kentoh - Fotolia

CPaaS market growth broadens amid new use cases

While the pandemic didn't have a significant effect on CPaaS market growth, organizations accelerating their digital transformation plans are driving demand for APIs.

The future of work is digital, and organizations are responding by accelerating their digital transformation plans. For some organizations, this means turning to communications platform as a service, or CPaaS, to improve operational efficiencies and customer support.

About 20% of global organizations today use CPaaS APIs to enhance their digital competitiveness. But, by 2023, nearly 90% of organizations will use CPaaS, according to a Gartner report on the CPaaS market.

CPaaS market growth is being driven by global expansion of services into new regions, new CPaaS vendors, emerging communications modules and faster user adoption. Somewhat surprisingly, the COVID-19 pandemic did not have a significant effect on market growth as it had for other communications markets, according to the report.

Instead, the CPaaS market saw a decline from major customers, such as Uber, Lyft, Airbnb and the airline industry. But gig food delivery services, telehealth, remote learning and utility services drove some growth, the report said.

The CPaaS vendor landscape

Twilio has long been the CPaaS market leader, and its success has opened the door for other startups, including MessageBird and Nexmo -- the latter is now part of Vonage. Legacy text messaging providers, such as Zenvia, IMImobile and TeleSign, have entered the CPaaS market. Larger communications providers, like AT&T, Microsoft and Amazon, have also introduced CPaaS offerings.

Gartner expects more vendors will enter the market, ranging from startups to major technology vendors. Mergers and acquisitions could also shake up the market as vendors look to build out capabilities and gain customers.

While the CPaaS market initially focused on tools for developers, low-code and no-code options have grown in popularity for customers without developer skills. As such, CPaaS vendors usually take one of two approaches to their offerings.

First is the developer focus. In this self-service model, the vendor provides APIs, SDKs, integrated development environments and documentation to let the developer build out the communications modules to fit the organization's use case. Typical customers for this scenario are digital natives, like Uber, Lyft and Airbnb. The organization's developer builds out the application, and the vendor handles interoperability across carriers and geographic regions. Vendors that take this approach include AT&T, Bandwidth, MessageBird and Twilio, according to the report.

Second is the co-creator focus, which is geared toward legacy customers in industries such as retail, finance and healthcare that have started to explore CPaaS. These organizations may or may not have developers on their teams; consequently, they often seek help from the vendor. These offerings normally use low-code tools, such as visual builders, for capabilities like text messaging, two-factor authentication (2FA) and payments. Vendors that take a co-creator approach include IMImobile, IntelePeer, Syniverse and Infobip, according to the report.

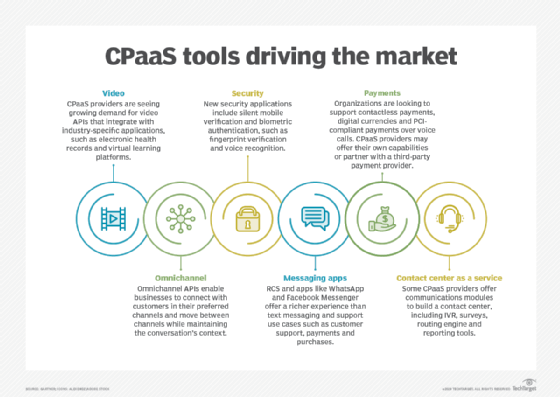

Emerging tools fuel CPaaS market growth

CPaaS products have expanded beyond the text messaging and authentication use cases that first drove adoption. New use cases as part of digital transformation initiatives are contributing to today's CPaaS adoption and market growth. The pandemic has contributed to some new use cases, such as telehealth and contactless payments, while other use cases are driven by changing consumer behavior, such as communicating with brands through messaging apps. Six key capabilities in particular are driving CPaaS market growth:

- Video. CPaaS video has been available for several years but saw increased demand in response to the pandemic to support remote use cases for healthcare and education. CPaaS video APIs integrate with a variety of industry-specific platforms, such as electronic health record services. Many organizations are looking to embed video into their platforms rather than buy a separate video service. Schools and universities are also taking advantage of video APIs to integrate with online learning platforms.

- Omnichannel. This approach enables businesses to connect with customers across multiple channels while maintaining the context of the conversation. Omnichannel generally focuses on customer experience and contact center use cases. Customers can use their preferred communications channel without worrying about restarting a transaction.

- Security. 2FA has been a popular CPaaS security application, but this method can be compromised by hackers. Some CPaaS providers are rolling out new security capabilities that are more difficult to hack, including silent mobile verification and biometric-based authentication.

- Messaging apps. Like with omnichannel customer engagement, customers want to talk to brands in their preferred messaging channels. Messaging apps -- such as WhatsApp, Facebook Messenger and Apple Business Chat -- and Rich Communication Services, which is touted as the replacement for SMS text messaging, provide a more engaging communications experience. These tools have features like QR codes, videos and images, which enable companies to support customer service, payments, and retail or food purchases through an app.

- Payments. This is one area that has seen growth driven by COVID-19 as businesses shirk traditional paper currency in favor of touchless transactions. Customers can pay through digital currencies, such as PayPal or Google Pay, or through Payment Card Industry-compliant payment methods, like dual tone multi frequency. CPaaS providers can also integrate with third-party payment providers or gateways.

- Contact center as a service (CCaaS). Some CPaaS providers offer capabilities to build out communications modules for contact centers, such as interactive voice response, surveys and reporting tools. Amazon Connect and Twilio Flex are the most prominent CCaaS offerings. However, CCaaS is a complex use case, so most CPaaS providers offer omnichannel capabilities instead, according to the report.