buchachon - Fotolia

WAN access focus of Cisco Viptela-DNA Center integration

The first phase of integration between the Cisco Viptela SD-WAN and DNA Center is aimed at providing WAN access from branch offices.

The first phase of integration between Cisco's Viptela SD-WAN and DNA Center -- the company's intent-based network management console -- will let customers set policies for accessing the WAN from branch offices.

Cisco said on Thursday it is working on extending SD-Access from within DNA Center to the wide area network. SD-Access lets engineers set access policies that follow employees wherever and however they want to enter the corporate network.

Cisco executives have said integrating SD-Access with the Viptela software-defined WAN is essential, because the latter routes traffic to and from business applications running on SaaS and IaaS platforms.

"In the next six months, the first phase of this integration will focus on being able to provide cross-domain orchestration between the WAN and SD-Access," Cisco said in a statement sent to TechTarget. "As to be expected, the exact delivery dates of these cross-domain integrations aren't set in stone, being largely influenced by customer needs and feedback."

Nevertheless, based on previous comments from company executives, Cisco could deliver the integration in the second half of the year. If so, then it's likely to please customers using Cisco's Catalyst switching and Aironet Wi-Fi access points in the branch, said Shamus McGillicuddy, an analyst at Enterprise Management Associates, based in Boulder, Colo.

"Enterprises want this kind of orchestration, which I assume Cisco means as configuration management, policy management, end-to-end network segmentation, etc.," he said.

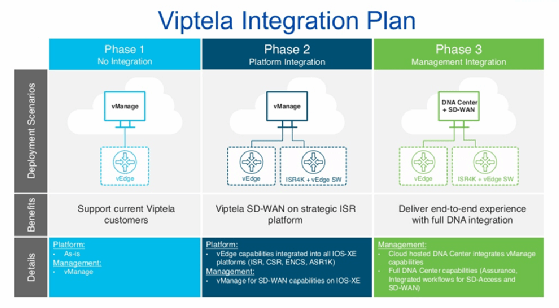

In August 2018, Cisco provided customers with the option of running Viptela on the IOS-XE operating system that runs the company's Integrated Services Routers (ISR) and Aggregation Services Routers (ASR). Both devices are used to connect the branch to the WAN.

The combination of Viptela and IOS-XE meant customers could manage the ISR and ASR hardware using the SD-WAN's cloud-based management software, vManage. The SD-Access-Viptela combination marks the start of bringing all vManage capabilities into DNA Center.

"The integration of vManage and Cisco DNA Center continues to be a priority for Cisco," the company said.

Cisco Viptela and DNA Center analytics

Cisco's plans aren't clear for integrating the separate operational analytics that exist in DNA Center and Viptela. DNA Center has Assurance, and Viptela's software is called vAnalytics.

"Both offer network managers insight into network and application performance," McGillicuddy said. "I anticipate that some customers will want that integration."

A slide deck shown at a Cisco presentation in Canada last year provides a list of integrations between DNA Center and Viptela that include Assurance. It also lists vManage and a cloud-hosted version of DNA Center.

Introduced a year ago, Assurance keeps tabs on how policies created in DNA Center affect network infrastructure. Engineers write policies in the software to align switches and routers to the needs of applications.

Assurance marked a significant step for Cisco toward intent-based networking (IBN), a developing area of technology that incorporates artificial intelligence and machine learning to automate administrative tasks across a network. Nevertheless, Cisco's IBN portfolio overall is far from complete.

"Intent is largely an aspirational vision for Cisco and many other vendors," said Andrew Lerner, an analyst at Gartner. "It represents where they are aiming long term versus where they are today with product capability."

Cisco's rocky path to SD-WAN

Cisco is integrating SD-WAN into its products to meet customer demand for the technology as a more efficient and cost-effective way to connect branch offices to applications running on private data centers and SaaS and IaaS providers. The technology also coincides with Cisco's push to sell software that requires the vendor's hardware to manage networks.

Cisco is battling for share in an SD-WAN infrastructure market that IDC predicted will rise from $833 million in 2017 to $4.5 billion in 2022. That amounts to an annual growth rate of more than 40%.

Cisco's development of SD-WAN has not been smooth. Its first attempt, iWAN, wasn't a strong enough product to fend off competition from SD-WAN startups, so Cisco bought one.

"Customers that invested in iWAN got stuck," said Steve Garson, president of WAN consulting firm SD-WAN Experts, based in Denver. "Viptela is much simpler from the perspective of [being] on a single platform and a lot easier to implement than iWAN."