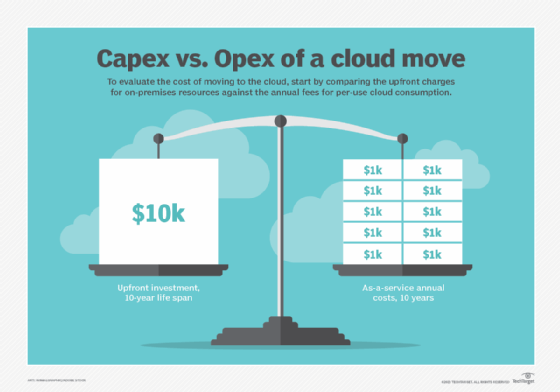

With the emergence of cloud computing, the Capex vs. Opex analysis has changed. Some IT assets and asset types commonly categorized as Capex have become Opex. Instead of buying IT assets such as hardware, software and networking equipment upfront and using these assets for years, companies purchase cloud services that they pay for monthly or over other periods of time under a year. For instance, if a company decided to spend money with Amazon Web Services on cloud networking instead of purchasing physical servers, that would be considered Opex and could only be deducted during the year in question.

The consumption-based or pay-as-you-go pricings are also available for some on-premises equipment, such as storage infrastructure.

Capex formula and calculation

Calculating Capex is important to enterprise asset management (EAM) financial modeling. The basic formula for calculating Capex payments is the following.

Capex = ΔPP&E + current depreciation

Here, Capex refers to capital expenditures, and ΔPP&E refers to the change in the value of property, plant and equipment.

Capex can be calculated from a balance sheet or a company's cash flow statement. The formula for a balance sheet and or income statement is the following.

Total Capex = net increase in PPE (from the previous year to the current year) + current year depreciation

The formula for a cash flow statement is the following.

Net Capex = cash outflow on the purchase of fixed assets – cash inflow on sale of fixed assets

Capex is an important part of enterprise asset management. Learn the five key benefits of EAM software and how it helps organizations get the most from physical assets.