Getty Images/iStockphoto

6 enterprise data storage startups to watch in 2022

Storage startups continue to innovate despite supply chain sluggishness. Here are six we'll be keeping an eye on in 2022.

Storage startups continued to come up with new takes on how to solve old and emerging issues in 2021 and into 2022.

Here are six we're tracking in 2022. The group selected represents storage and data protection vendors with a focus on issues such as migrating to and managing multiple cloud environments, squeezing more performance out of existing equipment, and battling the ever-growing threat of ransomware attacks.

MemVerge

Specialty: In-memory computing

CEO: Charles Fan

Funding: $43.5 million

Worth watching because: Makes data-intensive applications portable across multiple clouds.

Market hurdles: Larger vendors, such as VMware, looking to move into the same space.

MemVerge, founded in 2017 and headquartered in Milpitas, Calif., took advantage of 3D XPoint, specifically Intel Optane DIMMs, to deliver software that helps customers fully utilize 3D XPoint with its Big Memory Machine, an in-memory computing product. The vendor can extend memory pools up to terabytes for faster processing without the capacity limitations of RAM or the reduced performance of SSDs.

Last year, MemVerge focused on portability, pushing Big Memory Machine to public clouds. Through ZeroIO snapshots, which use persistent memory, and AppCapsules, which containerize snapshots, users can move applications from on premises to the cloud and from one cloud to another.

MemVerge also threw support and its ZeroIO technology behind checkpointing, a type of snapshot for high-performance computing (HPC) environments that captures the application and all the resources needed to run it. MemVerge speeds up the process and movement of checkpointing, increasing its adoption. This could lead to various use cases outside of HPC.

While the vendor highlighted portability in the last year, MemVerge has also described its products as helping data-intensive applications avoid data storage bottlenecks.

In-memory computing is still a new market, but as it gains interest, more players will provide competition.

MemVerge was co-founded by Charles Fan, formerly of VMware; Shuki Bruck; and Yue Li.

Pavilion Data Systems Inc.

Specialty: High-speed parallel flash storage

CEO: Dario Zamarian

Funding: $107 million

Worth watching because: Unique storage that enables switching fabric for data-centric performance.

Market hurdles: Lack of name recognition against well-known high-performance storage vendors.

Pavilion Data Systems Inc., founded in 2014 and based in San Jose, Calif., uses built-in network switching fabric architecture rather than traditional storage controllers; instead of a dual controller, Pavilion uses 20. As the computational storage market grows, artificial intelligence and machine learning (ML) become more prevalent in the enterprise, creating workloads that will need faster performance.

Performance aside, the Pavilion HyperParallel Flash Array can deliver 2.2 petabytes of NVMe storage in a 4U footprint. The array's switching architecture enables performance as high as 120 GBps read, 90 GBps write and more than 20 million IOPS read all while achieving latency as low as 25 µs. Other parallel file systems can be put on top of Pavilion's hardware to increase performance.

With the computational storage market continuing to expand, Pavilion is in position to reap the rewards of the expansion.

Pavilion was co-founded by Kiran Malwankar, Sundar Kanthadai and V.R. Satish.

Lightbits Labs

Specialty: Pioneer of NVMe/TCP

CEO: Eran Kirzner

Funding: $54.2 million

Worth watching because: Provides a more cost-effective means for higher performance.

Market hurdles: Several large vendors now support NVMe/TCP, making for a noisy market.

Lightbits Labs, founded in 2016 and based in San Jose, Calif., is a disaggregated storage provider and an early adopter of NVMe/TCP, which uses existing networking infrastructure like Ethernet to bring faster speeds from storage to host and at lower cost.

Lightbits Labs is a software-defined block storage vendor that enables users to scale compute and storage separately. This is done through its operating system, LightOS. The vendor helped develop NVMe/TCP and used it to provide customers with centralized storage that performed like local storage, according to Lightbits Labs.

In April 2019, the vendor also ventured into hardware with its SuperSSD, a 2U all-NVMe array aimed at AI and cloud applications. The SuperSSD comes with LightOS pre-installed and pre-configured and can be added to a company's private cloud for AI and ML use cases.

These days, NVMe/TCP is growing in popularity, which puts Lightbits Labs in a competitive position -- but it has to go up against entrenched vendors such as NetApp, which can use their current infrastructure's version of NVMe/TCP.

Lightbits Labs was co-founded by Avigdor Willenz, Eran Kirzner, George Agasandian, Muli Ben-Yehuda, Ofir Efrati and Sagi Grimberg.

Rewind Software Inc.

Specialty: Data protection for SaaS applications

CEO: Mike Potter

Funding: $80.1 million

Worth watching because: Provides SaaS backup for many small vendors rather than focusing on only top-tier SaaS providers.

Market hurdles: Data protection market is growing, and Rewind will see an uptick in competition from top vendors in its field.

