Getty Images/iStockphoto

Trends in the electric vehicle market in 2024

In recent years, the EV market has gone through many changes due to rapid advancements in technologies and shifting market trends.

Electric vehicles are becoming more common across the United States, especially as states look toward banning the sale of gas-powered vehicles by 2035.

States that plan to phase out gas-powered vehicle sales include California, Delaware, Maine, Maryland, Massachusetts, New Jersey, New York, Oregon, Pennsylvania, Rhode Island, Vermont and Washington.

Electric vehicle sales are not just growing in the U.S. market; many domestic and foreign markets are also seeing growth in the EV industry.

Current EV market trends

EV sales are expected to continue growing in 2024, with the largest and most significant global markets for EVs being in China, the U.S. and Europe.

According to research published in June 2024 by Rho Motion, more than 5 million EVs were bought globally from January to May -- a 20% increase compared to the same period in 2023.

However, EV sales in the U.S. and Europe are beginning to slow. This could be due to several factors, such as tariffs on foreign EVs, lacking EV charging infrastructure, price, range anxiety and a challenging economy in general for both regions.

A forecast published at the end of 2023 by Cox Automotive predicted EVs will still account for 10% of total vehicle sales in 2024 in the U.S.

While these markets are still growing, their overall growth is expanding at a slower rate than China's. The Chinese EV market in 2024, as stated by Rho Motion, has grown 31% in the same January-May period compared to 2023.

The increased number of sales in China is also due to a number of different factors, such as many Chinese EV manufacturers being state-backed. Other factors, such as a heavier automated manufacturing process and lower wages, mean that Chinese consumers have access to EVs at substantially lower prices.

Here are some other trends happening in the EV market in 2024.

Import tariffs

Both the U.S. and EU are applying tariffs to foreign -- notably Chinese -- EVs to defend their own market. For example, in 2024, Europe applied an increased tariff on Chinese EVs up to 38.1%.

The U.S. enacted a 100% tariff rate on Chinese EVs, quadrupling the previous 25% tariff. Imported EVs also do not qualify for federal tax credits.

Many electric vehicle companies on market

As of October 2023, Tesla accounted for more than half the EV market share in the U.S., according to MarketWatch statistics. Chevrolet followed next with 5.9% and then Ford with 5.8%, Hyundai at 4.8% and Rivian at 3.7% -- 23.5% were labeled as Other.

Globally, the top-selling brands are Tesla, BYD, Geely-Volvo, SAIC and Volkswagen Group, as reported by InsideEVs.

Increased competition

Some of the largest manufacturers in the EV space include the following:

- BYD.

- Chevrolet.

- Ford.

- Geely-Volvo.

- Hyundai.

- Rivian.

- SAIC.

- Tesla.

- Volkswagen Group.

Other popular EV manufacturers include Lucid, Polestar and VinFast.

A combination of factors, such as increased competition, unrealistic expectations, slowing markets and rushed-to-market vehicles, have caused the collapse of some EV manufacturers. For example, in June 2024, EV manufacturer Fisker filed for bankruptcy. Days before, Fisker recalled more than 6,000 Ocean SUVs due to loss of drive power in the motor control units.

Declining prices

As technology improves and batteries become more affordable and efficient, the price of EVs will continue to drop. This will open the market to a broader, more cost-conscious audience.

The battery alone can make up to 40% of the cost of an EV. With better battery technology, the price of an EV can be dramatically reduced.

It's more common now to find EVs less than $40,000, but it's more difficult to find one below $30,000. The 2024 Fiat 500e is an example of what a budget electric car can sell for now, with a U.S. price point starting at $32,500.

Other cars might also qualify for federal tax credits, which can help bring down the price.

Secondhand markets

While consumers can't currently get new EVs for less than $30,000, they can get a used EV. The lower prices of older model EVs are likely to persuade more cost-conscious buyers and lead to increased market adoption.

A report published by Recurrent in July 2024 found a number of listings for EVs under the $25,000 mark, with even more falling under the $30,000 mark.

Increased range

As manufacturers continue to invest in battery technology and vehicle design, the average range of battery electric vehicles (BEVs) has also steadily increased. Notably, in 2023, Toyota announced the development of a solid-state EV battery that could have a 700-plus-mile range. This advancement could play a big role in boosting EV range.

The gradual advancements in technology will also help eliminate consumer range anxiety, where drivers worry about how far they can go before they are forced to find a charging station.

Web marketing

Most potential buyers research new vehicles online before purchasing one. This research leads to more prepared and knowledgeable buyers. As such, many marketers have started to market their products via video marketing and social media lead generation. Marketers have also started using AI-enabled predictive analytics tools to forecast online shopping behaviors.

EV technology trends

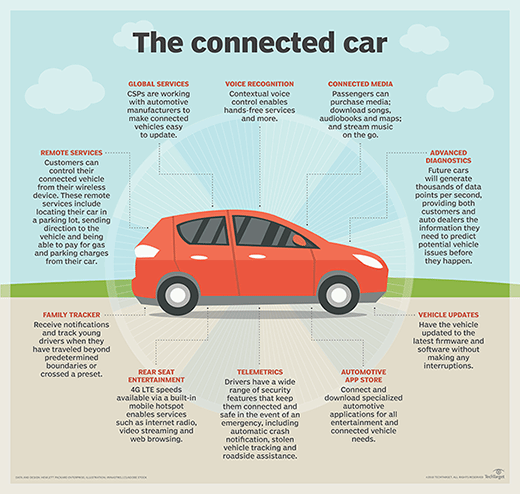

The technology built into electric vehicles is rapidly evolving, driven by advancements in autonomous driving capabilities, battery efficiency and safety features.

