What is NetApp?

NetApp, formerly Network Appliance, Inc., is a multinational corporation in the computer technologies industry specializing in data storage hardware, software and cloud services. NetApp storage products are used by enterprises and service providers to store and manage large amounts of digital data across physical and cloud environments, including hybrid cloud and multi-cloud.

NetApp celebrated its 30th anniversary in 2022. It is a publicly traded company that was first incorporated in April 1992 in Santa Clara, Calif. In 2001, NetApp reincorporated in Delaware and relocated its headquarters to a 58-acre campus in Sunnyvale, Calif. NetApp is now headquartered in San Jose, Calif.

According to analyst firm IDC, NetApp ranked fourth in enterprise external storage revenue for 2022. NetApp's sales represented 8.3% of the market share, placing it ahead of Pure Storage and Hitachi Vantara, but behind Dell, HPE and Huawei. The previous year, NetApp held 9.9% of the market share and ranked third behind Dell and HPE.

In the fourth quarter of fiscal year 2024, NetApp earned $1.67 billion in net revenues, compared to $1.58 billion in the same quarter of the previous fiscal year. This represented a year-over-year increase of 6%. However, the total net revenues for fiscal 2024 were $6.27 billion, a 1% decrease from the $6.36 billion in net revenues in fiscal year 2023.

NetApp portfolio

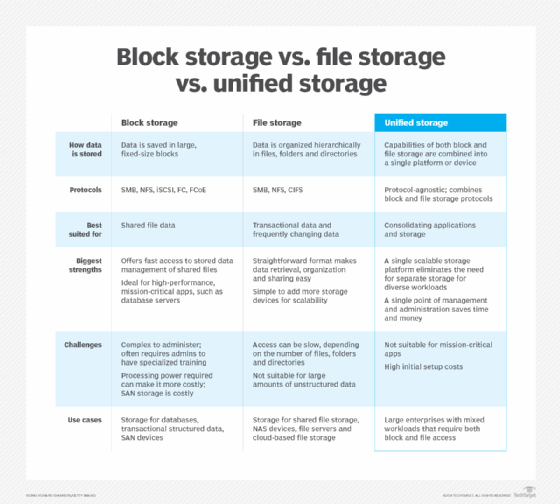

Gartner's Magic Quadrant for Primary Storage rated NetApp as a leader in the primary storage market from July 2022 through May 2023. As part of its review, Gartner describes NetApp as having "mature and rich enterprise file services capabilities, making it a reliable unified storage offering."

NetApp provides a wide range of storage-related products and services for storing and managing data both on premises and in the cloud. The storage hardware includes all-flash arrays and hybrid cloud storage systems for block, file and object storage. The following systems are some of the company's more prominent storage products:

- All-flash. ASA SAN Storage, AFF A-Series, AFF C-Series and EF-Series.

- Hybrid flash. FAS Series and E-Series.

- Object. StorageGRID (software-defined object storage platform).

- Converged. FlexPod (converged infrastructure system from NetApp and Cisco).

NetApp storage systems integrate with the three major public cloud platforms -- AWS, Azure and Google Cloud -- and natively support VMware vSphere for virtualized workloads. In general, NetApp is known for providing unified storage that goes beyond the hardware, offering solutions for data management and protection, data services and infrastructure management.

Integral to many of these solutions is NetApp's OnTap, a unified storage operating system that can span multiple environments, including on-premises systems, virtual storage platforms and multiple cloud services. OnTap also supports features such as automated data placement, cloning, data tiering, flexible volume RAID groups, inline data reduction, hybrid caching, metro clustering, quality of service and triple-parity RAID 6 data protection.

In addition, NetApp offers its BlueXP line of storage and data services. BlueXP is a software as a service (SaaS) platform that provides a single control plane for managing and protecting data across on-premises and cloud environments. BlueXP enables administrators to work directly with their local storage systems, as well as their OnTap cloud deployments across AWS, Azure and Google Cloud environments.

