ESG strategy and management guide for businesses

ESG initiatives can help boost business success. This guide takes an in-depth look at creating and managing an ESG strategy to benefit a company and its various stakeholders.

For companies of all sizes, environmental, social and governance issues have become key business considerations. Corporate ESG policies and practices are closely watched by investors, employees, customers, government officials and other stakeholders. That makes an effective ESG strategy underpinned by strong management processes increasingly important to long-term business success.

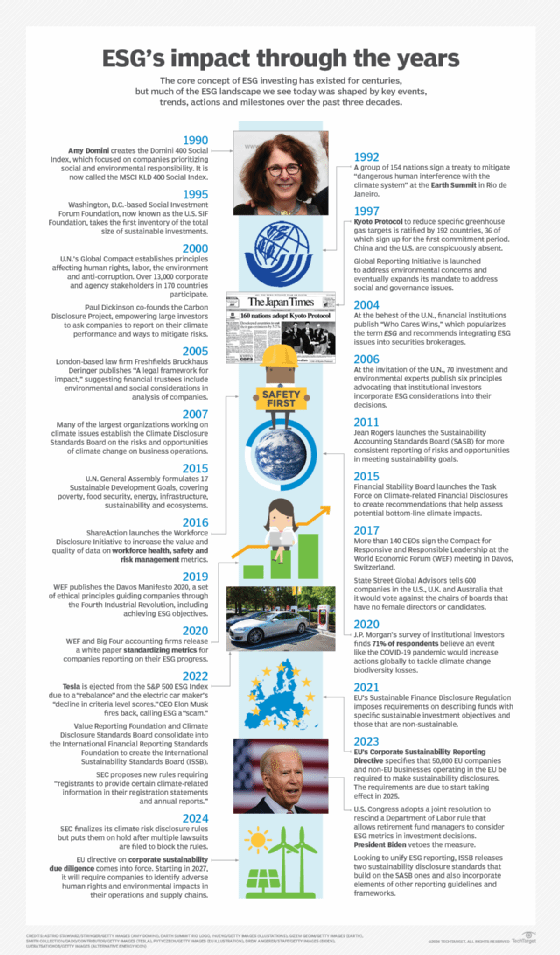

ESG isn't a new phenomenon: The history of ESG investing, in which investors use ESG criteria to help evaluate companies, dates back to the early 2000s. But ESG initiatives in companies have been thrust into the spotlight in recent years because of increasing pressure, from both inside and outside organizations, to improve environmental sustainability and act in socially responsible ways.

Studies show most large companies have some form of ESG program. For example, 99% of the companies in the S&P 500 published an annual sustainability report in 2024, according to research done yearly by Governance & Accountability Institute Inc. Starting in 2023, the ESG consultancy found that companies in the Russell 1000 Index also surpassed the 90% mark on reporting. Similarly, professional services firm KPMG said research it conducted in late 2024 found that 95% of the world's 250 largest companies and 80% of a broader group of 5,800 businesses had published carbon reduction targets.

ESG currently faces strong political headwinds in the U.S., where the Trump administration has backed away from proposed federal rules on climate risk disclosures by publicly traded companies and targeted diversity, equity and inclusion (DEI) programs in government agencies, academic institutions and businesses. In response to those and other actions, some organizations aren't publicizing their ESG efforts as much as they did before. However, surveys indicate that most initiatives are continuing without significant changes.

For example, in survey results released in July 2025 by sustainability ratings firm EcoVadis, nearly nine in 10 executives at large U.S. companies said their organization was maintaining or increasing its sustainability investments for the year. Forty-eight percent of the 400 respondents reported that their sustainability spending and strategy hadn't changed. Another 31% said they were spending more but promoting their activities less, while 8% said they were still investing as planned but not talking publicly about sustainability at all. Only 7% said their company had cut back on its sustainability efforts.

Still, many ESG programs aren't fully formed: In a September 2025 report, KPMG said 76% of 300-plus companies it surveyed were in the early or middle stages of ESG maturity based on scores it gave them.

This ESG strategy and management guide is designed to help organizational leaders implement a successful program. It explains how ESG can benefit companies; provides guidance on creating an ESG strategy and measuring a company's performance on ESG issues; and offers information on frameworks for ESG reporting, common challenges and software that can help manage ESG initiatives. Throughout the guide, hyperlinks point to related articles that cover those topics and others in more depth.

