ESG materiality assessments: What businesses need to know

Identifying the ESG issues that are important to the business and to both internal and external stakeholders can help organizations develop a plan to address them.

Executives are seeing a range of stakeholders ask for more information about their organization's environmental, social and governance work and demand more action on ESG issues. Consumers, business partners and employees are also showing an increasing interest in corporate ESG initiatives.

Yet stakeholders have run up against a lack of transparency. Findings from a September 2022 Dow Jones survey speak to that point, with 52% of respondents saying that the ESG data available isn't enough to make investment decisions, 45% saying the ESG ratings are too static and 58% seeking greater transparency around how ESG ratings are scored.

All this attention on ESG has more organizations performing ESG materiality assessments -- and for good reason, as experts consider a materiality assessment the foundation for a well-focused enterprise ESG strategy.

"When building an ESG program, you start with the blank sheet of paper. The materiality assessment fills out that paper with the identified risks that you want to deal with, and it sets the basis for what you want to report on. It sets the starting point. It's the basis for your ESG programs," said Nick McKeehan, managing director at the consulting firm Protiviti.

This article is part of

ESG strategy and management guide for businesses

What is an ESG materiality assessment?

An ESG materiality assessment is a process through which an organization identifies the ESG issues that are the most relevant and critical -- and thus, material -- to its operations, its success and its stakeholders.

In other words, it's a starting point for ESG-related work, although it should be revisited and refreshed to ensure it reflects current ESG concerns and risks.

"It's a way to help companies identify what the ESG issues are most important, so the company can then prioritize them and determine how to address them," said Caren Shiozaki, CIO and executive vice president at TMST and a member of the Emerging Trends Working Group with the governance association ISACA.

The ESG materiality assessment evolved from financial concepts. In fact, the term materiality is part of longstanding accounting practices. The Generally Accepted Accounting Principles (GAAP) standard defines it as those material items to include in financial statements because they could individually or collectively influence the economic decisions of users. Furthermore, materiality is one of the four basic constraints associated with GAAP, the other three being objectivity, consistency and prudence.

Increasingly, though, ESG materiality assessments involve double materiality, which considers both the possible financial impact of ESG factors on an organization and how its operations affect different groups of stakeholders -- not only investors, but also employees, customers, supply chain partners and their workers, community members and others.

As accounting frameworks and standards evolved to help organizations identify, measure and report on ESG issues that could affect enterprise finances, specific frameworks for ESG reporting based on internal materiality assessments have also emerged in recent years.

Organizations that have introduced ESG frameworks and standards for enterprise use include the International Sustainability Standards Board, which is now responsible for both a new set of disclosure standards it created and related ones originally developed by the former Sustainability Accounting Standards Board that offer guidance for nearly 80 different industries. The Global Reporting Initiative, the Task Force on Climate-Related Financial Disclosures, CDP and the World Economic Forum's International Business Council are some other examples. There's also the Corporate Sustainability Assessment issued by S&P Global, which enables companies to benchmark their performance on industry-specific criteria.

The process of conducting an ESG materiality assessment is a scoping exercise that creates a foundation for understanding and quantifying the organizational impact of different ESG issues, according to Mark Thomas, president of Escoute Consulting and co-author of ISACA's 2022 white paper "Governance Roundup: What Are You Doing About Environmental, Social and Governance Practices in Your Enterprise?"

"Think of the materiality assessment as a guide or blueprint for ESG strategies," he said.

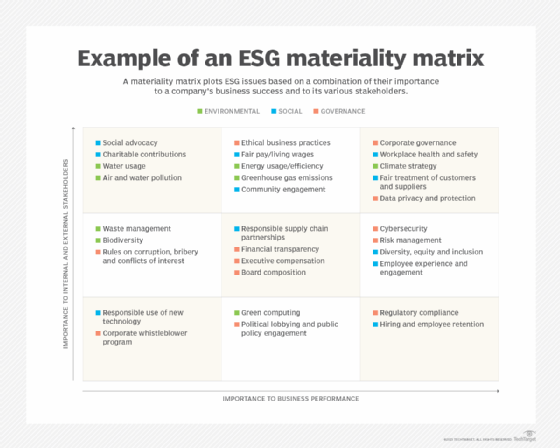

When working with executives at one organization on an ESG materiality assessment, Thomas plotted the ESG issues relevant to the organization in a materiality matrix. He placed issues based on their importance to business success on the x-axis and their importance to internal and external stakeholders on the y-axis, moving from least to most critical along each line. The quadrant of the matrix that contained the issues deemed most critical to both the stakeholders and business success indicated which ESG factors enterprise leaders should prioritize.

