Getty Images

UCaaS vendors take on cloud contact center market share

As the UC market matures, vendors are looking for new ways to attract customers. Some vendors have set their sights on CCaaS, but getting executive buy-in could be a challenge.

The maturity of the unified communications market and growth of cloud communications are forcing UC vendors to diversify their product offerings to stay competitive. For many vendors, cloud contact centers will be the key to attracting new customers.

"UC spaces are becoming pretty commodified -- everyone offers it," said J Arnold & Associates analyst Jon Arnold. Vendors are moving into the contact center market because they have to in order to differentiate their services, he said.

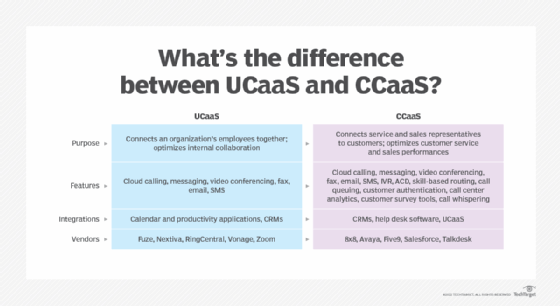

Historically, the UC and contact center markets have overlapped. UC as a service (UCaaS) vendors view contact centers as a growing market that's prime for a transition to the cloud, said Gartner analyst Daniel O'Connell. UCaaS vendors may find success on the smaller end of the contact center market -- namely companies with fewer than 200 contact center agents.

Smaller contact centers usually have simpler operations and will more likely opt for a vendor that offers combined UC and contact center, he said. Contact center customers are looking into newer capabilities like AI and digital channels, which UCaaS vendors see as an opportunity.

Cisco, for example, recently rebranded communications PaaS (CPaaS) IMImobile as Webex Connect and integrated it with Webex Contact Center. This integration should enable organizations to build personalized customer experiences across digital channels, including text messaging, WhatsApp and Facebook Messenger.

"Sometimes, users feel those channels operate in silos. That's where Cisco is trying to shine," O'Connell said.

While UC vendors are looking to expand their cloud contact center market share, contact center vendors are not pursuing the UC space. Most large contact center vendors aren't interested in telephony, which they view as a waning market, O'Connell said. Instead, they are interested in having good APIs that can tie into UC platforms like Microsoft Teams.

But some contact center as a service (CCaaS) vendors, like Talkdesk, will add telephony support mostly because of customer demand, Arnold said.

Challenges in selling UC and contact center

UCaaS providers may find difficulty in selling contact centers to a different type of buyer. UC buying decisions are made at the IT level, as the technology addresses the entire organization, while a contact center "is its own world," Arnold said.

UCaaS vendors need to learn how to educate customer experience leaders on the value of choosing them over contact center mainstays like Genesys, Nice or Avaya, he said. Legacy contact center providers can support thousands of agents, as well as workforce management, quality management, payment card industry compliance and reporting, O'Connell said.

On the flip side, organizations that want to migrate their contact centers to the cloud may find UCaaS vendors to be a more attractive option if their legacy provider is inflexible or slow to introduce new features, Arnold said.

Another challenge for UCaaS vendors: Migrating contact centers to the cloud is more complex compared to UC, so many contact center deployments are still on premises.

The driver for moving to cloud-based UC starts with telephony, which is an easy bridge for organizations to cross because it's one app, Arnold said. As organizations get more comfortable with the performance of voice over IP, it's easier to make the decision to move other real-time communication apps, like video, to the cloud.

Contact centers, however, are an all-or-nothing migration, which can be more costly. To encourage buyers toward CCaaS, UC vendors must educate them on how the cloud addresses pain points for agents and customers, he said.

For example, legacy on-premises contact centers will have a harder time supporting remote agents with a consistent set of tools and can't easily scale compared to cloud-based contact centers.

Complex contact centers need standalone vendor expertise

Part of the driver for UCaaS vendors to expand their portfolios for cloud contact center market share is the idea of a single, integrated platform. Standalone versus integrated suite has been an endless debate in the UC space. Organizations either trust and standardize on one vendor or opt to integrate multiple vendors.

One advantage of a single, integrated vendor for UC and contact center would be when an agent needs to communicate with a subject matter expert during a complex customer call, O'Connell said. That's one of the selling points for 8x8, which touts an integrated platform for UCaaS, CCaaS and CPaaS.

However, the most successful providers in the contact center space right now -- such as Five9, Talkdesk and Genesys -- are focused solely on contact centers, he said.

Contact centers require a high level of specialization, such as integrations with CRM and workforce optimization. A UCaaS vendor may not be able to deliver these services the way a pure-play contact center vendor could, Arnold said.

"That's the challenge," he said. "You have to build a good contact center experience, and no mix-and-match company is going to come close."