BlueXP also provides a variety of data protection services, including backup and recovery, ransomware protection, data replication and disaster recovery for VMware. In addition, BlueXP includes core services such as tiering, copy and sync, volume caching and data classification. Administrators can also monitor energy consumption and storage utilization.

NetApp company history

Founders Dave Hitz, James Lau and Michael Malcolm started Network Appliance in 1992. The three were professional colleagues at now-defunct Auspex Systems, an early Network Appliance competitor.

The first Network Appliance product was a file server appliance, which sought to eliminate the overhead associated with competing storage products. The file server appliance is now known generically as the NetApp filer.

Network Appliance brought the product to market in 1994, aided by nearly $13 million in venture funding that was led by Sequoia Capital. The product's design foreshadowed the concept of disaggregation. In the NetApp system, the storage filer itself was connected to, yet independent of, a nonprogrammable compute server.

Initially, NetApp marketed its filers to Unix-based technical workgroups writing client-server programming software for the Network File System. The technology proved to be a steppingstone to NetApp's emergence as an innovator of network-attached storage (NAS) systems.

Malcolm was NetApp's first president and CEO but was forced out in 1994 by investors preparing to take the company public. Daniel Warmenhoven replaced Malcolm and led NetApp to its initial public offering of stock in November 1995. The stock sale raised nearly $26 million, "just in the nick of time, because we were out of money," Hitz wrote in his history of NetApp, How to Castrate a Bull: Unexpected Lessons in Risk, Growth and Success in Business.

By the mid-1990s, NetApp generated most of its revenue from the sale of network filers and cache appliances. By then, the market had started to evolve beyond the Unix and Windows NT workstations that had been the core of NetApp's early growth. NetApp shifted gears to ride the internet wave, selling storage products to high-tech and internet-based companies. Revenues grew from roughly $250 million to more than $1 billion between 1999 and 2001.

About 70% of NetApp sales came from internet-based firms during that time. The price for NetApp stock soared to $150 per share at its high point, but the dot-com bubble wiped out almost all the gains. By 2001, NetApp revenues fell to $800 million, and share prices dropped to approximately $6, forcing NetApp to enact its first round of layoffs.

Following the collapse, NetApp began focusing on large enterprise customers across vertical markets, including automotive, energy, government, healthcare, manufacturing, banking and financial services. NetApp targeted its NAS products at organizations that would use them to complement, and in some cases replace, traditional storage area networks (SANs) based on the Fibre Channel (FC) networking technology.

In 2002, NetApp started selling block-storage SANs that supported FC and Ethernet-based iSCSI connectivity. The move into SAN storage systems intensified NetApp's competition against rival EMC, which trailed NetApp in the NAS market but still led in the SAN market. At the time, EMC and NetApp were the largest pure-play storage companies, while competitors such as IBM and Hewlett-Packard sold servers and storage.

In 2009, Warmenhoven turned over the CEO reins to Tom Georgens, although Warmenhoven continued as NetApp's chairman until 2014. Prior to taking over the top spot, Georgens served as NetApp chief operating officer. During his tenure, NetApp revenues peaked at $6.3 billion in 2014, but the vendor fell behind other storage vendors in bringing all-flash, cloud and hyperconverged products to market.

NetApp fired Georgens in 2015 after a string of disappointing quarters, marked by flat earnings and sluggish customer upgrades from OnTap-7 Mode to clustered OnTap. George Kurian took over as CEO after serving in several executive roles at NetApp, including his most recent position as executive vice president of product development.

In September 2016, after Dell acquired EMC for more than $60 billion, NetApp became the largest company to focus predominantly on storage. By 2017, NetApp's cloud and flash storage sales accounted for about 70% of product revenue.