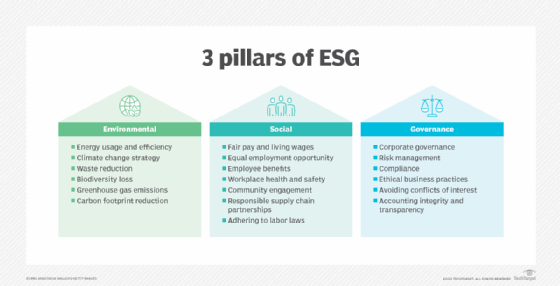

The 3 pillars of ESG

ESG focuses on various issues related to environmental, social and corporate governance practices. An ESG program documents a company's impact on the environment and on different stakeholders as well as its approach to governing business operations and employee actions. Potential ESG-related business risks and opportunities in each of the three areas are also assessed so they can be managed and acted upon. Here's a breakdown of the key ESG factors to consider as part of corporate initiatives:

- Environmental. Examples of environmental factors include energy consumption; water usage; greenhouse gas emissions and overall carbon footprint; waste management; air and water pollution; deforestation; biodiversity loss; and adaptation to climate change.

- Social. The social factors of ESG involve a company's treatment of employees, supply chain workers, customers, local communities and other groups of people. In addition to DEI programs, examples include fair pay and living wages; workplace health and safety; fair treatment of customers and suppliers; responsible sourcing; oversight of supply chain partners; community engagement; charitable donations; and social advocacy.

- Governance. This involves the internal management practices, policies and controls that govern how a company operates. Examples include the composition of senior management and the board of directors; executive compensation; financial transparency; regulatory compliance; risk management; data privacy and protection policies; ethical business practices; and rules on corruption, bribery, conflicts of interest and political lobbying.

ESG is closely related to business sustainability and corporate social responsibility (CSR), two other concepts that look beyond standard profit-and-loss calculations. But there are differences between the three concepts. Business sustainability focuses more broadly on positioning a company for ongoing success through responsible management practices and business strategies, while CSR is a self-regulating approach to taking actions that have societal benefits. By comparison, ESG is a formalized strategy that includes measurable goals and processes for tracking, managing and reporting on them.

How can ESG initiatives benefit businesses?

From a general standpoint, ESG programs can contribute to business sustainability efforts and ensure that there's a commitment to -- and accountability for -- responsible and ethical practices in companies. Those things can pay long-term dividends, but there are also more immediate reasons for companies to invest in ESG strategies. The following are five specific business benefits of ESG initiatives:

- Competitive advantages over business rivals. Companies with successful ESG programs can improve their market position and brand strength compared with competitors. In a March 2025 Capgemini Research Institute survey, 82% of 984 senior executives in 12 countries cited potential higher sales as a driver of sustainability investments in their company. Conversely, 55% said their organization had lost market share to a competitor with more sustainable products.

- More attractive to ESG-focused investors. ESG investing has become a significant part of capital markets. In a Morgan Stanley survey conducted in early 2025, 59% of 1,765 individual investors in North America, Europe and the Asia-Pacific region said they likely would increase their sustainable investments in the next 12 months. At the institutional level, the US SIF Foundation said in a December 2024 report that $6.5 trillion in assets were being managed in the U.S. using ESG and sustainable investment approaches. That amounted to 12% of all investment assets under professional management, according to the sustainable investment industry association.

- Better financial performance. In addition to boosting sales, ESG initiatives can help improve a company's overall financial performance by reducing energy bills, operating costs and other expenses. Sixty-two percent of respondents to the Capgemini survey said anticipated cost savings were a factor in their organization's sustainability investments.

- Increased customer loyalty. Companies that adhere to ESG principles can more easily attract and retain customers who apply ESG considerations in buying decisions. In an online survey conducted in March 2025 by advisory services firm GlobeScan, 49% of 1,004 U.S. consumers said they had bought an environmentally friendly product in the past month, while another 36% would have liked to if they could have -- data points that show many consumers do care about ESG issues. Corporate buyers do, too: A 2024 survey by Informa TechTarget's Omdia division found that 94% of 435 IT and data professionals thought their company would pay a price premium for products or services from IT vendors with strong sustainability practices.

- More sustainable and adaptable business operations. It's also easier for companies with well-managed ESG strategies to adapt to changes in regulatory and legal requirements, as well as the effects of climate change, depletion of natural resources and other environmental issues.

In addition, ESG initiatives can increase employee engagement, make it easier to hire and retain workers, reduce business risks and improve the standing of companies in the communities where they operate.

How to create an ESG strategy

Companies should incorporate various ESG trends, practices and ideas into their strategies and plans. Some examples include reducing greenhouse gas emissions, implementing climate adaptation measures, creating more responsible and sustainable supply chains, setting up ESG oversight processes at the board level and adopting a circular economy model, which aims to reuse product components and materials instead of recycling or disposing of them.

