ESG metrics: Tips and examples for measuring ESG performance

ESG metrics measure performance on environmental, social and governance issues. Here's how they can benefit companies, plus tips on using them effectively.

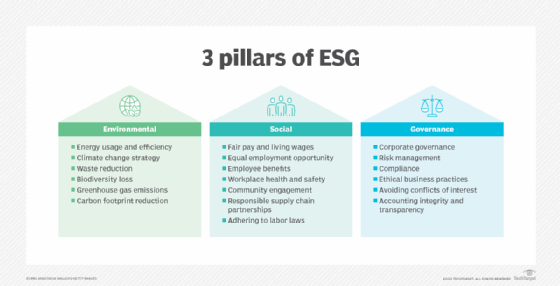

Environmental, social and governance considerations are increasingly important for businesses. While issues such as employee well-being and business ethics are longstanding corporate concerns, sustainability, environmental impact and broader social and internal governance factors have also become key elements of ESG initiatives in companies.

With this increased attention, corporate leaders must be able to measure their organization's ESG performance to help manage business risks and capitalize on business opportunities. Also, more jurisdictions around the world are requiring detailed ESG disclosures from companies, with significant financial penalties for noncompliance. Accurate ESG metrics are crucial in an environment where performance on ESG issues directly affects market access, corporate costs and regulatory standing.

What are ESG metrics?

ESG metrics are various performance indicators that help companies assess their business operations on sustainable and responsible practices. Primarily nonfinancial in nature, these metrics provide insights into things such as environmental impacts, corporate social responsibility (CSR) efforts and corporate governance structures. By tracking and analyzing relevant ESG metrics, companies can monitor their progress toward improved business sustainability and better business practices -- and, ultimately, their contributions to overall economic value creation and societal welfare in the areas where they operate.

Why are ESG metrics important for businesses?

Consumers are increasingly concerned about the social and environmental impact of products and services, and many are more likely to support companies that are transparent about their ESG performance. Investors also use ESG metrics to evaluate companies.

This article is part of

ESG strategy and management guide for businesses

In addition, ESG metrics can help businesses identify opportunities for growth and innovation. For example, companies that invest in renewable energy, green computing and other sustainable measures could better position themselves to take advantage of changes in customer preferences and the impact of new government regulations on their industries.

Effective use of ESG metrics delivers the following tangible business benefits:

- Enhanced market position and brand reputation. As mentioned above, companies can better differentiate their products and services and build increased customer loyalty through transparent disclosure of environmental and social impacts. They can also strengthen their brands and protect against potential reputational damage from things such as poor labor practices or environmental incidents.

- Increased access to capital and investments. By disclosing positive ESG metrics, companies can better attract investments from ESG-focused funds, which manage trillions in assets globally. Borrowing costs can also be reduced through improved credit ratings linked to strong ESG performance.

- Improved operational performance and innovation. ESG metrics enable businesses to document cost savings from energy efficiency, waste reduction and resource optimization. They also support efforts to increase operational resilience and reduce supply chain dependency risks. In addition, they can be used to drive innovation in sustainable products, services and business models.

- Better talent acquisition and retention. Sharing ESG metrics helps companies attract and retain top performers who increasingly prioritize working for purpose-driven organizations. Employee engagement and productivity can also be boosted by creating a workplace culture with strong ESG-driven values and inclusive, equitable work environments.

- Strategic and competitive advantages. Companies can use ESG performance metrics to position themselves for growth in emerging sustainable markets and particular customer segments. They can also build strategic partnerships with suppliers and customers that share their sustainability commitments, while anticipating and adapting to evolving regulatory requirements ahead of less forward-looking competitors.

Quantitative vs. qualitative ESG metrics

ESG metrics can be divided into two main categories: quantitative and qualitative. Quantitative metrics are based on numerical data that can typically be directly measured and compared. Examples of quantitative ESG metrics include greenhouse gas emissions, energy usage, employee turnover rates and reported HR violations. These metrics are useful for benchmarking and tracking performance over time.

Qualitative metrics, on the other hand, are based on non-numeric data and are harder to measure and compare. Examples of qualitative ESG metrics include a company's commitment to diversity, equity and inclusion (DEI), its labor practices and its impact on local communities. These metrics are more subjective and require more interpretation, but they can provide valuable insights into a company's culture and values.

Both quantitative and qualitative metrics are important for measuring a company's ESG performance. By using a combination of them, businesses can gain a more comprehensive understanding of ESG issues and work to improve in the areas where they fall short.

Common ESG metrics and associated KPIs

While the metrics that are most meaningful to track might vary from organization to organization, let's look at some commonly used ones in the different aspects of ESG.

