total risk

What is total risk?

Total risk is an assessment that identifies all the risk factors associated with pursuing a specific course of action.

Historically, risks were often addressed in isolation, with little consideration of their interconnected nature. However, in the contemporary business realm, the concept of risk assessment and management has transformed from a siloed, reactionary function to a proactive, integrated discipline.

The change has occurred because of the increasing complexity of globalization, technological advancements and sociopolitical shifts that have created an intricate web of potential threats and opportunities. The evolving landscape mandates a holistic approach to risk, where multiple facets of uncertainty are simultaneously assessed, managed and monitored.

At a time when businesses face unprecedented uncertainties, from global pandemics to rapid technological shifts, understanding and managing total risk becomes crucial. Firms that adopt a comprehensive view can anticipate challenges, mitigate potential downsides and harness risk as a catalyst for innovation and growth. Those that don't adjust to the current environment risk obsolescence, reputational damage and significant financial setbacks.

Understanding the types of risks constituting total risk

Developing a comprehensive understanding of risks is indispensable. Thus, it's paramount to dissect the components that constitute total risk. This categorization is essential as it equips businesses to deploy targeted risk management strategies for each type of risk, ensuring more effective risk mitigation.

The primary risk categories include the following:

- Strategic risks. These are risks stemming from operational decisions made by the organization. They may include aspects like mergers and acquisitions, entry into new markets or decisions related to product development.

- Operational risks. Operational risks relate to internal processes, systems, people and external events. Examples could include supply chain disruptions, data breaches or internal fraud.

- Financial risks. Financial risks encompass risks associated with the financial structure of the business, transactions the company undertakes and the financial systems in place. It can include currency fluctuations, interest rate changes or liquidity risks.

- Compliance and regulatory risks. These arise from potential lack of compliance with regulations or violations of laws in the jurisdictions the company operates. These could stem from changes in employment laws, environmental regulations or industry-specific standards.

- Reputational risks. These are risks associated with potential damage to the company's reputation. They can emerge from a variety of sources, including negative publicity, product recalls or public controversies.

- Environmental and societal risks. These risks revolve around the company's impact -- both direct and indirect -- on the environment and society. They may encompass issues like environmental degradation, social responsibility breaches or not aligning with sustainability goals.

By identifying and categorizing these risk types, businesses can develop a multifaceted approach to risk management, ensuring each risk is addressed with the specificity and thoroughness it requires.

Measurement of total risk

Having delineated the various categories of risk, the next step is to quantify each risk category. To truly harness the concept of total risk, businesses must be adept at measuring each risk facet, evaluating its potential impact and then integrating these measurements into a cohesive risk profile.

The total risk measurement process not only aids in prioritization, but also informs the allocation of resources for risk mitigation. The various methods for measuring total risk include the following:

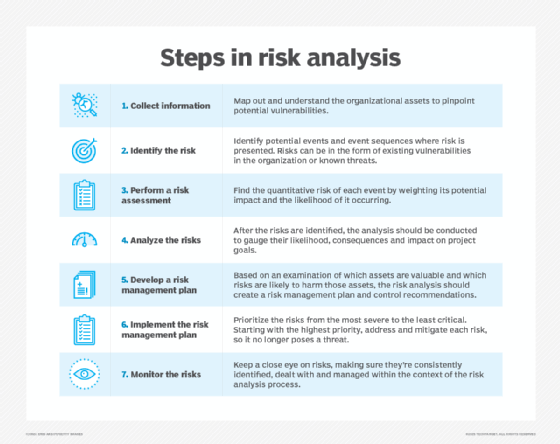

- Risk assessment. The process should begin with a comprehensive risk assessment, which involves identifying potential hazards, determining their likelihood of occurrence and assessing their potential impact. This should be a continuous process, adapting as the business landscape changes.

- Quantitative analysis. Use statistical tools and financial models to quantify risks, especially financial ones. Quantitative analysis may include applying value-at-risk models, sensitivity analysis or stress testing.

- Qualitative analysis. For risks harder to quantify, like reputational or environmental risks, methods using qualitative data should be used. Surveys, expert opinions and focus groups can provide insights into the potential repercussions and stakeholder perceptions of these risks.

- Aggregate analysis. Consolidate individual risk measurements to get an overarching view of the company's risk exposure. Tools such as enterprise risk management systems can provide an integrated perspective.

- Benchmarking. It may be useful to compare the organization's risk profile with industry peers or best-in-class standards via benchmarking. This contextual understanding can help in identifying areas of improvement or potential blind spots.

- Feedback loops. Establish feedback loop mechanisms to continuously relay insights from risk measurements into the organization's strategy and operations. This ensures that the organization remains agile and responsive to emerging risks.

By systematically measuring the multiple components of total risk, companies can not only gauge their current risk exposure, but also forecast potential vulnerabilities, providing a comprehensive foundation for strategic decision-making.

Implications of total risk management

When transitioning from the measurement to the application of total risk, there are many implications, particularly in decision-making and strategic planning. Navigating these implications can be the difference between a resilient organization and one susceptible to unforeseen challenges.

By providing a comprehensive picture of all potential risks, total risk guides executives and board members in making informed choices, whether they concern new ventures, mergers or even restructuring activities. The total risk big picture ensures that decisions are not made in silos but are grounded in a holistic understanding of the organization's risk landscape.

For example, for finance professionals, understanding total risk informs investment strategies by highlighting potential pitfalls and opportunities. Moreover, when a company looks towards expansion, such as new markets or new product lines, total risk analysis can forecast potential challenges, ensuring that capital is allocated efficiently and return on investment is maximized.

Additionally, a holistic approach to total risk recognizes the interdependencies among different risks. For example, a financial risk in one market might simultaneously pose a reputational risk for the brand globally. By adopting a panoramic view, businesses can craft strategies that address these interlinked challenges.

Finally, a holistic approach must occur in tandem with diversification. Whether it's an investment portfolio or a company's global operations, spreading assets or operations across varied domains can mitigate potential losses. By not putting all eggs in one basket, firms can better cushion against unforeseen disruptions.

Strategies and tools for total risk management

When analyzing total risk, many rapidly growing organizations may be overwhelmed when attempting to ascertain all the risks and opportunities facing their organization.

Thankfully, an array of sophisticated tools and strategies are at the disposal of businesses to manage total risk. Advanced analytics, artificial intelligence-driven forecasting models and risk management software platforms can help organizations track, quantify and even predict emerging risks.

Meanwhile, regular risk audits, scenario planning and crisis simulations help organizations prepare for diverse challenges before they occur, making mitigation and recovery easier.

In essence, the realm of total risk management transcends mere identification and mitigation of potential hazards. It's a strategic lever that, when pulled effectively, can steer organizations toward growth, resilience and sustained success in an increasingly unpredictable business landscape.

Learn how a risk map helps identify and prioritize risks, and see how to implement an enterprise risk management framework. Explore the steps in the risk management process, and read about common risk management failures and how to avoid them.