With such considerations in mind, here are eight steps to take in developing and implementing an ESG strategy:

- Get input from internal and external stakeholders. Consult with board members and business executives about ESG issues that are important to the organization. Also, talk to other stakeholders -- for example, employees, investors, customers, suppliers and community leaders -- about the issues that matter to them.

- Assess the materiality of different ESG issues. Use the input you gather to identify the issues that are most important -- or material -- to both the business and the canvassed stakeholders, as well as those that are less important. The individual elements of the ESG strategy can then be prioritized based on that assessment.

- Establish a baseline on ESG performance. Document current performance levels, policies, practices and statistics on the ESG factors that will be addressed as part of the strategy. Doing so provides a starting point for future comparisons to evaluate the progress of ESG efforts.

- Define measurable goals for ESG initiatives. This involves setting objectives and performance targets for the ESG strategy as a whole and its various pieces. Some of these goals might include desired improvements on KPIs that will be tracked, while others might call for maintaining current performance levels and practices that already meet requirements.

- Create a deployment roadmap. Next, build out a detailed implementation plan for the ESG program that includes project timelines, milestones and responsibilities.

- Choose the reporting standards and frameworks to use. As covered in more detail below, numerous ESG reporting options are available to companies. Many businesses use more than one to meet different reporting and disclosure requirements. Choosing the right framework or combination of them is a key part of developing a successful ESG strategy.

- Collect, analyze and report on ESG data. Once the ESG program is operational, processes are needed to collect and analyze data on the relevant KPIs and then to prepare reports for stakeholders. The ESG data generated by an organization usually includes both quantitative and qualitative information. Full reports are typically done on an annual basis, but internal progress updates are often provided to the board and senior management more frequently.

- Review and revise the strategy as needed. ESG requirements can change as business needs, stakeholder concerns and regulatory mandates evolve. An ESG strategy should be reassessed regularly to make sure it's still effective and to identify required updates, including weak spots that need to be optimized.

ESG materiality assessments and audits

These are two important elements of an ESG program, as explained below.

What a materiality assessment involves

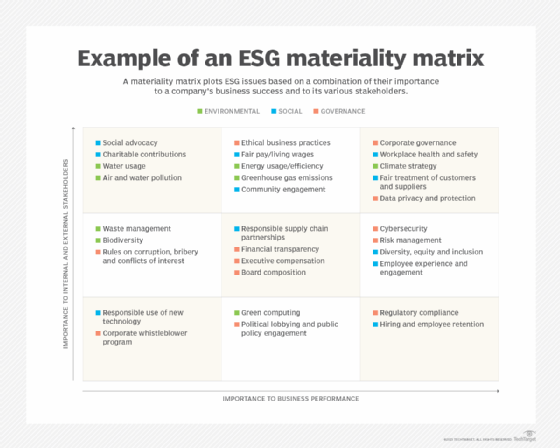

The second step in the list above is formally known as an ESG materiality assessment. Such assessments apply the financial accounting concept of materiality to ESG issues and extend it to what's called double materiality. That considers not only how material individual ESG factors are to a company's business operations, but also their materiality to different groups of stakeholders.

Combining the materiality information provides a blueprint for ESG strategies, which can be visualized by creating a materiality matrix. It plots different ESG issues in a grid along x- and y-axes that represent their importance to the business and stakeholders, thereby depicting the issues from least to most important.

In addition to helping companies prioritize ESG plans, materiality assessments can aid in creating a business case for initiatives and deciding what performance measurements to track. To be accurate, though, an assessment must begin with a comprehensive stakeholder engagement process to gather information on relevant ESG issues as well as related risks, opportunities and goals.

What an ESG audit involves

Audits are another vital step to take later in ESG programs. An ESG audit involves internal or third-party verification that ESG data, performance metrics and reports are accurate and comply with accepted standards. That process is commonly referred to as ESG assurance, which can take these two forms:

- Limited assurance that involves less scrutiny and verification by the auditor.

- Reasonable assurance, a higher-level procedure in which an auditor affirms that the ESG information is materially correct.

An ESG audit is similar in nature to a financial audit. As a result, best practices in preparing for an audit include implementing appropriate controls on ESG data collection and reporting, establishing board oversight of the reported information and conducting an audit readiness assessment beforehand.