Environmental metrics

These metrics assess a company's environmental impact and efforts to reduce it. They typically are quantitative and lend themselves to direct comparison across different organizations. The following are notable examples.

Greenhouse gas emissions. This measures the amount of greenhouse gases, such as carbon dioxide and methane, that a company emits into the atmosphere. Greenhouse gas emissions drive climate change, and companies that emit large amounts face potential regulatory, reputational and financial risks. Key performance indicators on emissions include:

- Scope 1, 2, and 3 emissions (often measured in metric tons as a CO2 equivalent).

- Emissions intensity per unit of revenue or production.

- Year-over-year emissions increase or reduction percentage.

- Progress toward carbon-neutral or net-zero emissions targets.

Energy usage. The amount of energy a company uses to produce goods and services, power its data centers and run other operations is another common ESG metric. Companies that use renewable energy sources, such as solar or wind, might have a lower environmental impact than those that rely on fossil fuels. Analyzing data on energy consumption can also highlight opportunities to increase energy efficiency. KPIs include:

- Total energy consumption in megawatt-hours.

- Percentage of renewable energy used.

- Energy intensity per unit of production.

- Energy efficiency improvements year-over-year.

Water usage. Water is an increasingly limited natural resource in many areas, and companies that use large amounts of it can face reputational and financial risks -- as well as excessive operating expenses -- if they don't take steps to reduce their consumption levels. Doing so begins with accurately measuring the amount of water used in a company's operations, along with related metrics. KPIs include:

- Total water consumption in cubic meters.

- Water intensity per unit of production.

- Percentage of water recycled or reused.

- Water stress risk assessments for operational locations.

Waste management. This includes metrics on waste generation and programs for managing waste. It's relatively simple for a company to track the amount of waste it generates and the materials it recycles. But it might also look at actions that are more complex to measure -- for example, efforts to reduce waste at the source or implement circular economy principles to minimize waste. KPIs include:

- Total waste generated, usually measured in tons or metric tons.

- Waste diversion rate from landfills.

- Percentage of waste recycled, reused or composted.

- Hazardous waste generated and properly disposed of.

Impact on biodiversity and nature. Due to recommendations from the Taskforce on Nature-related Financial Disclosures and requirements under disclosure mandates such as the EU's Corporate Sustainability Reporting Directive (CSRD), companies face increasing pressure to measure their impacts on biodiversity and natural ecosystems. KPIs include:

- Biodiversity footprint assessments.

- Mean Species Abundance, or MSA, impact scores.

- Percentage of operations in biodiversity-sensitive areas.

- Investments in nature-positive projects.

Social metrics

Measuring a company's performance on the social factors of ESG isn't always so straightforward: Social metrics are often qualitative and can be subjective. Here are some examples of these metrics.

Labor practices. ESG metrics can be used to evaluate how a company treats its employees and the workers in its supply chains. Labor practices that are commonly tracked include issues such as fair wages and safe working conditions, which have quantitative components. Other considerations, such as nondiscrimination policies, are more qualitative. KPIs include:

- Employee turnover rate.

- Workplace injury rate -- e.g., OSHA recordable incidents per 100 employees.

- Percentage of employees covered by collective bargaining agreements.

- Employee satisfaction scores.

Supply chain sustainability. In addition to labor issues, a company can look at the broader social impact of its supply chain. This might include measuring supplier diversity and the social benefits of responsible sourcing and sustainable procurement initiatives. KPIs include:

- Percentage of suppliers assessed on ESG criteria.

- Percentages of minority-owned, women-owned and locally owned businesses among suppliers.

- Supply chain audit completion rates.

- Supplier code of conduct compliance rates.

Human rights and associated labor standards. There's an increased regulatory focus on due diligence related to human rights protections for workers, particularly in high-risk sectors such as manufacturing, mining, agriculture and apparel. As a result, companies now track more comprehensive metrics on prevention of forced labor and other human rights violations, both internally and in supply chains. KPIs include:

- Percentage of operations assessed for human rights risks.

- Forced labor risk assessments completed.

- Grievance mechanism utilization and response rates.

- Monitoring for child labor in the supply chain.

Community engagement. This measures how a company engages with the communities in which it operates. Community engagement can include things such as philanthropy, volunteerism and CSR programs. KPIs include:

- Community investment as a percentage of revenue.

- Employee community service volunteer hours.

- Community impact assessment scores.

- Number of community partnerships and programs.

Governance metrics

These can be used to measure how well a company is managed and the effectiveness of its internal controls and corporate policies. Many governance metrics are quantitative and can be easily compared across different organizations. The following are some examples.