"We did that grid so we could prioritize what was most important," Thomas explained.

Benefits of materiality assessments for organizations

Organizations derive many benefits from an ESG materiality assessment, according to executives, ESG officers, governance leaders and auditors.

According to Joe Holman, principal and practice leader for ESG services at the advisory and accounting firm Withum, "Companies that can understand the materiality assessment in the long run tend to become better companies."

Specific benefits of ESG materiality assessments include the following:

- Identifying the ESG issues most important to the enterprise. ESG spans a wide array of issues, with certain issues in each area affecting different organizations and industries to varying degrees. A mining company, for example, has more many environmental considerations than a software development company. Similarly, a healthcare company that holds significant amounts of individual medical information must be more attentive to governance around data security and privacy than a manufacturing company that has little protected or proprietary data. Each organization must determine what ESG issues are most consequential to its stakeholders, operations and success -- something a materiality assessment does.

- Establishing a business case for addressing ESG issues. By identifying what ESG issues can help or hinder business success, organizations can better plan how to address them and why it's important to do so. Research shows that attention to ESG is important. A March 2023 survey of 200-plus companies by professional services firm EY found that 76% of companies with strong sustainability governance feel optimistic about financial performance, as compared with 45% of companies with weaker controls in place.

- Determining the right metrics for quantifying and communicating ESG impacts. With ESG priorities identified and the business case established, organizations can determine what data they must collect, analyze and report on internally and externally.

IT's role in ESG materiality assessments

With ESG now a board- and C-level topic, work supporting the ESG materiality assessment requires input from all enterprise executives. The CIO and IT department can and should contribute in the following ways, according to many experts:

- Help identify ESG issues, risks and opportunities. Protiviti's McKeehan noted that many CIOs have gained extensive insights into operations as they've extended the reach of technology to every corner of their companies in recent decades. These insights, in turn, can help them identify concerns, risks and opportunities related to ESG.

- Identify existing and new technologies required to support ESG efforts. Significant amounts of data are required to develop a solid materiality assessment and provide various ESG metrics around the priorities identified during that process. CIOs must ensure that the organization has the applications needed to collect, store and report on all that data.

- Ensure that the technologies can scale to support ESG goals. A lot of ESG reporting is done on spreadsheets today, "but that will not be sustainable going into the future," said Ami Beers, senior director of the assurance and advisory innovation team at AICPA.

- Incorporate ESG factors into the IT department. The IT function has its own environmental footprint, its own social considerations and its own governance needs. Therefore, as the enterprise determines its priorities through the materiality assessment, IT must then integrate those priorities into its own roadmap.

- Capture and report on IT-associated ESG metrics. This should be done both as part of the initial materiality assessment process and then for ongoing reporting around the IT-related ESG priorities identified in the assessment.

For more on ESG strategy and management, read the following articles:

ESG audit checklist: 6 steps for success

18 sustainability management software providers to consider

ESG vs. CSR vs. sustainability: What's the difference?

5 steps to successfully conduct a materiality assessment

An ESG materiality assessment should be a collaborative, multifunctional process involving many -- if not most -- of the C-suite executives and the board of directors. Key steps of this process include the following:

- Identify key stakeholders, including investors, customers, employees, business partners, and communities where the organization operates and regulators.

- Through a stakeholder engagement process, document the ESG-related risks, opportunities and objectives that are important to them.

- Determine the ESG-related risks, opportunities and objectives that the organization believes could affect business operations, performance and success now and in the future.

- Integrate and then prioritize the ESG-related risks, opportunities and objectives identified by stakeholders and the organization, creating a materiality matrix to visualize ESG goals from least to most important.

- Use those priorities to determine how the company will measure and report on its ESG efforts.