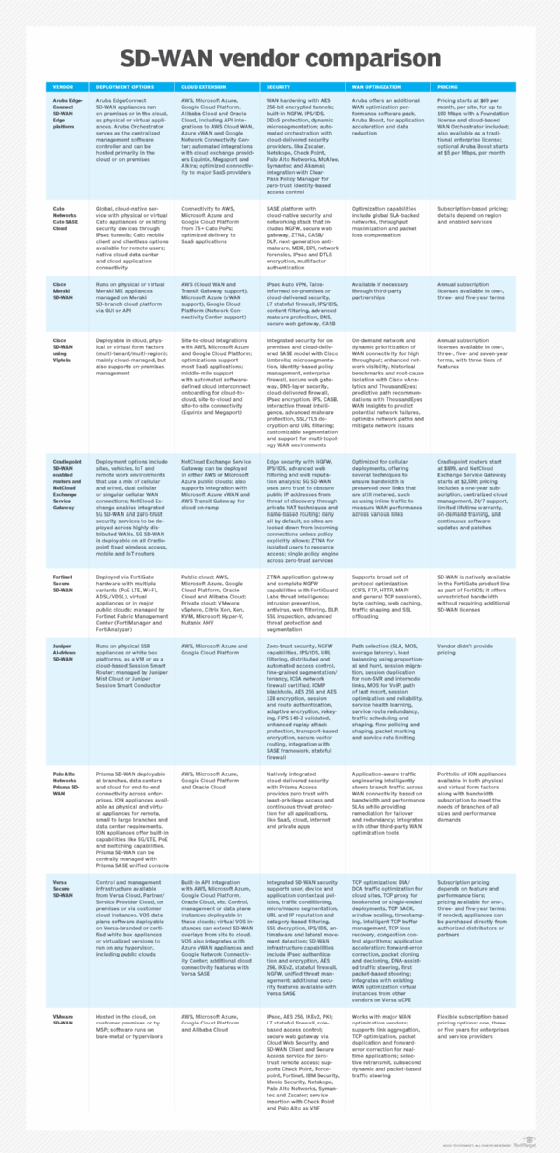

SD-WAN comparison chart: 10 vendors to assess

This SD-WAN vendor comparison chart is a useful starting point to evaluate information about deployment options, pricing, security, cloud connectivity and more.

As organizations prepare for software-defined WAN deployment, they need to research the market thoroughly and determine what they need from their WANs.

Enterprises can choose from multiple SD-WAN deployment models, such as fully managed, co-managed and DIY. Those that opt to purchase SD-WAN directly from a vendor might find it overwhelming to sort through the various vendors. To help, the comparison chart below provides a breakdown of 10 SD-WAN vendor offerings.

Our editors focused on enterprise SD-WAN technology and only included vendors that directly offer their own SD-WAN services to customers -- no third parties, middleware or resellers. This comparison does not include fully managed SD-WAN options offered by service providers. Also, note that some vendors have positioned themselves as both SD-WAN and Secure Access Service Edge (SASE) providers, due to the overlap in markets.

Overview of SD-WAN vendors

The comparison chart below provides a side-by-side view of the following SD-WAN vendor offerings, listed alphabetically.

1. Aruba EdgeConnect SD-WAN Edge platform

HPE Aruba acquired Silver Peak in July 2020 for $925 million and has since rebranded the SD-WAN technology as Aruba EdgeConnect. The EdgeConnect platform has strong application acceleration capabilities and an innovative consumption model, Gartner said in its 2022 Magic Quadrant for SD-WAN. But the vendor tends to have a lower customer experience score and a limited vertical strategy.

This article is part of

What is SD-WAN (software-defined WAN)? Ultimate guide

2. Cato Networks Cato SASE Cloud

Cato Networks has its own global private backbone and connects customers through more than 75 points of presence. Cato established itself early in the SD-WAN market as a vendor with comprehensive networking and security capabilities and now positions itself in the SASE market, offering SD-WAN as part of its SASE framework.