Rewind Software Inc., founded in 2015 and headquartered in Ottawa, has carved out a niche by providing data protection services to smaller but increasingly critical and growing SaaS applications such as Shopify, QuickBooks Online and GitHub.

Rewind finds and saves changes in data, encrypting it and moving it to its Rewind vault. If there are no changes, the data is maintained.

After two funding rounds in 2021, Rewind began to edge into more competitive territory. In December, it began providing protection for Microsoft 365, taking aim at other major backup and data protection providers such as Veeam, Commvault and Acronis.

Rewind has cemented a place in the data protection market, which may provide a competitive position as it looks to build out its business.

Rewind was co-founded by Mike Potter and James Ciesielski.

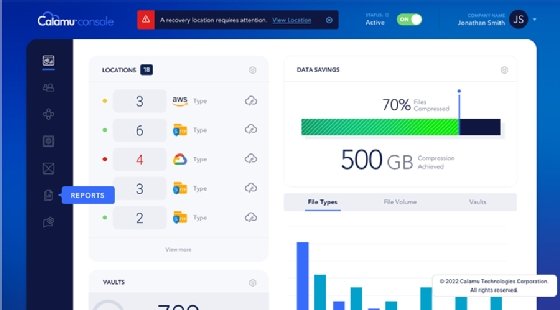

Calamu Technologies

Specialty: Self-healing data protection technology

CEO: Paul Lewis

Funding: $16.5 million

Worth watching because: With the spread of ransomware, companies need data protection options.

Market hurdles: Increasingly competitive market as more vendors release anti-ransomware products.

Calamu Technologies, founded in 2020 and based in Clinton, N.J., takes a different approach to data protection in the fight against ransomware with its data harbor. This virtual harbor is configured over multiple environments both on premises and in the cloud. Data that needs to be protected is fragmented and spread across these environments.

Data is encrypted before it is broken into fragments; each fragment is reencrypted using a different key and then scattered around the virtual harbor. Breaking up and encrypting data this way creates what the vendor calls "digital sludge" that can slow down a cyber attack. If a system using Calamu is compromised, attackers would only be able to access pieces of encrypted information. But even if they decrypt each piece, the attackers would have to assemble them correctly and then decrypt the full data.

Calamu also provides a self-healing feature, an automatic function that kicks in during an attack that results in no downtime. The feature relies on a series of redundancies.

Calamu was founded by its CEO, Paul Lewis, who was the founder of two previous cybersecurity firms.

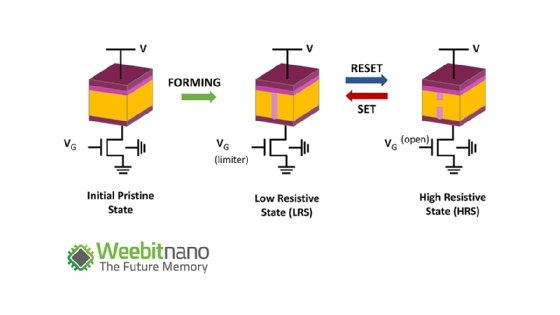

Weebit Nano

Specialty: Pioneer in Resistive Random Access Memory (ReRAM)

CEO: Coby Hanoch

Funding: $75 million*

Worth watching because: Creates a type of non-volatile memory that is faster and less expensive than traditional embedded flash*.

Market hurdles: New memory technologies are needed, but take time to get certified and adopted.

Weebit Nano, a small company of about 40 employees that was founded in 2015, develops silicon oxide-based ReRAM. Weebit's ReRAM constructs or deconstructs filaments to store bits, and Weebit uses a high or low charge to build or break the filament, depending on the storage need.

Made this way, ReRAM is more cost-effective and provides a lower power consumption at roughly 100 times higher endurance compared with embedded flash. It is also highly scalable and resistant to high temperatures and radiation. ReRAM will first be used by IoT devices, where resilience is a plus.

In the last six months, Weebit unveiled a string of news including that it has expanded partnership with CEA-Leti, a French government-funded research organization; landed its first commercial deal with the American foundry SkyWater Technology; and raised an additional $25 million in funding.

ReRAM may seem similar to storage class memory, a storage media that sits between RAM and NAND. But Weebit has stated it is focused on different use cases, including embedded storage uses and as a potential replacement for NOR flash memory.

Manufacturing variability had been preventing Weebit from mass production*, although the company has stated it has corrected the issue and will most likely see volume production for certain customers in 2023.

Although it calls itself a startup, Weebit Nano, which was founded by* Amir Regev, Dadi Perlmutter and Yossi Keret and is headquartered in Hod Hasharon, Israel, is publicly traded on the Australian stock exchange as a source of funding. The company got its start based on research that it licensed from Rice University in Houston.

Correction: This story was updated March 10, 2022 to reflect that total funding is at $75 million, Weebit Nano technology is a replacement for embedded flash, all of the founders are now listed.