- Share this item with your network:

- Download

Storage

- FeatureFlash, cloud top data storage options for storage pros

- FeaturePurchase of NAS arrays driven by need for capacity, desire to expand

- FeatureSmarter storage starts with analytics

- OpinionSecondary data storage takes center stage

- OpinionEssential elements of copy data management

- OpinionScale-out software-defined storage market menaces traditional storage

Fotolia

Purchase of NAS arrays driven by need for capacity, desire to expand

As unstructured data continues to lead storage growth, businesses are opting for scale-out NAS arrays to handle current and future capacity.

Cloud storage may be hot, but good old NAS arrays -- stand-alone and hybrid deployments -- are more than holding their own in today's data center. Beige Market Intelligence forecast, for example, that the global NAS market will grow to $44 billion by 2021, at a compound annual growth rate of about 24% annually. A healthy, if not thriving, market if ever there was one.

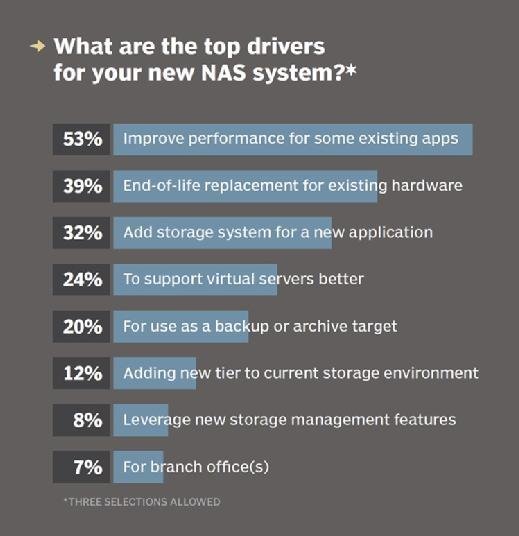

A number of factors are leading organizations to buy new NAS arrays. According to our surveys, more than half of respondents are looking to improve the performance of existing applications with a NAS upgrade, followed by about 40% whose main aim is to replace aging hardware. Other important factors include adding new storage systems to better support virtual servers and specific applications, a backup target, an additional tier to their storage environment, gain access to advanced storage management features and for deploying mass storage for branch/remote offices.

Of course, the top factor they are considering when evaluating NAS vendors is price (80%) followed by features and performance (60%), and maintenance and support agreements (40%). Additionally, the market position of the vendor is top-of-mind as is -- ever more essential to today's scale out data center -- plug-and-play capability.

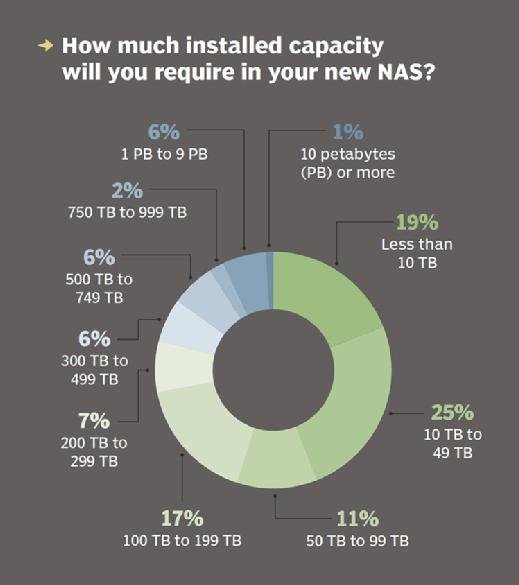

The average capacity of recent NAS purchases was 406 GB, with very few (11%) choosing arrays with than 500 TB or more storage. A little more than a quarter of survey respondents chose to buy arrays with between 10 TB and 49 TB of capacity, while a little less than a quarter picked up NAS devices with less than 10 TB. These are followed by 50 TB to 99 TB range (14%), 100 TB to 199 TB (10%), 200 TB to 299 TB (8%) and 300 TB to 499 TB (6%).

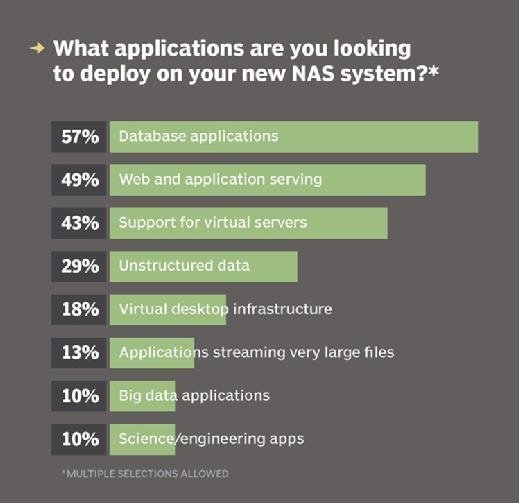

A trifecta of planned uses leads the way for what businesses are looking to deploy on their new NAS systems, including database applications, web and application serving, and platforms for virtual servers. These are followed in descending order by support for unstructured data (file, user shares and so on), virtual desktop infrastructure, applications that stream very large files (e.g., media applications), big data applications that use many files, science and engineering apps.

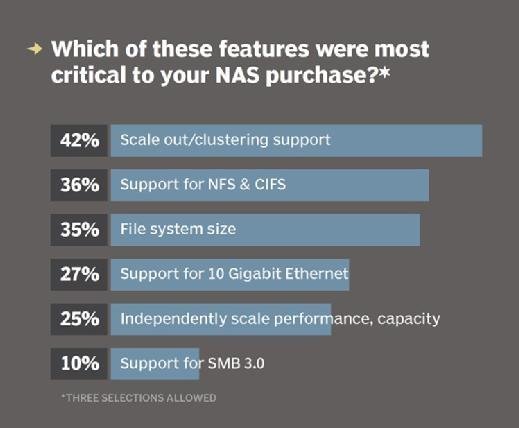

The sweet spot for connecting all these NAS arrays to the rest of the IT network is 10 Gbps Ethernet by a large margin, 66%. That's followed by the older but still in demand Gbps Ethernet standard (21%) and newer but ramping up 40 Gbps Ethernet. The vast majority, over 80%, go with Network File System as their NAS array's file system protocol, with Common Internet File System accounting for 44% and Server Message Block 3.0 31%, of NAS buys.

Next Steps

Attention, NAS system shoppers

Deciding between SAN and NAS arrays

The pros and cons of block, file and object storage