Epic Systems

What is Epic Systems?

Epic Systems, also known simply as Epic, is one of the largest providers of health information technology, used primarily by large U.S. hospitals and health systems to access, organize, store and share electronic medical records. As of 2024, Epic remains one of the largest electronic health record (EHR) vendors in the United States.

The company has a reputation as both a technological leader and one that comes with an expensive price -- sometimes more than $1 billion -- for its products and related installations. That said, it continues to remain a market leader as a vendor of EHR and related software.

Epic Systems history and culture

Started in 1979 by computer programmer Judith R. Faulkner in a Wisconsin basement, Epic is a privately held -- it has never raised venture capital -- employee-owned and developer-led software company specializing in healthcare. While its EHR system is its most visible offering, Epic's software also seeks to address a broad range of clinical and operational needs, like population health management, patient engagement and revenue cycle management. The company refers to itself as a "software factory" due to having made no acquisitions to date.

In addition to its software, Epic is known for its headquarters in Verona, Wisconsin. Resembling a whimsical theme park more than a corporate campus, the setting features a carousel, wizard academy, treehouse, barn and more. The atmosphere is intended to inspire creativity and innovation among the company's 13,000 employees. Every year, the company hosts thousands of visitors at a user conference at its headquarters, with a highlight being the costume Faulkner dons during her keynote speech -- past choices have included Lucille Ball, Alice in Wonderland's Mad Hatter and The Wizard of Oz's Scarecrow.

In April 2024, Epic broke ground on its newest Verona campus -- its sixth -- dubbed Other Worlds, which will take inspiration from The Lord of the Rings and The Chronicles of Narnia. Each campus has its own theme, usually inspired by popular fantasy fiction, like Alice in Wonderland, the Harry Potter series and Willy Wonka and the Chocolate Factory. At many conferences, the company's exhibit booth typically includes quirky additions, such as a large butterfly and fireplace, which symbolized Epic's support of the Fast Healthcare Interoperability Resources standard.

Epic Systems revenues, market share, major competitors

Since the federal government established incentive programs in 2009 to promote the adoption of EHRs through meaningful use of the technology, Epic has seen its client base grow. In 2016, Epic earned $2.5 billion in revenue, and it employed 9,700 people in 2017, according to the Milwaukee Journal Sentinel. By 2023, Epic's revenues grew to $4.6 billion. By April 2024, the company employed over 13,000 people. As of June 2024, Faulkner remains Epic's CEO. As of June 2024, Epic's software maintains the EHRs of over 305 million patients worldwide.

In 2017, Klas Research concluded that Epic had the largest EHR market share in acute care hospitals at 25.8%. More recent research showed that Epic's market share has consistently increased:

- 2021: 31%.

- 2022: 35.9%.

- 2023: 39.1%.

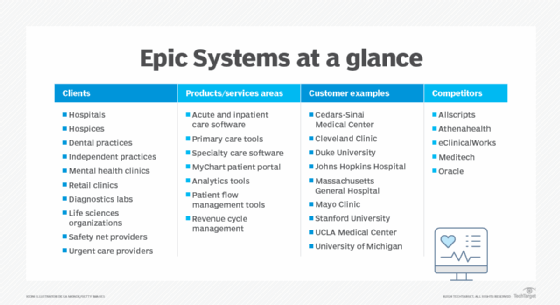

Epic's primary competitors are companies that sell EHR software to healthcare providers:

- Allscripts.

- Athenahealth.

- eClinicalWorks.

- Meditech.

- Oracle.

Epic Systems clients

Epic's software is used by many different healthcare entities:

- Hospitals, including academic medical centers, specialty hospitals and community hospitals.

- Hospices.

- Dental practices.

- Independent practices.

- Mental health clinics.

- Retail clinics.

- Diagnostics labs.

- Life sciences organizations.

- Safety net providers.

- Urgent care providers.

The company's clients include some of the biggest names in healthcare, including the majority of U.S. News & World Report's top-ranked hospitals and medical schools. Many research universities also use Epic's products.

Some well-known Epic customers are the following organizations:

- Cedars-Sinai Medical Center (Los Angeles).

- Cleveland Clinic (Cleveland).

- Duke University (Durham, N.C.).

- Johns Hopkins Hospital and Johns Hopkins Medicine (Baltimore).

- Massachusetts General Hospital (Boston).

- Mayo Clinic (Rochester, Minn.).

- Stanford University (Stanford, Calif.).

- UCLA Medical Center (Los Angeles).

- University of Michigan (Ann Arbor, Mich.).