3. Cisco Meraki SD-WAN

Cisco Meraki offers fewer and more basic features than other SD-WAN offerings, including Cisco Viptela. It is commonly touted as easy to use, making it better suited for smaller deployments.

4. Cisco SD-WAN using Viptela

Cisco announced it would acquire SD-WAN startup Viptela in 2017 for $610 million in the first major move by an incumbent networking vendor to enter the SD-WAN market. Cisco Viptela can support more complex deployments than Meraki and offers security integration and service chaining with its SD-WAN platform.

5. Cradlepoint SD-WAN enabled routers and NetCloud Exchange Service Gateway

Cradlepoint, acquired by Ericsson in 2020, specializes in smaller, remote locations that primarily use wireless connectivity. Cradlepoint NetCloud Exchange works with LTE, 5G non-standalone networks, 5G standalone network slices -- as they roll out -- broadband and wireless WAN. Gartner said one of Cradlepoint's strengths is its presence in vertical industries that rely on cellular, but the vendor faces challenges with product limitations and market visibility.

For more on software-defined WAN, read the following articles:

How to build an SD-WAN RFP to evaluate vendors

Top 9 SD-WAN benefits for businesses

5 common SD-WAN challenges and how to prepare for them

6. Fortinet Secure SD-WAN

In April 2019, Fortinet announced its intention to deliver an SD-WAN application-specific integrated circuit that would integrate with its FortiGate security appliances. Since then, the security vendor has increased its SD-WAN market share, touting features like self-healing capabilities and granular analytics. However, the vendor does face customer doubts about its ability to meet networking requirements.

7. Juniper AI-driven SD-WAN

Juniper Networks acquired 128 Technology in October 2020 for $450 million and has since integrated the SD-WAN technology with its Mist AI, wireless and security platforms. Juniper's SD-WAN portfolio provides a more unified networking offering, but it tends to have higher pricing and lower market visibility, Gartner said.

8. Palo Alto Networks Prisma SD-WAN

Palo Alto Networks acquired CloudGenix for $420 million in April 2020, highlighting the growing convergence of networking and security. Palo Alto integrated its Prisma cloud-based security portfolio with Prisma SD-WAN, positioning itself as a SASE contender.

9. Versa Secure SD-WAN

Versa Networks emerged as an SD-WAN startup in November 2015, offering an SD-WAN platform with routing, SD-WAN and a security stack. Since then, Versa has also moved to position itself in the SASE market with its Versa SASE framework. Despite its strengths in networking and security, Versa Secure SD-WAN can be complex, and the vendor doesn't always score well in customer experience, Gartner said.

10. VMware SD-WAN

VMware acquired VeloCloud, another SD-WAN startup, for $449 million in 2017. VMware SD-WAN has consistently been a market leader and is well suited for large enterprise deployments. Broadcom announced in May 2022 it intends to acquire VMware. The deal is expected to close in 2023, but some customers are concerned about how the Broadcom acquisition might affect the SD-WAN offering.

SD-WAN comparison chart details

The SD-WAN comparison chart addresses a variety of important features and capabilities to consider, such as security, WAN optimization, deployment options, public cloud connectivity and available pricing. The comparison does not include details about requirements that are considered SD-WAN fundamentals, such as the following:

- The SD-WAN offering should create a network overlay that abstracts the existing WAN infrastructure.

- It should enable dynamic bandwidth allocation for traffic efficiency.

- It should be transport-agnostic and support multiple types of connectivity, like MPLS, Ethernet, 4G or 5G, and broadband.

Deployment options

This section explains how a vendor's SD-WAN offering is available to customers, such as through physical appliances, virtual appliances, cloud-based instances, universal customer premises equipment and more.