Executive compensation. How much a company pays its top executives can be an indicator of how well-managed it is and whether its financial incentives for senior management are aligned with the interests of employees and other stakeholders. KPIs include:

- CEO-to-worker pay ratio based on median compensation for all employees.

- Results of say-on-pay advisory votes by shareholders.

- Balance of long-term vs. short-term incentive compensation.

- Clawback policy implementation for recovering erroneously awarded compensation.

Business ethics. This assesses a company's commitment to ethical business practices, such as anti-corruption policies, whistleblower protection programs, and transparency in business operations and financial reporting. KPIs include:

- Ethics hotline utilization rate.

- Number of internal ethics incidents reported.

- Average resolution time on ethics incidents.

- Percentage of employees trained on the company's code of conduct.

Compliance and risk management. How well does an organization manage business risks and comply with laws, regulations and industry codes of practice? Regulatory compliance should be considered across all the jurisdictions where a company operates, while internal risk assessments inform risk management metrics to track, including different key risk indicators and the results of risk mitigation efforts. KPIs include:

- Regulatory compliance audit results.

- Cybersecurity incident response times.

- Number of data breaches and privacy violations.

- Risk assessment completion rates across business units.

How to choose and implement ESG metrics

Selecting and implementing the right ESG metrics requires a strategic approach that aligns with your company's business objectives, stakeholder expectations and regulatory requirements. Rather than attempting to track every possible metric, successful organizations focus on material issues that have real business impacts. Here's a structured approach to help chief sustainability officers, ESG program managers, CIOs and business leaders navigate this process effectively.

1. Identify the ESG issues that are material to your organization

The foundation of any effective ESG program starts with understanding which issues matter most to an organization's business operations and its various stakeholders. An ESG materiality assessment is a vital tool for identifying and prioritizing relevant factors. Take the following steps to conduct one:

- Start with stakeholder mapping. In addition to board members and business executives, key stakeholders commonly include investors, employees, customers, business partners, regulators and community leaders. Different stakeholder groups are likely to have varying priorities -- for example, investors might focus on climate risk and corporate governance, while employees care more about workplace equity and community impact. This makes including all of them a must to get a full picture for the materiality assessment.

- Conduct comprehensive stakeholder engagement efforts. Use surveys, interviews, focus groups and workshops to gather input from the various stakeholders on which ESG issues they consider most critical. These might include key ESG risks and opportunities, the organization's sustainability strategy or ESG-related priorities that inform its wider business strategy.

- Research what industry peers are tracking. Examine how competitors approach ESG reporting and which metrics they prioritize in their disclosures. Industry-specific guidance from external reporting frameworks can also help identify topics relevant to your sector.

- Create a materiality matrix. A materiality matrix maps the identified issues based on their importance to both the company and stakeholders. It typically displays the issues on a graph, with one axis representing the significance to stakeholders and the other showing their importance to -- and potential impact on -- the company's business success.

2. Review relevant regulations on ESG reporting

Understanding the regulatory landscape that applies to your organization is fundamental to building a compliant and future-proof ESG metrics program. For example, conducting a materiality assessment is becoming a requirement, especially for companies that are subject to the CSRD. Follow the steps outlined below:

- Map your regulatory requirements. Start by identifying which ESG regulations apply to your organization based on its size, sector and geographic footprint. Consider both current requirements and upcoming legislation that might affect your business in the next three to five years.

- Prepare for a double materiality assessment. The CSRD mandates the use of double materiality, which means companies must assess both the financial impacts of sustainability issues on their business and the effects of their activities on people and the planet. This requires you to track ESG metrics that relate to each of those perspectives.

- Stay informed about emerging requirements. Regulatory mandates evolve rapidly. Subscribe to regulatory updates, join industry associations, and work with internal and external legal counsel to stay ahead of changing requirements. Also, consider establishing a regulatory monitoring system to track developments across all the jurisdictions where your company operates.

- Plan for ESG audit and assurance needs. The CSRD also requires companies to have their sustainability reports independently audited to provide assurance that metrics and disclosures are accurate. Build ESG data collection and management processes that can withstand scrutiny from both internal and external auditors.

3. Research tools for managing ESG data and tracking metrics

ESG reporting demands strong data management capabilities. Too many organizations still rely on error-prone spreadsheets to manage the ESG data that underlies the metrics they track, an approach that becomes unsustainable as reporting requirements grow more complex. The following steps can help ensure that your company is using suitable tools:

- Assess your current data infrastructure. Evaluate existing systems for collecting, storing and analyzing ESG data. Identify gaps where manual processes create risks or inefficiencies. Significant amounts of data are required to conduct a comprehensive materiality assessment and provide various ESG metrics related to the priorities identified during that process.