Examples of ESG initiatives across an organization

An ESG strategy typically encompasses separate initiatives in different departments and operations throughout a company. Here are some examples of what that can involve:

- IT. Data centers are at the heart of green computing efforts because of the high amounts of energy they consume. To help increase energy efficiency and reduce carbon emissions, green best practices in data centers include consolidating servers and storage devices; replacing old technologies with newer equipment that uses less energy; using AI and machine learning tools to create power usage effectiveness models and autonomously manage HVAC functions; and redesigning facilities to take advantage of hot and cold aisle configurations and energy-efficient doors, windows and lighting.

- HR. The HR department plays the lead role in ESG initiatives related to employees. This can include managing DEI programs that aim to increase the representation of different groups of people in the workforce and ensure all employees are treated equally. Employee experience and engagement efforts, fair pay practices, and health and well-being initiatives -- mental health support and flexible work schedules, for example -- also fall under HR.

- Supply chain. As part of ESG programs, supply chain managers are in charge of sustainable procurement and responsible sourcing initiatives that consider environmental and social factors in purchases of materials and finished products. They often also oversee supply chain partners on labor practices, efforts to reduce greenhouse gas emissions and other sustainability measures.

- Marketing. The marketing department is responsible for ESG marketing efforts that highlight initiatives, goals and progress on meeting those goals. Done properly, ESG marketing can help increase brand recognition, customer loyalty and, ultimately, revenue. But it needs to be honest about ESG plans and practices. If not, a company could face a backlash, including charges of greenwashing -- making false, unsubstantiated or exaggerated claims about its environmental actions.

- Finance. The CFO is directly responsible for financial transparency and accounting integrity initiatives as part of the governance aspect of ESG. The finance department also has a hand in considering and funding ESG initiatives throughout the organization as part of its regular financial functions.

- Legal. The legal department commonly leads the development of corporate policies on ethical business practices and rules that prohibit actions such as bribery and corruption.

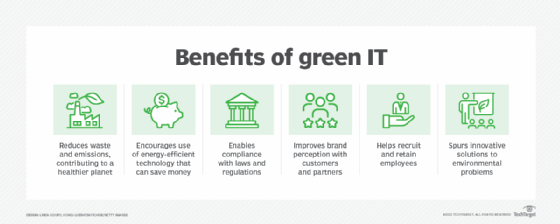

Convergence of ESG and green IT

In addition to green computing practices in data centers, ESG strategies are converging with other approaches that aim to make technology use in companies greener. These include green IT, a broader concept that encompasses the efforts to make data centers more energy-efficient plus initiatives such as green storage, green networking and green software development.

Another aspect is green cloud, which involves the steps that cloud platform vendors are taking to improve energy efficiency and reduce carbon footprints in their data centers. Cloud market leaders AWS, Google and Microsoft have all made commitments to increased sustainability and energy efficiency. In doing so, they've set various goals on using renewable energy, becoming carbon neutral or negative and minimizing water consumption, including the adoption of water replenishment measures.

The growing number of IoT devices has also led to an increased focus on how to address sustainability concerns and meet ESG goals in IoT deployments. Similarly, generative AI (GenAI) tools and other AI technologies often use massive amounts of computing and data storage resources. That creates additional energy consumption issues for IT teams to manage as enterprise AI deployments increase.

Who should oversee and manage ESG programs?

Oversight of ESG programs often begins at the board level or in the C-suite, with the CEO, COO or executive committee as a whole taking the management lead. Some companies have added a chief sustainability officer or a chief ESG officer to lead their corporate programs -- a role that's handled by a vice president of sustainability or ESG in other cases. KPMG's research in late 2024 found that 56% of the 250 largest companies globally and 46% of the 5,800 organizations it examined overall had named a dedicated sustainability leader from either their board or senior management.

The following people also have ESG management roles in organizations:

- Department heads. Individual ESG initiatives in separate departments are typically managed by their leaders, such as the CFO, chief marketing officer, general counsel or CIO. The latter plays a particularly big role in driving environmental sustainability efforts because of IT's high energy consumption and the proliferation of e-waste as systems and devices are replaced. In addition, the CIO must ensure that IT systems and tools are deployed as needed to support broader ESG efforts.

- Chief diversity officer. Companies might also have an executive who oversees their DEI program, generally in collaboration with the HR department. However, some U.S. businesses have eliminated or scaled back DEI efforts in response to the attacks on such programs by President Trump and other Republican politicians. Examples include Amazon, Google, IBM, McDonald's, Meta and PepsiCo. In some cases, DEI leadership positions have been cut.

- ESG or sustainability program managers. Workers in these positions might also be involved in overseeing initiatives at both the corporate and departmental levels.

