Getty Images/iStockphoto

Explore the 2022 application performance monitoring market

APM helps organizations get a leg up with insight into customers and applications -- and the market is only going to grow bigger as technology advances and becomes more complex.

Application performance monitoring is a collection of tools and processes that help organizations ensure their applications meet performance standards and provide a good customer experience. APM helps organizations monitor all aspects of their operations, from infrastructure and user experience to application dependencies and business transactions. APM tools enable IT teams to discover, isolate and solve problems with an application's performance with the necessary metrics.

Due to the growing complexity surrounding applications and the fast rate of change, the APM market has experienced considerable growth over the past decade. In response to market demands, APM tools are growing broader and evolving in new directions.

The APM market evolution

The application performance monitoring market has been around for more than a decade. Wily APM is considered the first APM tool; it was acquired by CA Technologies in 2006. The first generation of APM tools focused on three-tier applications and the relationships among databases, applications and web servers.

As time passed, organizations began to break applications into different components across multiple servers. This increase in complexity made it difficult for organizations to understand and track what was happening among the different components in their systems. This difficulty is due in part to increased dependencies and complicated networking systems.

Rob Strechay

Rob Strechay

The second generation of APM tools, including AppDynamics and Dynatrace, came onto the market in the early 2010s, with a focus on customer experience and application monitoring rather than on management. These tools provided specific and easier integrations to gain market share, said Rob Strechay, a senior analyst at Enterprise Strategy Group. They gave organizations greater visibility into their applications as many struggled to find where latency was occurring within their network and if users were experiencing it.

Now, APM services and tools have begun to enter the territory of observability. This shift toward observability has become an important part of monitoring, said Gregg Siegfried, vice president and research analyst at Gartner. The leaders in the market, such as New Relic, AppDynamics, Dynatrace and Datadog, are starting to include observability as an additional capability.

"APM is just a small piece of observability," Strechay said, and so observability acts as an umbrella term over APM. Observability provides a greater scope of system analysis by collecting raw data of the entire environment. In contrast, application performance monitoring provides teams with specific data about a system's health, customer experience and business outcomes.

"If you are monitoring, you know what you are looking for," Siegfried said. "But there's nothing about monitoring that [will] tell you there's anything wrong. An observability tool will allow you to think of it as a special-purpose data and analytics exercise -- you're digging through the telemetry you've collected to uncover pathologies that were otherwise impossible to monitor for."

APM market trends in 2022

The APM market has transitioned from monitoring large monolithic or client-server applications to monitoring a broad scope of digital experiences. The lines are beginning to blur regarding what's considered an APM tool as market and organization infrastructures become harder to understand and monitor.

APM vendors are expanding their features to broaden their appeal and scope. On average, an organization uses 12 different monitoring tools, Strechay said, as it's impossible to find one service or company that can do it all. From Strechay's experience, most organizations try to limit the number of vendors they use, and the market is responding to those needs with the following trends.

OpenTelemetry and other open source technology

APM tools are adopting more open source technology, such as OpenTelemetry and Prometheus, to provide organizations with API-driven metrics on their application's performance and system observability. In the 2022 APM market, the emergence of open source distributed tracing with OpenTelemetry is becoming more prevalent as a method to collect performance data from applications, Siegfried said.

Platforms such as Honeycomb, Lightstep, Grafana Labs and Chronosphere weren't considered APM tools, but the emergence of OpenTelemetry and the rate of change in the application landscape -- from monoliths to microservices and cloud-native -- has blurred the lines between traditional APM tools and getting the desired information about an application.

Gregg Siegfried

Gregg Siegfried

"It's less important to be a classical APM tool than it is the ability to manage telemetry more holistically," Siegfried said.

In addition, open source technology enables organizations and IT teams to instrument their own code and build out different parts of their applications to better service their needs. Strechay said he sees this pattern in the financial services, insurance and retail industries.

Infrastructure monitoring

Many APM tools include infrastructure monitoring so their customers can collect data as deep as the OS. This can save IT teams from putting another agent on their system to monitor the OS, Siegfried said.