- Consider ESG and sustainability management software. Offered by various vendors, these platforms are built for sophisticated data management and comprehensive sustainability reporting. By supporting materiality assessments and helping businesses to collect ESG data and track relevant metrics, ESG and sustainability management tools can play a crucial role in preventing greenwashing and highlighting genuine sustainability efforts.

- Evaluate software integration capabilities. ESG software can often integrate with other business systems, such as ERP or HR systems, to streamline data collection and improve overall sustainability management. Look for tools that can connect with your organization's existing technology stack to minimize manual data entry and improve data accuracy.

- Plan for scalability. Choose tools that can grow with your organization and handle increasing data complexity as your ESG program matures.

4. Review ESG reporting frameworks and standards

Standardized reporting frameworks provide structure, credibility and comparability to an ESG metrics program. Rather than creating metrics from scratch, use ones in established frameworks that align with your organization's material issues and reporting needs. Doing so builds confidence among investors, customers and other stakeholders. It also enables easier benchmarking against industry peers and reduces development time and costs on metrics.

The following are some prominent ESG reporting frameworks and standards:

- GRI Standards. Developed by the Global Reporting Initiative, the GRI Standards focus on sustainability reporting for multiple stakeholder groups, providing comprehensive guidance on disclosures related to environmental, social and governance factors. They include sets of universal, sector-specific and topic-based standards.

- SASB Standards. They provide industry-specific standards that help businesses in nearly 80 sectors disclose financially material sustainability information. Created by the now-defunct Sustainability Accounting Standards Board, the SASB Standards are currently overseen by the International Sustainability Standards Board (ISSB).

- TCFD Recommendations. This is a set of 11 recommendations for disclosing climate-related financial risks and opportunities, with an emphasis on forward-looking information about governance, strategy, risk management, and metrics and targets. They were created by the Task Force on Climate-related Financial Disclosures, or TCFD, which disbanded in 2023.

- IFRS Sustainability Disclosure Standards. Developed by the ISSB, which is part of the International Financial Reporting Standards (IFRS) Foundation, these are global baseline standards for sustainability-related financial disclosures and disclosures on climate-related risks and opportunities. They build on the SASB Standards, incorporate the TCFD Recommendations and are also aligned with other frameworks.

- CDP. This is an online system for reporting on business risks and opportunities related to climate change, water security and deforestation. Participating companies get letter-grade scores in each area. The system was created by the Carbon Disclosure Project, which -- like the platform -- is now known simply as CDP.

- European Sustainability Reporting Standards. Unlike the previous frameworks, which are voluntary to use, the ESRS are mandatory for companies under the CSRD. They provide detailed requirements for double materiality assessments, reporting and governance of sustainability topics.

5. Align your metrics and reporting with one or more frameworks

Be strategic in choosing which framework, or frameworks, to use. Adopting more than one -- such as reporting against both the GRI Standards and the SASB Standards -- might provide more comprehensive and balanced reporting and better meet your company's needs for relevant metrics on material issues.

For simplicity's sake, though, many organizations begin with one framework and gradually incorporate additional standards as their ESG program matures.

6. Follow best practices for a successful implementation

Here are some best practices to adopt when implementing ESG metrics and associated reporting procedures:

- Start with pilot programs to test internal processes and systems.

- Establish clear roles and responsibilities for ESG data collection and reporting.

- Document data sources and the methodologies used to collect data and track metrics.

- Build in regular review cycles to assess and improve metrics.

- Engage key stakeholders throughout the implementation process to ensure alignment and buy-in.

How else can companies use ESG metrics?

In addition to reporting and the business uses and benefits detailed previously, the following are some additional options for using the ESG metrics your company tracks:

- Commercial ESG scores and ratings. Several providers offer ESG rating services that rank a company's performance based on various criteria. For example, these services assess the company's adherence to ethical and compliance standards, as well as other metrics, typically using the ESG reports it prepares. The rating agencies then assign a numerical ESG score or a letter rating that the company, investors and other stakeholders can use for comparisons with other businesses in the same industry.

- Certifications. ESG metrics can be used to seek certifications that demonstrate a company's commitment to specific practices. For example, there's the Fairtrade certification for ethical social, environmental and economic trade practices. Another option is third-party certification of compliance with the International Organization for Standardization's ISO 14001 standards for environmental management.