Here are some of those technology trends.

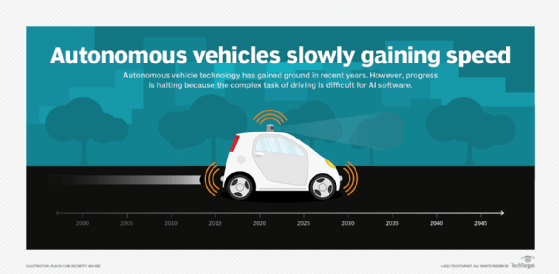

Self-driving vehicles

Although many vehicles today aren't quite at the point of being fully self-driving, many cars -- not just limited to EVs -- come with varying levels of self-driving capabilities. Some common self-driving features available in many production cars today include the following:

- Hands-free steering. This centers the car without a driver's hands needing to be on the wheel. The driver is still required to pay attention.

- Adaptive cruise control (ACC). This automatically maintains a selectable distance and speed between a driver's car and the car in front.

- Lane-centering steering. This keeps the vehicle centered in a lane and often comes with some form of steering assist.

- Self-parking. This uses the car's sensors to automatically steer, accelerate and stop the car in a parking space.

- Highway driving assist. This combines ACC and lane-centering assist while on a highway.

- Lane-change assist. This feature monitors a vehicle's surrounding traffic to help the driver change lanes safely. This feature either provides alerts or automatically steers the vehicle when safe.

- Lane departure warning. This alerts the driver if the vehicle starts to change lanes without signaling.

- Evasive-steering assist. This is a safety feature that automatically steers the vehicle to potentially avoid an imminent collision.

- Automatic emergency braking. This is a safety feature that detects imminent collisions and then applies the brakes.

- Remote summon. This is a feature seen in Tesla vehicles that can autonomously navigate out of a parking space and come to the driver's location in a parking lot.

Many cars aren't fully self-driving today due to a number of technological, regulatory and safety concerns. For example, even though Tesla is commonly given credit for pushing for fully self-driving cars, the manufacturer still faces challenges, including technological complexity, sensor limitations and safety issues.

Many self-driving systems also use a combination of AI technologies. Large amounts of data from image recognition systems are typically analyzed using machine learning and neural networks. These sensors collect data from which the neural network learns to identify traffic lights, trees, curbs, pedestrians, street signs and other parts of any given driving environment.

Battery technology

Battery technology is also slowly advancing. Advancements in this technology typically mean improvement of power and range. A good example of this is Toyota's development of solid-state batteries. Compared to the lithium-ion batteries used in most EVs today, solid-state batteries will boost range and energy density, while also reducing weight. Solid-state batteries are not yet available in cars but are expected to be present in the EV market by the mid to late 2020s.

Safety features

Commonly occurring safety features found in EVs today include the following:

- Cybersecurity. This includes the protection of any hardware and software that is designed to prevent unauthorized access to vehicle-related systems. As EVs become more reliant on software and electronically controlled systems, protecting them from cyberthreats has become more and more important. This also includes systems that are meant to secure EV-to-charger transactions.

![Electric vehicle software systems graphic]()

Electric vehicles are becoming more reliant on software and other electronically controlled systems. - Better sensor systems. EVs now commonly include a collection of different sensors, including radar, lidar and cameras. This collection of sensors can aid in driving-related tasks, alarm the driver of potential road dangers, and used to help recognize and avoid potential accidents.

Current EV infrastructure

One of the limitations keeping buyers from purchasing an EV is the lack of EV charging stations in certain areas. Currently, if someone lives in a city with an extensive enough infrastructure, an EV can be an ideal form of transportation. But, in more rural areas without the same infrastructure, buyers have more concerns related to range anxiety.

Getting more consumers to invest in EVs relies on how built out the national charging infrastructure is. According to statistics from the U.S. Department of Energy, there are more than 64,000 EV charging stations across the more than 4 million miles of U.S. roads. That is well below the more than 196,000 retail gas stations in the U.S., according to statistics from Xmap.

Although the EV charging infrastructure isn't nearly as prevalent as the gasoline infrastructure, it is slowly being built up. An infrastructure law in 2021 was passed, which included $7.5 billion of funding for EV charging. In that, $5 billion was allocated to individual states to build a network of fast chargers along major highways. Only eight stations, however, have been built in the last two years, according to a report from Autoweek.

There have been other challenges with charging stations, too, such as the rapidly changing standards and protocols used and competition among EV manufacturers -- some having charging stations specifically for their brands. These issues, however, are starting to be overcome. In May 2023, Ford announced it would adopt the Tesla-developed North American Charging Standard (NACS) plug. Other automakers followed suit, announcing agreements with Tesla to use the same plug standard. The engineering group SAE International also announced that it would adopt the NACS connector as a standard. This series of adoptions will make the Tesla Supercharger network available to many more EV owners from 2024 onward.

Ionna is another competing joint venture network of chargers. This group includes automakers such as BMW, General Motors, Honda, Hyundai, Kia, Mercedes-Benz and Stellantis. This team-up is a collaborative effort from these companies to establish a high-powered EV charging network of 30,000 chargers across North America. The Ionna charging network aims to capitalize on subsidies provided by the Biden administration, as well as other corporate investments.

While the current trend for charging infrastructure in the U.S. seems to be focused on building a supercharging network, other places, such as China and Europe, are trending toward the use of battery-swapping stations. Instead of focusing on charging a vehicle's depleted battery, battery-swapping stations focus on swapping out a depleted battery for a fresh one at a dedicated location. This is a much faster process than having to wait 30 or more minutes to charge a car's battery at a charging station.

Alexander Gillis is technical writer for the WhatIs team at TechTarget.