ESG, SRI and impact investing: Key differences explained

Understanding the nuances of ESG investing, SRI and impact investing is important for companies and investors. Learn what they have in common and how they differ.

In recent years, the investment landscape has seen a significant shift toward more conscientious and values-driven approaches. Environmental, social and governance investing, socially responsible investing and impact investing have emerged as powerful tools for investors and for companies seeking to align their financial goals with their personal values and societal concerns.

The terms ESG investing, SRI and impact investing are often used interchangeably, but there are subtle differences in their characteristics and objectives. While they share a common thread of considering nonfinancial factors in investment decisions, each approach has its unique focus and methodology.

What is ESG investing?

Environmental, social and governance investing refers to the practice of considering ESG factors alongside traditional financial metrics when evaluating potential investments. This approach aims to identify and manage risks and opportunities related to sustainability and ethically responsible business practices.

The three pillars of ESG are:

- Environmental. This includes factors such as energy consumption, clean energy initiatives, water usage, net-zero goals and overall carbon footprint.

- Social. This component focuses on how a company treats its employees and communities, including diversity, equity and inclusion (DEI) programs; workplace health and safety; human rights issues; and responsible supply chain sourcing.

- Governance. This relates to a company's internal management practices and corporate leadership.

ESG investing has grown out of ethical investing and corporate social responsibility, but it is more formalized with standardized practices and components. There are specific ESG funds, ESG scores, ESG ratings agencies and ESG reporting frameworks. Unlike purely ethical investing, which may exclude entire industries based on moral considerations, ESG investing can include companies from various sectors if they demonstrate strong ESG practices.

This article is part of

ESG strategy and management guide for businesses

The primary goal of ESG investing is to generate financial returns, while also considering a company's impact on the environment and society, as well as its corporate governance practices.

What is SRI?

Socially responsible investing, also sometimes referred to as social investment, is an investment strategy that seeks to generate both financial returns and positive social impact. SRI goes beyond traditional financial analysis by incorporating socially responsible and ethical considerations into investment decisions.

Key aspects of SRI include the following:

- Ethical screening. SRI often involves eliminating or selecting investments based on specific ethical criteria. For example, investors might avoid companies involved in tobacco, alcohol, gambling or weapons production, as well as those with poor labor practices.

- Positive impact. Some SRI strategies actively seek out companies that contribute positively to society, such as those donating a high proportion of profits to charitable causes.

- Values alignment. SRI enables investors to align their investment portfolios with their personal values and beliefs.

SRI is often seen as going a step further than ESG investing. While ESG looks at environmental, social and governance factors as part of a comprehensive investment analysis, SRI might completely exclude certain industries or companies based on ethical considerations, regardless of their financial performance.

It's important to note that SRI strategies can vary widely depending on an investor's specific ethical priorities. What one investor considers socially responsible may differ from another's view. This subjectivity is a key characteristic of SRI.

The primary goal of SRI is to invest in companies and industries that align with an investor's values, while avoiding those that conflict with these values, all while seeking financial returns. This approach appeals to investors who want to solely support what they consider to be good causes -- or at least avoid investing in companies they believe negatively affect these causes.

What is impact investing?

Impact investing refers to investments made with the intention to generate a measurable, beneficial social or environmental impact, alongside a financial return. This approach aims to use investment capital for positive social results that also generate financial gains.

Key aspects of impact investing include the following:

- Dual objectives. Impact investors seek both financial returns and positive social or environmental outcomes. Unlike philanthropy, impact investing expects a return on investment.

- Measurable impact. A critical component of impact investing is the explicit commitment to measuring and reporting the social and environmental performance of investments.

- Focus areas. Common sectors for impact investments include renewable energy, affordable housing, healthcare, education, finance and sustainable agriculture.

- Alignment with Sustainable Development Goals (SDGs). Many impact investments align with the United Nations' SDGs.

Impact investing is distinct from both ESG investing and SRI in its explicit intention to create measurable positive outcomes. While ESG investing considers environmental, social and governance factors as part of risk assessment and value creation and SRI typically involves negative screening based on ethical criteria, impact investing actively seeks to generate specific, quantifiable social or environmental benefits through the investment itself.

The concept of impact investing represents a proactive approach to using capital for social good, moving beyond simply avoiding harmful investments to actively funding solutions to social and environmental challenges.

What are the differences among ESG investing, SRI and impact investing?