"Most APM tools don't monitor network devices or storage devices, but if your organization works in the cloud, then the infrastructure monitoring provided by an APM tool can be enough," Siegfried explained. Teams often don't need to configure monitoring as deep as the device level, which might be necessary with an infrastructure monitoring tool.

APM tools, such as New Relic, enable teams to integrate APM and infrastructure data to view it side by side for troubleshooting. In addition, Datadog provides insight into the applications, infrastructure and third-party services an organization uses.

Security capabilities

Within the last year, APM tool vendors -- such as AppDynamics with Cisco Secure Application and Dynatrace -- have begun to include identification abilities for application security vulnerabilities into their APMs. This provides IT teams insight and real-time access to security events in an application.

Siegfried believes security capabilities will become more widespread with APM tools in the future.

Shift toward machine learning and AIOps

The lack of DevOps and site reliability engineering skills in the IT industry, and growing complexity around infrastructure, means APM vendors have turned to AIOps and machine learning in their tools.

Vendors are also partnering with AI and machine learning companies to combine their tools for greater insight. "Right now, there's a lot of noise around AIOps," Strechay said, so APM vendors can find connections for you instead of having to turn to other tools. For example, Cisco acquired AppDynamics in 2017 and then purchased Perspica and its machine learning tool; in 2019, New Relic acquired AI vendor SignifAI.

But the use of the term AIOps can be confusing in relation to APM. "Before choosing an APM tool with AIOps, make sure you understand what they mean by AIOps and ask the right questions," Strechay said. What technology is driving it? How do they train their models? Can customers augment those models or do they self-update based on the application for greater accuracy over time?

The future of the APM market

Due to the complex nature of APM, the venture capital world is investing a lot of money into the market, Strechay said. Large companies, like Cisco and Broadcom, are making large investments, such as Broadcom's planned purchase of VMware in May 2022, to keep up and play a role in the market.

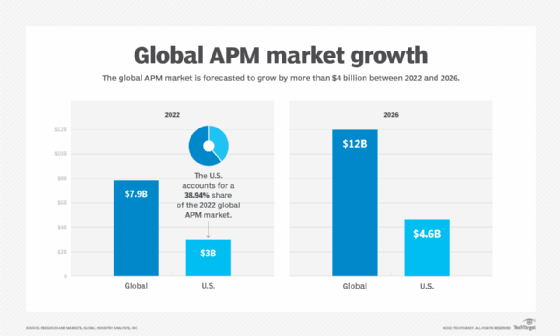

The global APM market is expected to reach $12 billion by 2026, according to a report from Global Industry Analysts Inc. released on Research and Markets. In 2020, the APM industry was estimated to be valued at $6.3 billion, but due to factors such as the COVID-19 pandemic and increased investment and adoption, the market is forecasted to grow at a CAGR of 11.4% over a six-year period.

North America is a global leader in the APM market because it's the biggest consumer of cloud and cloud-native applications, Strechay said. Currently, the U.S. market accounts for a 38.94% share of the global market.

Global Industry Analysts found the Asia-Pacific market continues to invest in the APM market due to a growing understanding of the effect reliable and high-performance applications have in business environments. They predict China's APM market will reach $1.2 billion by 2026 with a CAGR of 15.1%. The size of the European APM market falls between that of the U.S. and Asia and is expected to reach $1.4 billion by 2026.

Why such major growth?

As an analyst, Siegfried has seen an increase in inquiry traffic and interest from clients regarding APM tools over the last few years. As organizations move their workloads to the cloud, they find their current tools are ill-suited for the cloud environment and must therefore alter their monitoring strategy. In today's market, 20% to 25% of applications are cloud-native in nature, Strechay said. If an organization builds a new application, it will be cloud-native. Many organizations, Siegfried said, will replace their tools or on-premises options for those better suited to a hybrid environment.

APM tools have also seen a significant change in cost dynamics. Traditionally, APM tools have been the costliest monitoring tools, Siegfried said. Because of this, many organizations chose to only monitor a portion of their portfolios with APM tools. Lower costs and different APM tools and observability platform styles mean organizations can now have more coverage of their portfolios and gain more perspective.

Enterprise Strategy Group is a division of TechTarget.