Epic Systems key products and services

Epic Systems offers a wide range of software products that serve various purposes, including acute and inpatient care management, digital patient experience management, patient flow management, analytics and data integration, and patient flow management:

- Acute and inpatient care. This line of business includes software to help healthcare providers digitally manage hospital medicine, infection control, critical care, inpatient pharmacy, case management, patient engagement and medication administration, among other clinical needs for hospitalized patients.

- Primary care. Epic provides tools to help primary care providers effectively manage outpatient care, including chronic illnesses, routine screening, mental health and other primary care needs via in-person and virtual visits.

- Specialty care. Epic has software designed to address the unique needs of various specialties and streamline common tasks for those teams, including emergency and urgent care, oncology, nephrology, orthopedics, cardiology and dermatology.

- MyChart. This patient portal enables patients to access their health records, upcoming and past appointments, medication history, billing, educational materials and more. Its customizable features provide the option for healthcare providers to offer patients self-service scheduling, online refill requests and virtual visits as well.

- Analytics. These tools enable healthcare organizations to obtain data that can inform evidence-based research; individualized care delivery; quality and safety benchmarking; and clinical, operational and financial decision support.

- Patient flow management. Epic's tools enable hospitals, clinics and other providers to better manage capacity in order to optimize the use of beds, staff, transfers and transport.

- Revenue cycle management. Epic's self-service tools and automation aim to simplify patient scheduling, billing, referrals and financial experiences, as well as help to automate revenue cycles.

In addition to the above, Epic's software suite includes features designed to optimize care coordination and continuity, identify and track social determinants of health, boost clinical trial recruitment, facilitate better payor-provider communication and improve clinician efficiency. More recently, the company has also introduced generative artificial intelligence (AI) capabilities to help address clinical documentation burden and reduce provider burnout. Its deidentified patient database, Cosmos, enables researchers to tap into Epic's worldwide EHR data for 122 million patients.

Criticisms of Epic software

Due to its influence, product costs and, in some cases, practices, the company is often criticized. The fact that Epic has access to the healthcare data of millions of patients creates privacy concerns.

Also, one of the chief complaints, historically, has been its EHR system's lack of interoperability with other vendors' products. Epic has acknowledged this problem and indicated it is taking steps to address it. For example, it has created tools that bring together patient data across non-Epic EHR systems to enable providers to coordinate care and deliver improved health outcomes to patients.

The company was also not as fast as smaller EHR vendors to embrace cloud-based medical records systems. That said, today, Epic provides a cloud-based EHR option with multiple modules available for different types of practices and specialties.

The costs of installing an Epic system can be enormous. For example, Mass General Brigham -- previously known as Partners HealthCare, a health system that includes Massachusetts General Hospital and Brigham and Women's Hospital -- rolled out Epic's her system across 10 hospitals in 2015. The project took three years to build prior to its rollout, and the initial price tag of $600 million doubled to $1.2 billion by the time the implementation was completed. The cost of deploying Epic varies depending on the scope and scale of implementation, but in many cases, the capital and operating expenses can be cost-prohibitive for smaller healthcare organizations.

To some extent, Epic has sought to address interoperability and cost concerns through its Epic Community Connect program, which invites smaller hospitals and clinics using non-Epic EHR platforms to partner with larger, Epic-based health systems and hospitals in a cost-sharing arrangement. Hosts extend an instance of their Epic system to partners, which pay a fee to the host. The program is designed to enable entities with Epic systems to reduce their total cost of ownership and increase referrals, while making Epic more affordable for smaller and midsize hospitals and clinics to deploy.

Epic in the news: CVS and Supreme Court

In October 2017, Epic Systems and CVS Health announced an initiative to help lower drug costs using Epic's population health and analytics platform. According to the companies, the project was aimed at granting providers real-time information about prescription insurance coverage and less expensive alternative drugs. Since then, the two companies have continued to partner on various initiatives, such as a 2021 project to enable people who received COVID-19 tests at CVS Pharmacy and MinuteClinic locations to access their results via Epic's MyChart patient portal.

Not all mentions of Epic in the news have been positive, however. In 2018, the U.S. Supreme Court ruled on Epic Systems Corp. v. Lewis, a case in which former Epic employee Jacob Lewis sued the company in federal court on the claim that he had been denied overtime wages in violation of the Fair Labor Standards Act of 1938. The case centered on whether an agreement by a company and employee to settle employment disputes through individual arbitration, rather than class action, is allowed under the Federal Arbitration Act (FAA). A five-justice majority of the court sided with Epic, ruling that class-action waivers were enforceable under the FAA, resulting in a substantial increase in the use of mandatory arbitration and class-action waivers in employment contracts in the United States over the next six years.

There's been a lot of talk about generative AI use in healthcare with EHR vendors introducing tools to streamline clinical workflows and administrative tasks. See how EHR vendors are using generative AI in clinical workflows.