Partners bet on tools for accelerated digital transformation

Proprietary tools for fast-tracking change are sweeping the industry, with offerings from professional services giants such as Accenture and Deloitte to specialized consultancies.

Accelerators have emerged as an increasingly important part of a service provider's kit as digital transformation and IT modernization customers demand faster turnaround on projects.

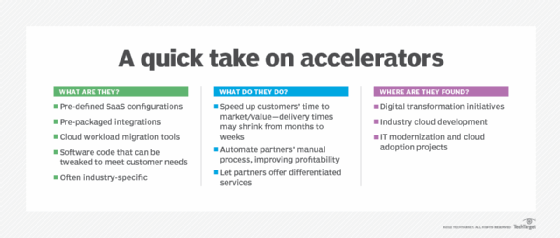

A widely used industry term, accelerators are tools for speeding up technology adoption, often within a specific vertical market. Their prominence is a sign of the times. Accelerated digital transformation took root during the COVID-19 pandemic, when the need to digitalize suddenly became urgent. The pace of change, however, hasn't slowed. As a result, partners look to augment their offerings with intellectual property (IP) that speeds up the task of reshaping business processes and deploying cloud services and emerging technologies.

Recent developments have highlighted the role of various types of accelerators:

- Deloitte this week cited its proprietary industry accelerators as part of its new Oracle MyCloud ERP offering. The consulting firm aims to help customers rapidly adopt the Oracle Cloud platform and boost business transformation.

- Accenture said its digital twin project with confectioner Mars, announced Oct. 4, makes use of the consultancy's "proprietary edge accelerators." The initiative seeks to modernize Mars' manufacturing operations with a combination of AI, cloud and edge as well as digital twin technology. The initiative builds upon an ongoing collaboration between Microsoft and Accenture.

- Accelerator technology propels Orium, a composable commerce consultancy that rebranded last month following an $11 million investment from Tercera, a firm that takes minority stakes in cloud professional services companies. Eighty percent of Orium's customers use the Toronto-based company's Composable.com Accelerator, which lets organizations create custom e-commerce applications from multiple components.

Keeping pace with transformation

The rise of accelerators is all about keeping up with the speed of transformation.

"Digital transformation programs are yet to slow down," said Boz Hristov, professional services principal analyst at Technology Business Research, Inc., a market research firm based in Hampton, N.H. "The promise of cloud to lower total cost of ownership is now being accelerated in terms of the benefits AI and automation provide."

Those benefits support buyers' cost optimization efforts, boost customer experience and advance digital transformation programs, he added.

Chris Barbin, CEO and founder of Tercera, suggested that accelerators aren't necessarily new but the impetus for building them has recently grown. "Services companies have been building out accelerators and IP for years. But the need for speed and automation to lower costs and drive scale in today's economy is pushing greater focus to reusable IP."

The need to push the tempo has intensified as enterprises pursue digital transformation programs in parallel. During a September earnings call, Julie Sweet, CEO at Accenture, said nearly 70% of the CFOs the company surveyed reported having three or more transformation programs underway or soon to launch.

"Compressed transformation is absolutely critical," said Lan Guan, global lead of Accenture Cloud First data and AI. "[Clients] need to execute bold programs in accelerated timeframes and now with multiple transformations occurring simultaneously across different business units."

The rapid compression of transformation timelines comes amid "a new sense of urgency to optimize cost and risk on one hand and modernize, digitize and innovate at scale on the other," she said.

Technical advancements in data management and AI make it possible to shrink the timelines, according to Guan. Accenture combines pre-built data and AI services accelerators with its industry expertise to speed up time to value. For example, a pre-built computer vision accelerator, coupled with manufacturing-sector knowledge, could help customers recognize the potential risk of defects in equipment. Such offerings can be reused across clients with similar needs.

"We don't need to reinvent the wheel," Guan said.

Types of accelerators -- buyer beware

The term "accelerator" can describe different types of tools from one service provider to another.

"We see IP and accelerators that run the gamut between tools used to differentiate in sales cycles to packaged pre-integrations that can save hundreds of hours in delivery to full productized solutions that are licensed, supported and maintained," Barbin said.

Not all accelerators are created equal, he cautioned, noting that service providers' IP varies in sophistication.

"When everyone is touting their IP, it becomes hard to tell what's real and what's marketing," he said. "This puts the onus on the firm to prove the IP's value and show that it can make a difference."

Assessing a tool's resourcing and support provides a way to evaluate IP. "If there isn't a budget or dedicated resources around a solution -- and it's being developed or supported in the cracks by billable consultants when they have some free time -- it falls lower on the maturity curve," Barbin said. "If a services company is spending 3% to 5% of revenue dedicated to IP, that is a material amount for a services company."

Investment in accelerators -- at whatever level -- looks set to continue among service providers dealing with the quickening pace of transformation and the drive for both cost efficiency and digital innovation.

"We do not anticipate that these trends will slow down or be resolved any time soon, especially as many buyers are just starting to invest in their digital transformation programs," Hristov said.