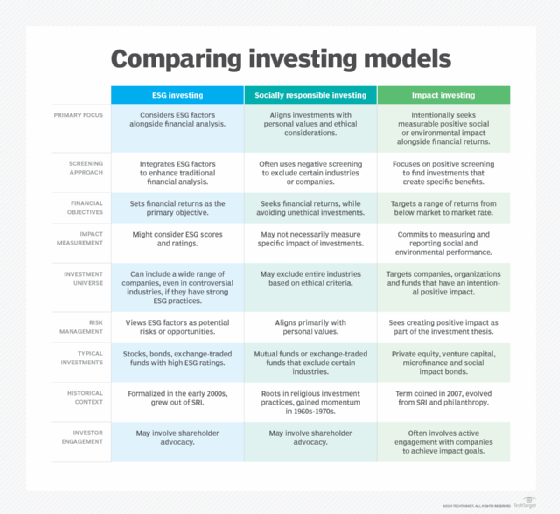

All three of these approaches to investing home in on environmental and social factors. The following chart lays out how they differ across nine elements: their primary focus, screening approach, financial objectives, impact measurement, investment universe, risk management, types of investments, historical context and investor engagement.

Key takeaways for investors and companies

There are opportunities and risks associated with ESG investing, SRI and impact investing for both investors and companies. Here are considerations to keep in mind.

Investors

A thorough understanding of the aims of each approach and their differences, outlined above, is step one for investors. It's critical to analyze how your portfolio aligns with the values of each approach before making investments. For ESG investments, consult ESG scores and ratings from agencies like MSCI, Bloomberg and S&P Global. SRI requires first defining your personal criteria for socially responsible corporate behavior and then screening investments accordingly. Impact investing entails seeking investments that are geared toward making a measurable, positive difference.

All three approaches offer options across various asset classes, including stocks, bonds, mutual funds, and exchange-traded funds. Impact investing often involves more specialized vehicles, like microfinance or social impact bonds.

Here's a snapshot of the key advantages and risks associated with these values-centric investing approaches:

- ESG investing

- Key benefit: Can help identify well-managed, sustainable companies with less long-term risks.

- Risk: Companies with high ESG scores may still be involved in controversial industries.

- SRI

- Key benefit: Enables alignment of investments with your personal values.

- Risk: Excluding entire industries may limit diversification and potential returns.

- Impact investing

- Key benefit: Provides the opportunity to contribute to specific social or environmental causes.

- Risk: It may involve lower liquidity or higher risk, especially in emerging markets.

Companies

Companies need to think about aligning their environmental, social and governance practices with investors' expectations. As noted, ESG investing, SRI and impact investing differ slightly in their aims and interests, but they all require companies to provide transparent, accurate reports on their social and environmental initiatives and policies.

To that end, companies should adopt standardized ESG reporting frameworks; provide clear, accessible ESG data to rating agencies and investors; and be transparent about successes and challenges in their sustainability efforts.

Here are some additional considerations for how to align your company with these socially responsible investing approaches:

- Alignment with ESG investing

- Implement and report on environmental initiatives, e.g., carbon footprint reduction and clean energy adoption.

- Develop strong social policies, e.g., DEI, employee welfare and community engagement.

- Ensure comprehensive governance practices, e.g., board independence and executive compensation transparency.

- Alignment with SRI

- Be aware of industries and practices commonly excluded by SRI-focused investors.

- Clearly communicate ethical practices and values to attract SRI-focused investors.

- Alignment with impact investment

- Develop measurable social or environmental impact goals.

- Implement systems to track and report on impact metrics.

- Consider innovative financing models, like social impact bonds.

Aligning your company's values and practices with those of ESG, SRI and impact investors can be demanding. There are costs associated with implementing and reporting on ESG initiatives. Navigating evolving and sometimes conflicting ESG standards and expectations is challenging. Balancing short-term financial pressures with long-term sustainability goals requires strong executive leadership and stakeholder engagement. In addition, an organization needs to avoid greenwashing -- false or misleading actions and claims on environmental sustainability -- and other missteps in ESG initiatives that could damage its relationships with investors committed to these approaches.

The potential payoffs for becoming a sustainable business are many, including improved access to capital from ESG-focused investors, enhanced reputation and stakeholder trust, and the prospect of long-term risk reduction and value creation.

Sean Michael Kerner is an IT consultant, technology enthusiast and tinkerer. He has pulled Token Ring, configured NetWare and been known to compile his own Linux kernel. He consults with industry and media organizations on technology issues.