Blue Planet Studio - stock.adobe

Valmont Industries tests network as a service to improve WAN

Valmont Industries wants an agile WAN that the company can modify in days instead of months. The global manufacturer is testing network-as-a-service provider Graphiant.

Valmont Industries is fed up with having a WAN that it can't modify quickly to accommodate sudden changes in its business operations. The global manufacturer of custom infrastructure gear for cities, utilities and farmers wants an alternative.

How it will overhaul its WAN is a work in progress. Re-architecting a network connects hundreds of engineers and 85 manufacturing facilities across 22 countries could take a couple of years.

Nevertheless, Dixon Greenfield, Valmont's director of network operations, knows his promised land: a WAN that runs like a utility. That would allow the company to relocate an edge data center serving 24 to 30 locations in Australia, for example, by unplugging the system, moving it and plugging it in again. The network provider would handle security and ensure the internet traffic reached its destination in compliance with latency requirements set in a service-level agreement.

Greenfield also wouldn't have to contend with multiple carriers when, for example, a network-to-network interface (NNI) fails between a manufacturing facility in Uberaba, Brazil, and the company's headquarters in Omaha, Neb. An NNI hands off traffic from one ISP to another; carriers won't talk to you if you're not a customer, so international companies like Valmont must wait for their internet provider to negotiate a fix for an NNI problem.

"Dealing with carriers is like poking yourself with a sharp object over and over again," Greenfield said.

Hoping to eliminate those carrier problems led Greenfield to test startup Graphiant's network as a service. The company, based in San Jose, Calif., debuted last week with $33.5 million in series A funding from Sequoia Capital, Two Bear Capital and Atlantic Bridge.

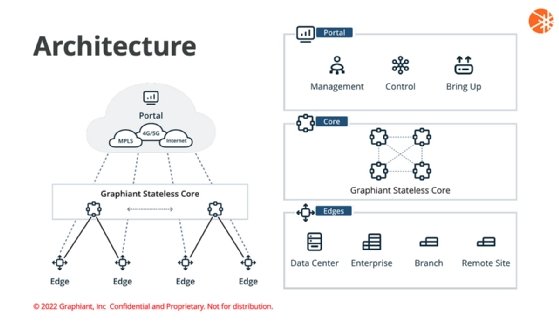

Graphiant has built a network control plane that sits on top of the company's cloud-based data plane. The latter is a global multi-tenant transit network that's programmable, according to a report from Enterprise Management Associates (EMA).

The stateless transit core uses proprietary protocols to establish a label-switched network that routes internet traffic at the data layer instead of the traditional network layer, EMA said. Application-based metadata can dictate routing, or customers can manage traffic through a portal that provides access to the control plane.

To connect to the Graphiant network, companies install a lightweight software component called Graphiant Edge on a commodity server in the data center, branch or cloud.

Graphiant targets companies that need a multi-cloud network and organizations like Valmont that require a more agile private enterprise WAN.

Greenfield is ready to look at any innovative network provider to help him avoid the nightmare of a recent data center move from Amsterdam to Paris. He asked not to use the name of Valmont's provider.

Valmont had leased an Amsterdam colocation facility before AT&T sold it with the rest of its colo business to Brookfield Infrastructure and its institutional partners in 2019. Brookfield later turned the business into a wholly owned Dallas company called Evoque Data Center Solutions. Evoque decided to wind down the European operation, so Valmont switched to Equinox in Paris. It took 18 months to reestablish all the network services.

At around the same time, Greenfield had to move three much smaller edge data centers in other parts of the world. Getting them fully operational on the network took almost a year. "That makes you want to choke somebody," he said.

Despite the misery, Greenfield doesn't expect Valmont to go beyond testing Graphiant. Without a track record for operating a secure global network, Graphiant is unlikely to convince executives of the publicly traded company with $3.5 billion in sales last year to take a chance on a two-year-old startup.

"It's so bleeding-edge that I don't think my company would allow me to get that far out there," he said.

Nevertheless, Greenfield plans to keep an eye on Graphiant because he's familiar with CEO Khalid Raza. Raza co-founded the software-defined WAN vendor Viptela, which Cisco acquired in 2017 for $610 million; Valmont licensed the original Viptela SD-WAN and uses the product today under Cisco.

Cisco and Juniper Networks are examples of longtime networking vendors that would compete with Graphiant. Younger competitors include Arrcus, which also focuses on network routing to distinguish itself in the market.

Greenfield plans to watch many network providers for an alternative to what he has now. Valmont wants a better WAN, and it intends to get one.

Antone Gonsalves is the news director for the Networking Media Group. He has deep and wide experience in tech journalism. Since the mid-1990s, he has worked for UBM's InformationWeek, TechWeb and Computer Reseller News. He has also written for Ziff Davis' PC Week, IDG's CSOonline and IBTMedia's CruxialCIO, and rounded all of that out by covering startups for Bloomberg News. He started his journalism career at United Press International, working as a reporter and editor in California, Texas, Kansas and Florida.

Have a news tip? Please drop him an email.