Other roles found on ESG teams can include analysts, data analysts, strategists and specialists focused on ESG as a whole or specific areas such as sustainability and community relations. In addition, teams often pull in workers from other departments on a part-time basis -- for example, risk managers, compliance managers and internal auditors.

Organizations often need to hire ESG professionals, but retraining or upskilling current employees on ESG, sustainability and green IT is also an option. Workers looking to expand their knowledge and skills in such areas can take advantage of various ESG certification programs and courses.

How to measure ESG performance and progress

A program's performance is measured through various ESG metrics. They're KPIs that, as mentioned above, can be both quantitative and qualitative in nature. The following are examples of quantitative metrics:

- Greenhouse gas emissions.

- Energy and water usage.

- Amount of waste generated.

- Compensation data.

- Employee turnover rates.

- Charitable contributions.

- Workforce and board diversity.

Examples of qualitative metrics include the following:

- Labor practices.

- Community engagement.

- Impact on local communities.

- Responsible sourcing.

- Codes of conduct.

- Business ethics policies.

ESG metrics are the key content in the reports that companies file on the status and progress of their initiatives. Metrics also help executives manage ESG-related risks and can be used by organizations to measure themselves against the triple bottom line. The TBL is a sustainability-focused management concept and framework that treats the social and environmental impact of companies and the overall economic value they create as bottom-line categories. It was designed to encourage business leaders to think more deeply about how their company operates instead of focusing only on financial performance.

ESG data collection and management

Collecting and managing data is a crucial part of ESG programs. An effective data collection process helps ensure that performance monitoring, analysis and reporting are accurate and comprehensive. It also aids in planning ESG strategies, identifying opportunities to improve initiatives and managing compliance with regulations and reporting requirements.

Data quality management procedures should be incorporated into the collection process to fix errors, inconsistencies and other issues in ESG data. That includes data cleansing work plus ongoing data validation and verification checks. Data security and privacy protections should also be a priority. Centralizing data collection and management tasks enables ESG teams to standardize practices for better data consistency and reliability across an organization, particularly in large companies.

Top ESG reporting frameworks and standards

Reporting frameworks and standards provide a structured approach for publicly disclosing information about a company's ESG strategy and initiatives. They help businesses demonstrate their commitment to ESG practices and sustainable growth, while also creating transparency and accountability and giving stakeholders a detailed view of ESG programs. In addition, ESG rating agencies use submitted reports and other data to issue ESG scores to companies. The scores are a number or a letter rating that investors and other stakeholders can use in evaluating an organization.

At first, various frameworks and standards -- most of them voluntary to use -- were developed for different reporting purposes. Efforts to consolidate and align some of the key ones began in late 2021 and continue to progress. The following list outlines prominent ESG reporting frameworks and standards, with details on recent consolidation and alignment moves:

- IFRS Sustainability Disclosure Standards. These are currently a pair of standards that cover disclosures of sustainability-related financial information and information about climate-related risks and opportunities. First released in mid-2023, they're developed by the International Sustainability Standards Board. The ISSB was established in 2021 by the International Financial Reporting Standards (IFRS) Foundation with the goal of creating a unified set of standards for disclosing sustainability info. In keeping with that objective, IFRS S1 and IFRS S2, as the two standards are known, build on the preexisting SASB Standards (covered below) and incorporate elements of other reporting guidelines and frameworks. In November 2025, the ISSB announced standard-setting plans for disclosures about nature-related risks and opportunities that aren't already required by IFRS S1 and IFRS S2. It expects to release an initial draft of the incremental requirements by October 2026; still to be decided is whether they'll be in a separate standard, amendments to the existing ones or other forms of guidance. The ISSB is also researching a possible standard on human capital issues involving internal employees plus workers at suppliers and other business partners.

- SASB Standards. Released in 2018 by the now-defunct Sustainability Accounting Standards Board, the SASB Standards provide specifications for disclosing financially material sustainability information that are tailored to 77 industries. They were consolidated into the IFRS Foundation in 2022 and are now overseen by the ISSB. Despite the development of the IFRS standards, the ISSB encourages continued use of the SASB Standards by organizations that prefer them and says it will continue to enhance them. In July 2025, it published a draft of proposed climate-related amendments, most of which would also be applied to its guidance on implementing IFRS S2 in various industries.

- GRI Standards. Developed by the Global Reporting Initiative, the GRI Standards include sets of universal, sector-specific and topic-based standards for sustainability reporting on economic, environmental and social factors. GRI published the first version as guidelines in 2000 and made several updates before formally releasing the standards in 2016. It and the ISSB are working to align the GRI and IFRS standards on disclosure topics that are common to both. For example, disclosures on greenhouse gas emissions prepared under IFRS S2 can be used with a new version of GRI's climate change reporting standard launched in June 2025.