- Internal or third-party audits. Even if they aren't required to by regulations, companies can conduct internal audits and assessments or hire third-party auditors to evaluate their ESG performance based on the metrics being tracked. Among other things, this also involves reviewing company policies and procedures, evaluating internal monitoring and reporting systems, and conducting interviews with executives and other employees to identify potential areas of improvement.

- Engagement with external stakeholders. Another approach is to use ESG metrics in follow-up engagements with outside stakeholders. This demonstrates the actions a company is taking -- and the progress it's making -- in response to stakeholder concerns and expectations regarding environmental, social and governance issues.

Challenges with ESG metrics and how to overcome them

Inevitably, there will be areas in which companies need to do better on ESG-related practices. However, to make improvements, an organization must ensure that its ESG metrics are properly targeted and actionable. This often is a challenge itself, in the following ways:

1. Setting clear goals and targets

Many organizations struggle with vague or overly ambitious ESG commitments. Without clear and measurable targets, it's difficult to track progress, allocate resources effectively or demonstrate meaningful business impacts to stakeholders.

Aim for clarity on ESG goals to help focus efforts and ensure that progress can be measured. For example, your company might set a goal to reduce its greenhouse gas emissions by 20% over the next five years. Doing so with the involvement of a wide range of stakeholders creates a sense of accountability while also ensuring that the efforts are aligned with strategic priorities -- and realistic.

2. Measuring and reporting on progress

Organizations frequently encounter significant obstacles in tracking and reporting their ESG performance. The required data can be incomplete, inconsistent or difficult to obtain, particularly for supply chain metrics and Scope 3 emissions by suppliers and other business partners. There's often a lack of standardization in how ESG metrics are measured and reported, making it challenging for companies to compare their performance across time periods or against industry peers.

Many companies also struggle with manual processes prone to errors and fragmented systems that don't communicate effectively with one another. As a result, you might need to invest in new systems or processes that can capture and report on ESG data more effectively. For example, this could involve steps such as working with third-party data providers or developing better data governance capabilities.

3. Integrating ESG factors into business decision-making

Many organizations treat ESG as a separate initiative instead of integrating it into core business processes. This siloed approach means ESG considerations and metrics are often overlooked in strategic decisions, capital allocation and operational planning. There could be a lack of understanding or buy-in from key business stakeholders who view ESG as a compliance exercise rather than a value driver.

Committing to assess ESG issues in decision-making processes will help ensure that they're weighed alongside other factors, such as financial performance and risk management. For example, a company might consider the environmental impact of a new product line before deciding whether to invest in it. This approach could require changes to existing systems, processes and workflows. You might also need to provide training and education on ESG, including the various metrics being tracked, to business executives and other employees.

4. Getting all stakeholders involved in the process

There are numerous obstacles to engaging stakeholders in ESG initiatives. The different perspectives and priorities that various stakeholders have make it difficult to align on common goals or approaches. Stakeholder engagement can be time-consuming and resource-intensive, requiring dedicated personnel and budget allocations that might compete with other business priorities. Organizations also face the challenge of identifying the right stakeholders and determining appropriate levels of involvement for them.

To get a full range of stakeholder input, it's helpful to use multiple channels of engagement, such as surveys, focus groups, social media outreach, one-on-one meetings and public events. When this process is managed effectively, the insights gained help organizations focus their ESG efforts on the most relevant issues and metrics.

Eying the future of ESG metrics

ESG practices and the metrics used to gauge their performance continue to evolve rapidly despite political polarization and regional variations in regulatory approaches. The fundamental drivers for ESG and sustainability initiatives in companies remain strong, with trends pointing toward a more standardized, data-driven future.

Key trends shaping the ESG landscape include the expansion of mandatory reporting -- albeit somewhat fitfully due to delays and policy changes -- and the continued emphasis on ESG-focused institutional investments. Technology is transforming performance measurement through the use of AI, cloud-based APIs and real-time data integration, while metrics are becoming more sophisticated and expanding into emerging focus areas such as biodiversity loss and mental health indicators.

Notwithstanding the current political backlash in some countries and ongoing concerns about greenwashing, leaders from many multinational companies and other businesses find it impractical to walk back their sustainability commitments. There's a good reason for that: Companies that factor ESG considerations into their business strategies should still be better positioned to thrive in the future, especially if the ESG metrics they track become more precise, actionable and integrated into core business decision-making.

Editor's note: This article was updated in October 2025 for timeliness and to add new information.

Donald Farmer is a data strategist with 30-plus years of experience, including as a product team leader at Microsoft and Qlik. He advises global clients on data, analytics, AI and innovation strategy, with expertise spanning from tech giants to startups.