speculative risk

What is speculative risk?

Speculative risk is a type of risk the risk-taker takes on voluntarily and will result in some degree of profit or loss. All speculative risks involve the risk-taker making a conscious choice. Undertaking a speculative risk can create gain or loss for the risk-taker, or in some cases, neither profit nor loss. There's no way to predict the actual result, although factors such as market trends and company performance are often used to estimate the potential return on investment and attract investors.

In both investments and other financial activities such as betting, speculative risk refers to both price uncertainty and the possibility of loss. A higher speculative risk indicates a higher potential for profits or returns. Since there is some potential for gain, risk-takers consciously accept the speculative risk. This is known as the risk-reward ratio. In the investors' minds, the higher risk is worth the potential reward, and that overrides the potential for loss.

Examples of speculative risk

Almost all financial investment activities involve speculative risk because such ventures ultimately result in an unknown amount of success or failure, neither of which the risk-taker can predict or confirm in advance. Examples include purchases of the following:

- Stocks.

- Junk bonds.

- Penny stocks.

- Emerging market stocks.

- Initial public offerings, or IPOs.

Online gaming, online gambling and sports betting are other examples of speculative risk. In these activities, as with the preceding financial investments, both the win rate and risk-reward ratio vary.

Speculative risk vs. pure risk

A pure risk is a category of risk in which there's either a loss, or no profit or loss. With pure risk, there is no possibility for profit.

Examples of pure risk include the following:

- Fires.

- Natural disasters such as floods or earthquakes.

- Litigation.

- Unemployment.

- Unforeseen illness.

- Sudden accident.

- Premature death.

A pure risk is never the result of someone choosing to put their health, property or money at risk. Pure risk only arises due to uncontrollable circumstances. While it is impossible to protect against all threats, most companies engage in risk management strategies to minimize exposure and potential extra costs.

The potential for profit makes investments involving speculative risk attractive to risk-takers. Those who take on speculative risk and invest are usually aware of the uncertainty and willing to accept the high risk as long as there is a possibility of high reward.

Speculative risk and insurance

Speculative risk is not insurable because it is always the result of the risk-taker's conscious choice.

For example, a person who gambles at a casino, hoping to make some money, does so voluntarily and knowing that there is a high chance that they might lose their money. Also, the casino aims to enrich itself -- the "house" -- rather than its customers, the gamblers. As a result, one party -- usually, the house -- wins, and the other -- typically, the gambler -- loses.

Insurance companies know these facts. They also understand the moral hazard involved in gambling and other activities involving speculative risk. Moral hazard refers to the human tendency to not guard against risk when protection from its consequences is available -- e.g., insurance. Due to the moral hazard, a gambler is unlikely to bet moderately, increasing their own chances of loss as well as the insurer's. In addition, insurers underwrite policies after evaluating risk and assessing the probability for loss. Knowing that both are unacceptably high for speculative risk activities, they refuse to insure such risk-takers at any price.

Investments such as home or car purchases also involve some risk. For example, a home can catch fire or a car might be stolen. However, home or car buyers do not choose to expose themselves to such situations because they cannot hope to gain from them. Even though these purchases also involve some pure risks, many of the risks are insurable.

Hedging speculative risk

Although speculative risk cannot be insured, it can be hedged. Hedging refers to reducing the risk of an investment by taking certain actions. For example, a buyer of a security -- the risk-taker -- might buy a put option, which is a contract that gives them the right to sell the security at a predetermined price within a certain time frame. If the price of the security decreases, they can sell it within the predetermined time frame to mitigate its loss-making impact.

Hedging as a risk-reduction strategy can also reduce the investor's potential for profits. This can happen if the investment being hedged increases in price and therefore makes money. On the other hand, if the security loses money, the buyer reduces their potential for losses since the hedge was successful at reducing their speculative risk.

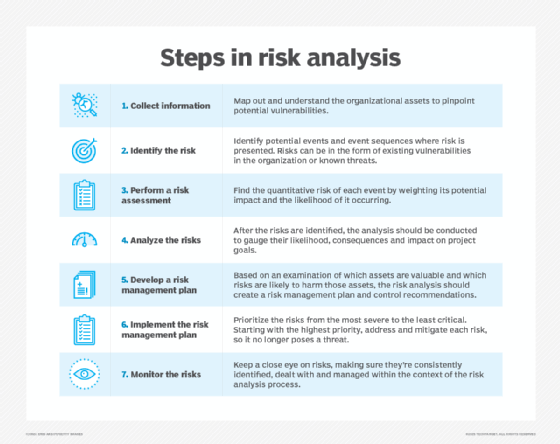

Explore the differences between traditional vs. enterprise risk management and the five steps in the risk management process. See how to implement an enterprise risk management framework and check out nine common risk management failures and how to avoid them.