In February 2018, NetApp reported quarterly earnings of $1.52 billion. The revenue included sales of the SolidFire all-flash arrays that NetApp acquired in 2015. Also in 2018, NetApp introduced its first end-to-end non-volatile memory express array, which delivered over 1.3 million IOPS at 500 microseconds per high-availability pair.

In 2019, NetApp was rated the No. 1 vendor in Gartner's Magic Quadrant for Primary Storage, and by 2022, NetApp was well established as a hybrid cloud provider. In 2023, Gartner still rated NetApp as a leader in its Magic Quadrant for Primary Storage. However, NetApp could no longer claim the No. 1 slot, an honor that went to Pure Storage.

Department of Justice probe involving trade sanctions

In 2011, The Washington Post reported that NetApp was suspected of violating U.S. trade sanctions by selling storage equipment to the Syrian government, which had been designated a state sponsor of terrorism. NetApp's products were reportedly used by Syrian police to monitor email and other communications from rebels opposed to President Bashar al-Assad's regime.

NetApp was one of several companies ensnared in the probe, which also included HPE. The storage equipment was purportedly first sold by NetApp's Italian subsidiary to an authorized vendor. The vendor then sold it to Area Spa, an Italian company that develops systems to monitor and intercept digital data communications.

In 2014, the U.S. Department of Justice concluded after a lengthy probe that NetApp was cleared of any wrongdoing.

NetApp acquisitions

In 2015, NetApp paid a reported $870 million to acquire the assets of all-flash array vendor SolidFire. The transaction occurred after NetApp's fitful development of its branded FlashRay all-flash system, which was available only as a single node. NetApp scrapped the FlashRay product following the SolidFire merger.

NetApp's SolidFire storage arrays are powered by the Element OS operating system. A core feature of the OS is its Active IQ predictive cloud-based analytics for diagnosing data and system hygiene. SolidFire arrays provide the storage component in NetApp HCI, a hyperconverged infrastructure product introduced in 2017.

In May 2011, NetApp paid $480 million to acquire the Engenio block storage systems from LSI Corp., which was later acquired by Avago Technologies. NetApp rebranded Engenio as its E-Series hybrid flash system. E-Series storage is powered by SANtricity software, which lets administrators provision and manage their E-Series storage systems from a web-based interface. The software helps to maximize performance and resource utilization for applications that support heavy workloads, such as data analytics or video surveillance.

NetApp StorageGRID object storage is based on technology gained by the 2010 acquisition of Canadian vendor Bycast. StorageGRID provides a software-defined storage platform that can support private, public and hybrid cloud environments. The platform offers native support for the Amazon S3 API and includes automated lifecycle management.

For secondary storage, NetApp picked up the SteelStore line of cloud backup appliances from Riverbed Technologies in 2014, rebranding the product as NetApp AltaVault. The SteelStore acquisition finally gave NetApp its own purpose-built backup appliance. In 2009, NetApp lost a bidding war to archrival EMC to acquire Data Domain, a vendor that specialized in data deduplication appliances. AltaVault enables customers to securely back up data to any cloud service. NetApp also offers cloud-based AltaVault appliances on Microsoft Azure.

In 2017, NetApp acquired startup Plexistor for its persistent memory storage technology, which provided the foundation for NetApp's MAX Data product. Also in 2017, NetApp acquired Iceland-based Greenqloud, whose cloud management software was integrated into NetApp Data Fabric technologies. NetApp Data Fabric, introduced in 2015, gives customers a method to seamlessly manage applications and associated data across any NetApp storage locally and in multiple hybrid clouds.

In 2020, NetApp acquired Spot, a service for continuously optimizing the costs for both cloud-native applications and legacy workloads. Spot by NetApp uses analytics and machine learning to adapt to application requirements and provide real-time optimization for both compute and storage cloud resources.

Learn about file vs. block vs. object storage technologies and explore the main differences between hybrid cloud vs. multi-cloud. Also, compare three suppliers and their approaches to unified file and object storage.