- CDP. Founded in 2000 as the Carbon Disclosure Project and now known simply by its acronym, CDP runs a namesake system for disclosing information on business risks and opportunities related to climate change, water security and deforestation. It then gives companies letter-grade scores in each area. Previously, there were three questionnaires on the different topics. CDP combined them in 2024, but companies still get separate scores. The integrated questionnaire is now aligned with IFRS S2, which provides the baseline for CDP's climate-related questions. CDP is also working with GRI to increase interoperability between their frameworks. In October 2025, they released a mapping between CDP's questionnaire and the new GRI climate change reporting standard, as well as an updated standard on energy-related impacts and activities also launched that June.

- TCFD Recommendations. The Task Force on Climate-related Financial Disclosures, commonly referred to as the TCFD, was set up by the Financial Stability Board in 2015. Two years later, it released a set of 11 recommendations on the information companies should disclose about financial risks and opportunities related to climate change. The recommendations were incorporated into the IFRS sustainability standards, and the TCFD disbanded in October 2023. Companies can still use the recommendations separately, though.

- CDSB Framework. This framework was created to enable companies to include ESG reporting in annual reports and 10-K filings. But the Climate Disclosure Standards Board (CDSB), which developed it, was also absorbed by the IFRS Foundation in 2022. While the framework is still available to use, no further work is being done on it and IFRS S2 is meant to take its place. The CDSB's technical guidance on disclosures was used as "part of the evidence base" for that standard, according to the ISSB.

- TNFD Recommendations. Modeled on the TCFD's guidelines, the TNFD ones include 14 recommendations on disclosing financial information related to nature and biodiversity issues. The Taskforce on Nature-related Financial Disclosures (TNFD) published them in 2023, two years after it was created, and also provided implementation guidance. The TNFD and GRI have collaborated on the development of each other's reporting guidance and a mapping of the interoperability between their frameworks. The ISSB is also working with the TNFD to build upon the latter's recommendations as part of the SASB Standards and the incremental IFRS nature-related disclosure requirements. In conjunction with the ISSB moving forward on the latter, the TNFD plans to complete its ongoing technical work by the third quarter of 2026 and then support the ISSB's work program.

- United Nations Global Compact. Launched in 2000, the UN Global Compact is a corporate sustainability initiative that aims to align business strategies and operations with 10 principles on human rights, labor practices, the environment and anti-corruption practices. Participating companies file an annual report on their adherence to the principles, using a standardized questionnaire.

- Workforce Disclosure Initiative. The WDI, which was created in 2016, offers a CDP-like reporting platform focused on workforce practices and management. Companies fill out an online survey on workplace health and safety, employee well-being policies and other topics to receive a disclosure scorecard from the WDI, which is now part of the Thomson Reuters Foundation.

ESG and sustainability reporting regulations

While reporting has primarily been voluntary thus far, ESG disclosure mandates are expanding, at least for large companies. The following are some notable examples.

Corporate Sustainability Reporting Directive. The EU's CSRD went into force in January 2023. In 2025, the European Commission proposed a reduction in the directive's scope due to concerns that compliance costs and administrative burdens could affect the competitiveness of businesses in the EU. If approved, the number of covered companies -- initially estimated at 50,000 over time -- would decrease by about 80%. However, the CSRD now requires a group of large companies to file annual reports on business risks and opportunities related to social and environmental issues and how their operations impact people and the environment. The reporting requirements would take effect for two more sets of businesses in 2028 under a revised implementation schedule also proposed by the EC. Some EU subsidiaries of U.S. companies or the parent companies themselves could eventually become subject to the CSRD, too.

The directive adds a new set of standards for filing the required reports: the European Sustainability Reporting Standards. The ESRS include two general standards on reporting mandates and disclosure requirements plus 10 that cover specific ESG topics. They align or support interoperability with many of the voluntary frameworks and standards listed above, including the TCFD and TNFD recommendations, CDP and both the GRI and IFRS standards. The EC is also now looking to simplify the ESRS: In July 2025, EFRAG, an independent association tasked by the commission with developing the standards, released draft amendments that would streamline double materiality assessments and reduce the number of mandatory reporting data points by 57%, among other changes.

Corporate Sustainability Due Diligence Directive. The CSDDD, also sometimes referred to as the CS3D, is a related EU measure that went into force in July 2024. Starting in 2028 under a proposed one-year implementation delay, it will require qualifying companies to identify and act on adverse human rights and environmental impacts in their own operations as well as their value chains. Annual reporting on due diligence activities will also be required; companies subject to the CSRD are expected to include the information in the reports they file to comply with that directive.

