biometric payment

What is a biometric payment?

Biometric payment is a point-of-sale (POS) technology that uses biometric authentication based on physical characteristics to identify the user and authorize the deduction of funds from a bank account. Fingerprint payment, based on finger scanning, is the most common biometric payment method.

Often, the system uses two-factor authentication, in which the finger scan takes the place of the card swipe and the user types in a personal ID number (pin) as usual.

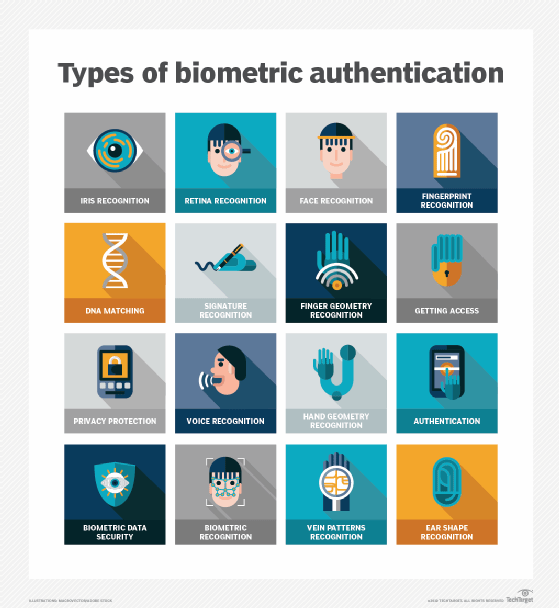

Some additional biometric authentication methods are the following:

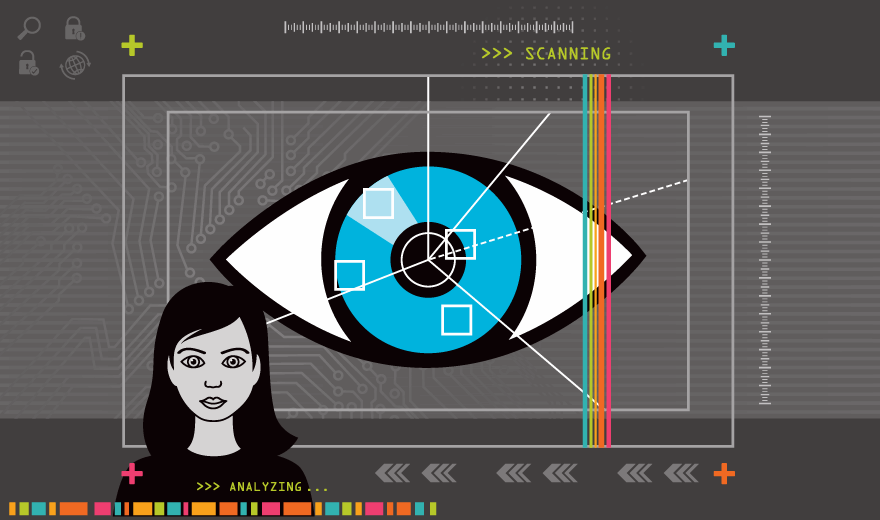

- iris recognition

- retina recognition

- face recognition

- DNA matching

- signature recognition

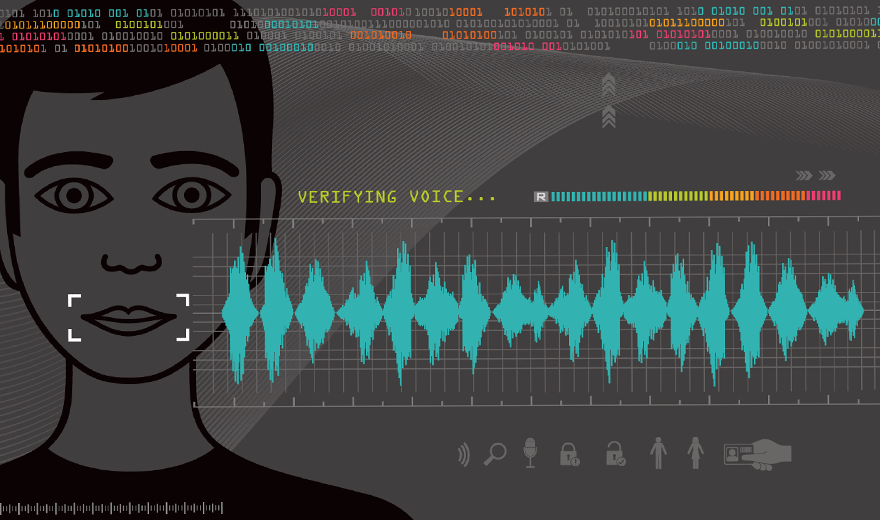

- voice recognition

- vein patterns

How does biometric payment work?

