Getty Images

CPaaS in CX: A look at top providers, trends and use cases

The CPaaS market, as it relates to customer engagement, is competitive and volatile. See how vendors cater to business customers and the trends driving innovation.

Communications platform as a service is a critical technology to help companies meet and advance their real-time customer engagement goals -- and adoption data confirms this.

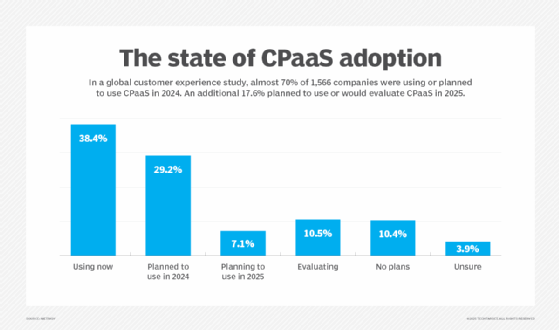

In a global customer experience study, Metrigy found nearly 70% of 1,566 participating companies had adopted or planned to adopt communications platform as a service (CPaaS) in 2024. An additional 17.6% planned to use CPaaS or were evaluating it for 2025.

CPaaS remains a highly competitive market. The choice of provider -- at least for the core messaging use case -- is often determined on a cost basis, with the smallest incremental price changes triggering movement. This means there's a fair amount of volatility in the CPaaS market. In the Metrigy study, nearly 40% of companies using CPaaS said they have already, plan to or are evaluating whether to replace their CPaaS providers.

This challenge has led many providers in new directions, such as broadening their API portfolios, extending their geographic reach and creating software for customer engagement and other use cases.

Leading CPaaS vendors

To guide enterprise buyers in their CPaaS decision-making, Metrigy ranks providers in its annual CPaaS MetriRank report. For the ranking, Metrigy determines the largest providers, based on revenue market share, and then evaluates the providers on a five-point scale for the following five criteria: financial strength, market share momentum, product mix, customer sentiment and customer business success. (Note: Because Metrigy gathers the latter two measures from its CX MetriCast study, which does not include input from IT/CX buyers in China, the research firm has excluded Alibaba and Tencent, which otherwise would have qualified based on revenue market share.) Metrigy then applies a weighting for each metric and tallies the individual scores to determine each provider's overall leadership score.

According to the report, here's a look at the five leading CPaaS providers and some information on their scoring:

- Twilio. Twilio continues its longtime reign as market share leader, further bolstered by the highest possible scores in product mix, customer sentiment and customer business success. Though it continues to operate sans profit, Twilio sits at average for financial strength. This score improved from 2023 due to the financial rigor Twilio has imposed to move into a profitable state.

- Infobip. Third largest in terms of market share, Infobip is ranked No. 2 overall in the Metrigy report. It received the highest possible scores in product mix and customer sentiment, as well as above-average scores for market share and customer business success. Infobip took a hit on its financial strength score, receiving the lowest possible score because it doesn't disclose its financials as a privately held company.

- Cisco. While CPaaS is an important component of Cisco's CX strategy, it's a small piece of the company's overall operations. That's evident in terms of market share, where it sits in the ninth spot; but Cisco is third in overall ranking. This is largely due to its strong financials; it's the only provider on the list to receive maximum points in this category. Additionally, it scored above average for product mix and sentiment.

- Vonage. Vonage is No. 4 in market share and in the fourth spot in the MetriRank report. Score highlights include above-average marks for financial strength -- based on the performance of Ericsson, its parent company -- and product mix, as well as an average score for customer sentiment.

- Sinch. Sinch rounds out the top five, holding the second-largest market share and standing out for above-average market share momentum, product mix and customer business success scores.

Filling out spots six through 10 are as follows: Link Mobility; Bird, formerly MessageBird; Route Mobile, majority owned by Proximus Group; Tata Communications, via the acquisition of Kaleyra; and Bandwidth.

Also noteworthy are 8x8, which is seeing significant CPaaS growth with a primary focus on enterprises in Indonesia and Singapore; India-based providers Gupshup and Tanla; and as mentioned previously, Alibaba and Tencent out of China.

Latest CPaaS apps and trends

As CPaaS providers strive to differentiate themselves, many have considered rich communication services (RCS) and network APIs, in addition to fleshing out the advanced capabilities afforded by AI.

Regarding RCS, this technology has long been touted as an improvement over SMS and an alternative to over-the-top messaging apps, such as WhatsApp and Facebook Messenger. This is because RCS enables companies to send secure, branded messages with rich media support, including audio, image and video content. It also has advanced features like interactive buttons, location sharing, product carousels and other enhanced capabilities. However, interest in and support for RCS had been limited because of the dominance of the Apple iPhone and Apple's lack of support for RCS.

That changed, however, near the end of 2024, with Apple's support for RCS on its iPhones beginning with the release of iOS 18. In recent months, several CPaaS providers have made RCS-related announcements. For example, Twilio and Vonage introduced RCS for their messaging APIs, joining Cisco, Infobip, Sinch and Tata Communications with RCS offerings.

In a global Metrigy CX optimization study, the research firm found growing business interest in the use of RCS. At least 75% of the 544 participants expressed interest in using enhanced capabilities enabled by RCS. Interest is highest for end-to-end journey support, brand identification and the ability to initiate workflows such as appointment scheduling.

Regarding network APIs, CPaaS providers are aligning themselves with mobile network operators and network equipment vendors with a goal of capitalizing on 5G investments. Vonage, owned by Ericsson, has been a primary mover here, and Infobip has joined in via a relationship with Nokia.

The idea is straightforward: Enable developers to marry communications APIs with advanced 5G network capabilities to create customer engagement applications that take advantage of a carrier's security/fraud protection, location awareness and quality-on-demand capabilities.

Business interest is growing here as well. Nearly 50% of companies that participated in the CX optimization study are already exploring potential use cases, whether internally or in conjunction with providers, and 40% are keeping tabs on network API-related efforts.

As for AI, the goal is continued enrichment of APIs with advanced capabilities. Video is a good case in point. For example, an AI-enhanced video API could include live captioning, translation and transcription capabilities. Other examples include the ability to add a generative AI-powered summary to automated workflows, handing customer interactions from bot to live agent or enable developers to describe a workflow in natural language and letting AI handle the build.

Use cases driving adoption

While these developments are ongoing, workflow automation -- followed closely by SMS and video calling/messaging -- are top CPaaS uses today, according to Metrigy research. For 2025, Metrigy's CX research indicates growth in the use of CPaaS for virtual assistance, application integrations and analytics.

Additionally, Metrigy expects to see CPaaS use growing around proactive outreach, dovetailing with rising interest in RCS for delivery of media-rich, interactive, branded messaging. Using RCS can build customer confidence for completing interactions such as ordering a new product or renewing a subscription, acting on an upsell or cross-sell suggestion, scheduling or changing an appointment in real time, or enrolling in a program, for example. Of those companies in the CX optimization study already proactively reaching out to their customers, nearly 20% do so via CPaaS, while nearly half use CPaaS plus a contact center platform to do so.

Future market outlook

Metrigy's data shows continued growth in the CPaaS market -- 11% CAGR from 2023 to 2028 -- as companies continue to find new uses for existing APIs or take an API-based approach to meet new CX opportunities.

Beth Schultz is vice president of research and principal analyst at Metrigy. She focuses her research on unified communications, collaboration and digital customer experience.