Cloud extension

This section details which SD-WAN vendors enable connectivity to public cloud -- like AWS, Microsoft Azure and Google Cloud Platform -- private cloud platforms and SaaS applications. It also discusses vendor support for cloud on-ramps, such as AWS Cloud WAN and Microsoft Azure Virtual WAN.

Security

This section provides a rundown about the security capabilities included in each SD-WAN offering, such as stateful firewall, next-generation firewall, web filtering, secure web gateway and integration with various security vendors. It also includes information about SASE integration with SD-WAN.

WAN optimization

This section discusses whether an SD-WAN vendor offers integrated WAN optimization capabilities, traffic steering, application acceleration add-ons or third-party support.

Pricing

This section lists all available pricing details, including subscription-based offerings and appliance costs, as provided by the vendors.

Additional questions to ask about SD-WAN technology

When looking for the right SD-WAN option for your company, it's a good idea to add the following questions to your list.

How easy is SD-WAN deployment and provisioning?

The majority of SD-WAN vendors say they offer zero-touch provisioning. Even so, configuration for any organization's deployment takes time -- it's a question of how much and how easy. Some options might require a few more steps before the SD-WAN connection is established, compared with plugging cables into an SD-WAN device that automatically begins provisioning.

Most SD-WAN vendors offer the following deployment models: DIY; fully managed; and hybrid, or co-managed.

While DIY deployment was common when SD-WAN first emerged, many enterprises opt for a fully managed or hybrid approach. Fully managed SD-WAN outsources all aspects of deployment to an MSP, while a hybrid approach gives customers control over some areas, while outsourcing others.

What protocols does the SD-WAN technology support?

Check with each prospective SD-WAN vendor to determine which routing protocols it supports, such as Border Gateway Protocol and Open Shortest Path First. Factor in IPv6 support, if that's an important consideration for your organization. Also, evaluate how the SD-WAN platform sends traffic to and from the internet, SaaS-based applications and cloud resources, as these can require different APIs and protocols.

Does the SD-WAN platform require specialty edge devices and gateways?

Are devices available in both virtual and physical hardware options? Is the hardware proprietary, or can you use commodity hardware? Also, ask how the vendor's SD-WAN equipment integrates with existing routers and legacy networks. This is valuable information for organizations with multiple distributed branch offices.

What are the monitoring, management and reporting capabilities?

SD-WAN uses software-defined networking technology to establish centralized control and management policies across the entire network. This enables SD-WAN to better monitor and prioritize network traffic, which improves application performance, packet loss and security, especially for real-time and business-critical traffic.

Most SD-WAN vendors include management and monitoring capabilities within the SD-WAN platform. Others work with third-party management tools, and some offer additional, more comprehensive software for customers to purchase. Ensure the SD-WAN option you select provides the management support and network insight you need for proper SD-WAN troubleshooting.

How does the vendor support remote access and SASE?

As more companies implement work-from-home policies, it's important for them to consider how an SD-WAN service enables remote access. Some vendors have introduced SD-WAN offerings that serve home offices, providing a more flexible -- but costly -- approach for essential remote workers to access SaaS applications and business resources.

Also, ask your SD-WAN vendors about SASE, which converges security and networking services, including SD-WAN, into a single cloud-based offering and delivers them directly to clients and end users. Some SD-WAN vendors have rebranded and moved into the SASE market, which comprises both networking and security vendors.

What partnerships does the SD-WAN vendor have in place?

Many SD-WAN vendors have established partnerships with security providers to integrate their security services with SD-WAN technology -- and, as the networking and security markets have shifted, some security vendors have acquired SD-WAN companies. Also, take into consideration any potential cloud and SaaS partnerships the SD-WAN vendor might have. SD-WAN vendors have also partnered with MSPs to offer their SD-WAN technology via managed SD-WAN services.

Editor's note: This article was updated to reflect changes in the SD-WAN market. Some vendors were added and removed from the list due to acquisitions and market shifts.