California Climate Accountability Package. Signed into law in October 2023, the CCAP combines two bills. One requires companies that do business in California and have more than $1 billion in annual revenue to publish carbon emissions data each year. The other mandates that companies with revenue of $500 million or more publish a biennial report on climate-related financial risks. Despite earlier talk of a possible implementation delay, the reporting requirements are due to take effect in 2026 as planned.

At the federal level, the U.S. Securities and Exchange Commission (SEC) finalized a set of rules on climate risk disclosures for publicly traded companies in March 2024. However, the SEC stayed their implementation after multiple legal challenges were filed. Shortly after President Trump took office again, the reconstituted commission voted to stop defending the rules against the lawsuits. The SEC has since refused to say whether it plans to rescind, modify or uphold the rules based on the outcome of the court cases, which an appeals court paused while it waits for an answer from the commission.

Key terms and concepts to know

Read our glossary of ESG-related terms that sustainability, IT and business leaders should understand to help build a foundation for developing an ESG strategy.

Common challenges on ESG initiatives

The following are some potential challenges that organizations can face in managing ESG programs:

- Data collection complexity. ESG data often needs to be collected from various internal systems and external sources. Aggregating and consolidating the data is complicated, and data reliability can be compromised if that process isn't managed effectively and supported by sound data quality practices. Data silos in an organization can further complicate collection efforts and leave relevant data inaccessible to ESG decision-makers.

- Reporting problems. Inaccurate or incomplete data sets top the list of the ESG reporting challenges that companies encounter, said Donald Farmer, principal of consultancy TreeHive Strategy. That's backed up by a January 2024 Deloitte survey, in which 57% of the 300 chief sustainability officers and other executives who responded cited data quality as their biggest reporting challenge. Regulatory mandates and the various frameworks and standards also complicate the reporting process, despite the ongoing unification efforts on the latter. Integrating ESG goals and metrics with overall business objectives in reports can be difficult, too.

- Greenwashing -- or the perception of it. In ESG reports and marketing programs, organizations must be careful to avoid overstatements or deceptive claims about their environmental sustainability initiatives. Even the perception of greenwashing can damage a company's reputation. In some cases, the potential risks have led to green hushing -- not publicizing sustainability goals or practices. But customers and other stakeholders might then think a company isn't doing anything to reduce its environmental impact, also potentially causing reputational damage.

- Employee training. If an organization can't find -- or afford -- skilled ESG professionals, internal training might be required to fill out ESG teams. Broader employee training on ESG and sustainability also poses challenges. For example, the training might need to begin with basic education on climate change, greenhouse gas emissions and other issues. But a training program is unlikely to be successful if it isn't material to the company and specific employee roles.

- Lack of resources. Securing required funding and other resources for ESG programs can also be hard. In an October 2023 KPMG survey, insufficient resources or capacity ranked as the top challenge impeding cross-functional collaboration on ESG -- it was cited by 44% of the 550 executives, managers and board members who responded. Similarly, 45% of sustainability leaders and other business professionals from organizations that have prepared reports under the CRSD or the IFRS standards said additional staff resources would have improved the reporting process, as part of a 2025 PwC survey with 496 responses overall.

ESG tools and technology

Software that can help companies manage ESG initiatives is available from major IT vendors, such as IBM, Microsoft, SAP, Salesforce and ServiceNow, as well as various providers that specialize in ESG and sustainability. It's also now offered by many risk management, compliance, and environment, health and safety vendors. ESG and sustainability management software typically provides a broad set of features for data collection, reporting, analysis and carbon accounting, among other tasks.

For example, these tools can be used to measure Scope 1, 2 and 3 greenhouse gas emissions, both in internal operations and across supply chains. Major ESG reporting frameworks are commonly supported. The software can also be used to conduct ESG materiality assessments, track metrics and, in some cases, support DEI programs and other social ESG initiatives.

Forrester Research said the following features were among the criteria it used to evaluate products from different vendors for an April 2024 report on sustainability management tools:

- Support for materiality assessments.

- Data collection capabilities, including native integrations.

- Data quality management and standardization functionality.

- ESG and environmental strategy management.

- ROI calculations.

- Audit and compliance management.

- Environmental risk assessment.

- Supplier policy management.

- Reporting.

- Sustainability intelligence tools and dashboards.

