Denys Rudyi - Fotolia

Macroeconomics, service providers behind ICT spending slowdown

Service providers will buy less information and communications technologies, contributing significantly to an overall slowdown in ICT spending this year and next, IDC said.

A slowdown in spending by service providers will diminish growth significantly in the global and U.S. markets for information and communications technology, according to IDC.

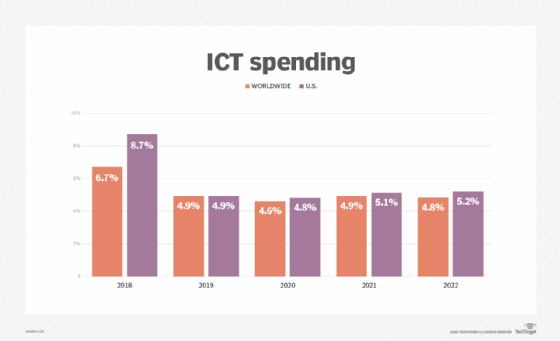

Across the globe and the United States, ICT spending growth will fall from 6.7% and 8.7%, respectively, in 2018 to 4.9% this year and remain roughly at that level through 2022, the research firm reported in its latest forecast.

Over the last 12 months, the largest cloud providers, such as AWS, Microsoft Azure and Google Cloud, have been "unsustainably aggressive" in data-center-related ICT spending, IDC analyst Stephen Minton said while releasing the projections last week. Cloud suppliers have spent from 20% to 30% more year over year on servers, storage and network gear to keep up with customer demand for services.

"We're going to see a normalization," Minton said of cloud provider spending. "We're going to start to see the supply start to catch up with the demand for the actual services."

Service provider spending on ICT has grown steadily over the last several years and is expected to account for almost half the market by the end of this year, according to IDC. Driving the growth is the increasing number of enterprises running business applications on the platforms of cloud providers, rather than on private data centers, IDC reported.

A TechTarget survey of enterprise IT priorities for 2019 found almost 30% planned to use public cloud infrastructure as a service to run production applications, and nearly 23% expected to deploy cloud monitoring software.

A second significant contributor to the projected ICT spending slowdown was the personal computing industry, IDC said. The amount spent by companies upgrading systems to Windows 10 will drive a 1.6% increase in spending in 2019. Over the next three years, however, spending will drop year over year, reaching a 2% decline in 2020.

Macroeconomic impact on the ICT market

IDC's overall projections on ICT spending also take into account an expected slowdown in the global economy this year and in 2020. Contributors include a slowing Chinese economy; the United Kingdom leaving the European Union, called Brexit; a potential trade war between the U.S. and China; and rising interest rates in the United States, the world's largest economy.

"There seems to be a pretty broad consensus that we are going to have some type of slowdown across the majority of economies over the next two years. And, of course, this will impact ICT spending," Minton said.

IDC is also expecting a "mild recession" in the United States in 2020, Minton said. "[But] it would be a pretty mild contraction by historical standards."

Indeed, more than three quarters of business economists surveyed by the National Association for Business Economics expected the United States to be in recession by 2021, Bloomberg reported. Ten percent said the recession would begin this year, 42% next year and 25% in 2021.