MICR (magnetic ink character recognition)

What is MICR (magnetic ink character recognition)?

MICR (magnetic ink character recognition) is a technology invented in the 1950s that's used to verify the legitimacy or originality of checks and other paper documents. Special ink, which is sensitive to magnetic fields, is used to print certain characters on the original documents.

MICR, which is pronounced as mick-er, is commonly used by banks and other financial institutions to accelerate the processing and clearance of checks. Retailers also often use MICR readers to minimize their exposure to check fraud.

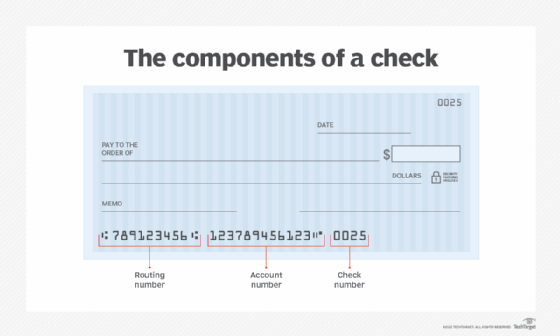

The MICR line is the sequence of numbers and characters that appear at the bottom of a check. It consists of three number sets: the bank routing number, the account number and the check number. The order of number sets is country-specific. These three sets of numbers act as unique identifiers for the check and the person who signs it.

MICR use can enhance security and minimize the losses caused by some types of fraud. For example, if a counterfeit check is produced using a color photocopying machine, the magnetic ink line either won't respond to magnetic fields or will produce an incorrect code when scanned using a reader-sorter that views the information in the magnetic ink characters.

Compared to technologies such as barcodes, MICR can be read quickly by machines and humans.

How does magnetic ink character recognition work?

Magnetic ink character recognition works by printing a MICR line on a check using magnetic ink or toner. The magnetic ink, which usually contains iron oxide, enables a computer to read the MICR numbers, even if they've been covered by marks or writing.

MICR is made up of routing, account and check numbers:

- The routing number is a nine-character number used to identify the bank on which the check is drawn. Banks are issued routing numbers based on the state in which they operate. For example, every check issued by a Chase bank branch in Florida has the same routing number.

- The account number is a 12-character number used to identify the checking account associated with the check. So, for example, every check for that account at that bank has the same account number.

- The check number is a three- or four-character number used to identify a check in a series of checks for an account holder. This number should be identical to the number printed at the top right-hand corner of the check. Some banks may reverse the order of the account and check numbers.

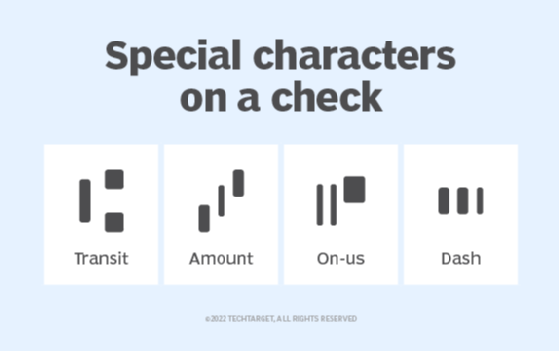

The banking, routing and account numbers are surrounded by four special symbols that indicate Transit, Amount, On-Us and Dash. These symbols are used to delimit the bank code, customer account number, transaction amount, and parts of the routing or account numbers.

In addition to being printed with magnetic ink, the numbers and symbols on checks use one of two custom MICR fonts: E-13B or CMC-7. These font types are certified by the International Organization for Standardization, and their use varies by country.

MICR readers

Magnetic ink character recognition readers are the primary tool used for check sorting, processing and validation. When scanning a document such as a check, MICR readers magnetize the ink and detect the MICR characters. The reader head of the device reads the characters. As each character passes over the reader head, a unique waveform is produced, which is used to identify the check.

Advantages of MICR technology

MICR technology offers the following benefits:

- Reduced fraud. The MICR line protects against some forms of financial fraud by using magnetic ink and unique MICR fonts. If someone changes the name of the payer of the check, the MICR number still shows the correct owner of the account. And, if someone tries to photocopy a check, the MICR reader doesn't detect the magnetic ink.

- Accuracy. MICR characters can be read through marks such as stamps and signatures because of the special ink that's used to print the characters.

- Processing speeds. A check can be processed quickly using a MICR reader.

- Low error rates. Compared to other character recognition systems, the error rate for MICR is small. According to the technology review site Techwalla, typically, there's one read error for approximately every 20,000-30,000 checks.

- Security. MICR is more secure compared to optical character recognition because the printed characters can't be changed.

Disadvantages of MICR technology

However, MICR also has some disadvantages, including the following:

- Only certain characters and symbols can be read, and it doesn't use alphanumeric

- MICR printing is demanding, as it has stringent standards.

- The iron oxide ink and the strict printing format can make the process expensive.

Additional uses of MICR technology

Aside from its widespread use in banking for check processing, MICR is also used with the following applications:

- financial documents in the U.S.;

- credit card invoices;

- gift vouchers;

- money orders;

- remittance vouchers;

- loan bonds; and

- rebate coupons.

Learn more about how fraudsters steal information such as credit card data.