ESG trends and developments to keep tabs on

The core values of ESG investing can be traced back to the socially responsible investing practices that began taking shape in the 1960s and 1970s and became more formalized over the next two decades. In the period from 2004 to 2006, the term ESG was popularized, a legal framework for factoring ESG information into investment decisions was outlined, and a set of six ESG investing principles still used today was published -- efforts all driven by the U.N.

The ESG landscape has evolved significantly since then -- and it continues to do so. The following are some ongoing trends for organizational leaders to be aware of in planning and managing ESG programs.

Growing use of AI tools in ESG initiatives

As mentioned previously, IT teams have been using AI and machine learning as part of green computing efforts in data centers. But the use of AI in ESG and sustainability programs is expanding into other areas. For example, AI tools can also analyze energy use in offices and manufacturing plants, as well as environmental issues in supply chains. Climate change modeling is another potential environmental use. On social and governance factors, potential uses include identifying workplace health and safety issues, bias in hiring and promotions, and ethical lapses. AI can also aid in data collection and management, and GenAI tools can help in writing ESG policies.

Increasing need to manage AI-related ESG risks

Conversely, the expanding use of AI in enterprise applications creates new risks across the ESG spectrum. As mentioned previously, AI tools are resource-intensive and can have a significant environmental impact. While AI can help identify bias, it can also amplify human biases if algorithms aren't coded and trained carefully enough. The use of GenAI and other AI technologies also poses various ethics, privacy and compliance risks. All these issues need to be addressed as part of an ESG program.

Heightened focus on ROI and business value

In a survey of 125 sustainability executives at large U.S. and multinational companies conducted by The Conference Board in 2025, 43% said their organizations were focusing more on the business ROI and shareholder value of ESG initiatives. "Boards and C-suite leaders increasingly expect sustainability investments to show clear business value tied to outcomes like risk reduction, efficiency, innovation and reputation," Andrew Jones, The Conference Board's principal researcher for corporate governance, sustainability and citizenship, said in a May 2025 video about the survey results.

Expanded emphasis on biodiversity and other nature-related issues

As indicated by the TNFD recommendations, there are increased expectations for companies to track, report on and address their nature-related dependencies, impacts, risks and opportunities. In particular, biodiversity loss caused by business operations has become a key aspect of sustainability initiatives in agriculture, mining, manufacturing and other industries.

Anti-ESG government actions and legislative efforts

The Trump administration has taken other steps against ESG initiatives in addition to the SEC halting the legal defense of its climate risk disclosure rules. In a similar move, the U.S. Department of Labor said it would stop defending a Biden administration rule that allows retirement plan managers to consider ESG factors in certain investment decisions; instead, the agency plans to initiate a new rulemaking process. The SEC also abandoned proposed rules that would have expanded requirements for ESG-related disclosures by investment advisors and managers as an anti-greenwashing measure.

In the highest-profile example, President Trump signed a set of executive orders aimed at curtailing DEI efforts, which he contends promote "illegal and immoral discrimination." Among other things, the orders directed the federal government to end its internal DEI programs, require federal contractors to certify that they don't have DEI programs that violate federal anti-discrimination laws, and identify private sector companies with "egregious and discriminatory" DEI policies.

Numerous bills to limit ESG investing and DEI initiatives have also been filed in various states. While many of the bills have been rejected, watered down or challenged in court, ESG is likely to remain a political target for Republican politicians in the U.S.

The political backlash has had an effect on businesses. For example, in addition to the companies mentioned previously that have ended or reduced their DEI initiatives, the six largest banks in the U.S. all withdrew from the U.N.-backed Net-Zero Banking Alliance shortly after the 2024 presidential election. Major banks from Canada, Europe and Japan then also left the voluntary emissions-reduction alliance, and it ceased operations in October 2025.

Fifty-two percent of respondents to The Conference Board survey said their company was narrowing or reframing its ESG-related communications. But while many organizations "are recalibrating ESG strategies," as Jones put it in his video, the EcoVadis and Capgemini surveys cited previously show that most companies aren't reducing their investments in ESG initiatives. In the Capgemini one, for example, 72% of respondents said environmental sustainability remains a top priority for their organization. An even larger number -- 82% -- said their company planned to increase spending on sustainability in 2025.

DEI programs and net-zero emissions targets are particularly under pressure. But Farmer said walking back ESG commitments as a whole isn't a practical -- or wise -- approach for companies. Those that consider ESG factors as part of their business strategies should be in a better position to succeed in the years to come than ones that don't, he added.

This article was updated in November 2025 for timeliness and to add new information.

Craig Stedman is an industry editor at TechTarget who creates in-depth packages of content on data technologies and processes.