Here's an example of how one fingerprint payment system works:

- The shopper registers for a biometric payment card program at a store kiosk by presenting valid identification and bank account information.

- The shopper scans their index finger using the kiosk's finger scan reader.

- The store's finger scan reader encrypts multiple point-to-point measurements of the fingerprint and stores the customer's biometric data and banking information in a centralized database.

- The shopper now has the option of selecting biometric payment at the POS register. If they choose biometric payment, they scan their finger at the checkout register with the store's electronic reader and enter their PIN code.

- The electronic reader compares the data from the new scan to the encrypted data in the database and either approves or declines payment authentication. If approved, the funds are electronically transferred from the shopper's account to the merchant.

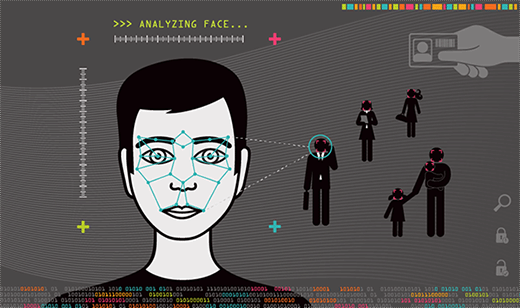

While fingerprint recognition is still the most common use case for biometric solutions, new technology featuring facial recognition is quickly gaining prominence as well.

Additionally, many consumers opt to pay directly from a digital wallet stored on their mobile devices or smartphone.

For example, newer-generation iPhones come equipped with Apple Pay, which provides an additional option for convenient payments using facial recognition or PIN on newer-model iPhones and fingerprint recognition or PIN on older models.

Where is biometric payment used?

In the United States, the use of biometrics has gained popularity in grocery stores, gas stations and convenience stores and as a form of one-click payment for online retailers, like Amazon.

In March 2006, the now-defunct biometrics payment company Pay By Touch indicated that more than 2 million of its customers had enrolled in their biometric services and that it had authenticated approximately $8 billion in transactions.

Biometric payment adoption hasn't slowed down, particularly in the wake of the COVID-19 pandemic, where social distancing became a global concern. In 2021, over 70% of consumers viewed biometric payment as an easier way to make payments, according to Visa data.

As a result, for example, Kenneth Research anticipates the global biometric payment market will grow 36 times in size -- at a compound annual growth rate of 49% -- from 2018 to as much as $15.59 trillion in 2027. Meanwhile, the research firm predicted the mobile payment segment will grow by 52.7% over the same period.

Why is biometric payment preferred by the majority of cardholders?

Biometric payment has a number of positives and a few disadvantages.

The advantages of biometric payment

Cited advantages of biometric technology include the following:

- enhanced security for the end user;

- more convenient, faster payment experience;

- no need for the end user to carry cash, checks or credit cards; and

- lower cost per transaction for the merchant, compared to credit or debit cards.

Of course, with all emerging technological innovations, there are challenges to overcome.

The disadvantages of biometric payment

Biometric payment is controversial. Traditionally, fingerprint scanners have been associated with law enforcement. Critics of biometric payment fear that fingerprint sensors could be available to government agencies or law enforcement officials.

Biometric payment service providers quickly point out that they don't keep the customer's actual fingerprint in their databases, however. They keep an encrypted number derived from the finger's point-to-point measurements.

It is that number that is used to verify a customer's identity, not the actual fingerprint. Ultimately, this means that a biometric payment system -- like any system that accesses sensitive information -- is only as secure as the associated databases and transactions.

Learn more about different kinds of biometric authentication, how a major facial recognition supplier builds a system to identify masked faces, and the pros and cons of biometric authentication.