Luiz - Fotolia

Cloud recasts global data center switch market

Cloud providers and enterprise cloud makers have dramatically changed the global switch market, dampening traditional networking gear's importance in the modern data center.

Organizations building cloud computing platforms or offering them as a service have become the growth engines of the global data center switch market.

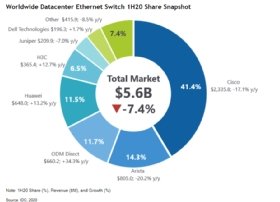

The shift to the cloud in public and private data centers has dampened spending on traditional networking gear. According to IDC, in the first half of 2020, revenue from white box switches favored in large-scale cloud environments grew more than 34%. That carried the segment from fourth place in 2019 to third in the overall switch market, which fell 7.4% to $5.6 billion.

Cloud makers and providers bought gear during the COVID-19 pandemic, while other enterprises tightened spending. As a result, providers Arista Networks, Cisco and Juniper Networks suffered year-to-year revenue declines of 20%, 17%, and 7%, respectively, in the first six months of the year.

Beneath the pandemic's impact are fundamental changes underway in the data center market. Enterprise tech buyers have shifted spending to the network infrastructure that supports cloud computing in modernized data centers.

"Cloud has redrawn the rules of engagement for data center Ethernet switching," IDC analyst Brad Casemore said.

The largest cloud providers, including AWS, Google and Microsoft, account for a growing share of the overall switch market. Those organizations buy bare-metal white box switches stripped of operating systems and automation software that established networking vendors sell for a premium.

"That's a challenge for name-brand vendors accustomed to bigger margins," Casemore said.

Those companies will have to chase smaller cloud providers and enterprises building cloud-computing environments to increase data center switch sales. Winning deals will depend on how vendors reconfigure their products into cloud-focused infrastructure.

Cloud impact on network management

Tech buyers want their network software, including analytics, automation and tooling, on boxes separate from switches. Customers demand management software independent from the hardware to prevent being locked into the latter, while also gaining more agility, flexibility and programmability, IDC said.

Enterprise tech shoppers also want software that standardizes network and security policies for applications running in private data centers and cloud environments. In June, an IDC survey found that enterprises plan to run about half of their applications in their data centers and the rest in the cloud in two years.

Venture capitalist-funded startups will compete with established vendors for companies that need networking software for those hybrid environments, IDC said. Incumbents have the advantage of having a presence in traditional data centers. But that inside track does not guarantee success.

For example, Cisco remains the market share leader in data center switching. However, its slice of the pie has shrunk steadily since 2017. According to IDC, Cisco's share has fallen from more than 53% to 41.4% in the first half of 2020.