Getty Images

A work-from-home reimbursement policy for network tech

Organizations should create comprehensive work-from-home reimbursement plans that drive better network and internet connectivity rates rather than offset employee's existing bills.

Hybrid and remote work are more common than ever before. Organizations must modernize their reimbursement policies to include work-from-home, or WFH, expenses.

Remote work has proven itself as a viable work option. While some organizations have called for workers to return to the office, many continue to hire remote employees who work from their residences or other locations. Like many on-premises employees, remote workers incur expenses while performing their duties at home, such as purchasing or upgrading the necessary technology to work.

Organizations must define how to reimburse remote workers at all levels. In a WFH reimbursement policy, employers pay for certain items to support remote employees as they work. Those items might include internet connectivity, phone services and office equipment.

Remote worker expense reimbursement varies by company. Organizations should examine the circumstances associated with reimbursement. HR and finance departments will likely lead businesses in these policies and offer guidelines for establishing them.

What constitutes remote worker expenses?

Many organizations already have an expense reimbursement policy for travel, hotel expenses and meals. Companies should consider revising existing expense reimbursement policies and procedures to accommodate remote workers. It's also an option to create an entirely new policy. Any new WFH reimbursement policy should be in line with current guidelines.

Organizations should also define what they mean by a remote employee. Some companies might consider employees remote if they don't work at the main company office. This includes if the company has branch offices close to the employee. In this case, the company already covers work-related expenses.

Employees working from home incur expenses for items such as internet service, electricity, office supplies and office furniture, all of which should be considerations in a reimbursement plan.

Network technology is also key to any reimbursement plan. Companies should establish minimum guidelines around WFH technology expenses. These guidelines might include established minimum connection rates and equipment standards that ensure remote work is as close to an on-premises experience as possible.

Employees might have opted for a lower-speed ISP package in their homes. Others in the home might also use the internet for work or school, so an employee's overall connection experience back to headquarters might be lacking. Reimbursement rules for internet connectivity should include connection parameters, and they should drive better overall network connectivity, not offset an employee's existing bills.

Enterprises can cover a percentage of the cost incurred or offer a flat payment or stipend. Reimbursement amounts might vary depending on the type of work employees perform and its value to the company's success.

What to include in a WFH reimbursement policy

Regardless of approach and methodology, it's helpful for enterprises to have an official WFH reimbursement policy. The policy should include the following parameters as a minimum:

- How the company defines remote working and the qualification criteria for remote employees.

- Type of work arrangement -- full-time in-office, full-time remote or hybrid in-office/remote -- and how reimbursement changes when an employee shifts to a different work arrangement.

- Performance expectations for remote workers.

- Types of reimbursements permitted based on job title.

- List of approved and unapproved items for reimbursement.

- Process for tracking, recording and submitting remote work expenses.

- Approvals needed when submitting expense reports and the time frames for submission.

- Reimbursement method for approved expenses, e.g., per expense, a flat stipend/per diem or specific percentage of costs -- for percentages, be specific about the reimbursed amount, such as 30% of internet costs and 25% of cellphone costs.

- List of disability considerations for disabled employees in compliance with federal regulations, such as the Americans with Disabilities Act.

Necessary vs. unnecessary expenses

While most companies need some type of WFH reimbursement, these costs don't necessarily offset existing expenses the company continues to accrue. When formulating a WFH expense reimbursement policy, distinguish which expenses are necessary and unnecessary. The policy should be as explicit as possible to identify what is necessary and what is not.

Necessary expenses are systems and services employees need to perform daily duties. These include the following:

- Internet access.

- Electricity.

- Mobile and/or landline phone services.

- Laptops and printers.

On a less technical level, postage, office supplies and storage cabinets might also be considered necessary. By contrast, items such as multifunction ergonomic chairs and adjustable desks might be nice but unnecessary.

For some knowledge workers, such as engineers, lawyers or executives, high-bandwidth connectivity is critical. Instead of reimbursing a monthly ISP bill, it might make sense to extend the network edge and provide a software-defined WAN appliance and connection to an at-home employee.

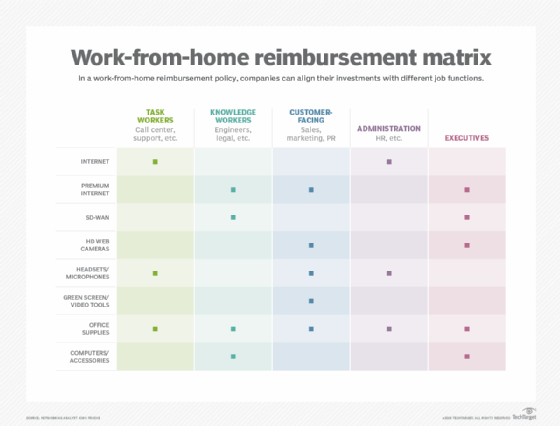

Don't assume every technology expense is a net positive. A company can benefit from aligning investments in different areas with job responsibilities. Enterprises that build a WFH reimbursement matrix can help target company investments into the right areas based on job function. A comprehensive and deliberate strategy tying the WFH reimbursement policy to areas that drive the greatest productivity can bring companies more success.

Legislation on remote work expense reimbursement

The federal government does not have statutes on remote worker expense reimbursement. The Fair Labor Standards Act does not specifically require WFH reimbursement. However, some states -- California, Illinois, Iowa, Massachusetts, Minnesota, Montana, New Hampshire, New York, North Dakota, Pennsylvania and South Dakota -- and the District of Columbia have passed their own laws governing employee reimbursement.

Knowledge of state requirements for reimbursement is essential to remain compliant. California has the most comprehensive employee reimbursement laws. Other states have similar statutes but with differing formulas on what can be reimbursed. States without specific laws might still require employee expense reimbursement based on company policy.

Remote Employee Expense Reimbursement Policy template

Download the PDF template.

Expense reimbursement policy template

Included in this article is a policy template that can serve as a starting point for a remote worker expense reimbursement policy. When forming the policy, closely collaborate with HR and finance departments, along with IT management.

It's valuable for enterprises to have a specific policy for handling reimbursements and improve employee understanding and transparency. It is also an important piece of audit evidence should companies need it.

Editor's note: This article was originally written by John Fruehe and expanded by Paul Kirvan. It was updated to reflect industry changes.

Paul Kirvan is an independent consultant, IT auditor, technical writer, editor and educator. He has more than 25 years of experience in business continuity, disaster recovery, security, enterprise risk management, telecom and IT auditing.

John Fruehe is an independent enterprise technology analyst with more than 25 years of experience. He has specialized in enterprise networking and data center markets with a focus on product marketing.