Budgeting software vs. Excel: Which one meets your organization's needs?

To make your decision easier, read expert Barry Wilderman's explanation of the pros and cons of each, plus cloud considerations.

As companies adopt more sophisticated approaches to budgeting, computer applications are being increasingly considered. The big decision is whether to use Microsoft Excel or other budgeting software. Generally, it’s a counting game: Count the number of distinct units in your organization (locations, products, profit centers, administrative departments and so on) that build budgets. If there are 10 or more, you are ready for budgeting software.

To know if dedicated budgeting software is the way to go for your organization, ask the following questions:

- Where does paper-based, manual budgeting fit in?

- How far can you get with Excel-based budgeting?

- What is the next logical step after Excel?

- How much can you leverage your existing accounting or ERP package?

- How can you take advantage of the cloud?

If you have a simple business with one location, and can describe the business in under 10 line items, then paper-based budgeting managed in Excel might be the right approach.

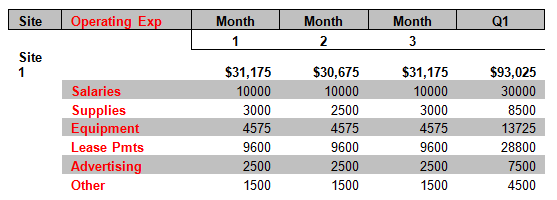

There are numerous sample budget templates available in Excel, as seen in this example.

The spreadsheet contains six types of operating expenses for five sites, and part of the data for site 1 is represented in Figure 1. There are five sections of the spreadsheet, one for each site. Each of the five sections has six rows of data, with a summary row represented at the top.

The columns show data that was inputted for each month of the year, and there are summary columns for each quarter, each half year and a grand total.

For this approach to be feasible there needs to be someone in the organization who can maintain the production copy of the worksheet, receive data from each site, ensure that the data is reviewed by management, return it to the original sites for changes and produce summary reports for the board of directors.

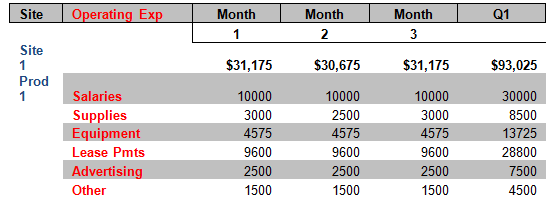

Although it seems relatively straightforward right now, the spreadsheet can get quite complicated. Assume the company has five sites, and each site has seven major products that it sells (see Figure 2).

Suppose management decides to budget at the product level for each site. Now there will be 35 sections (five sites x seven product lines) and data will have to be aggregated across product lines. Who is going to do this work in what has now, in truth, become a combination database, budgeting and report-writing application -- hardly a task for Excel.

There are other cases, however, where Excel will work. Think about the number of physical sites and the major product lines in each. If the number of sites multiplied by the number of major product lines is under 10, Excel will work. The same is true if your budgeting is restricted to expenses (and not many revenue categories), if management does not demand complex reports, or if they don’t want to do any planning, forecasting and strategic management.

Once you add a reasonable amount of complexity, though, Excel -- especially when maintained by a single user -- becomes unwieldy. However, there is hope for the Excel community. Some budgeting and planning vendors, such as Axiom EPM, use Excel as the user interface.

So, what is a budgeter to do?

There are many software vendors that can help you get budgeting right, including Adaptive Planning, Alight, Arcplan, Centage, Exact-Longview, Host Analytics, KCI Computing, Prophix Software, Tagetik Software, Tidemark, Winterheller. Review each vendor’s offerings for budget creation, collaboration across departments, budget reviews, change management and comprehensive reporting.

It makes sense at first to stick to the budgeting basics. At a later date, consider adding capabilities for planning, forecasting and strategy management.

Leverage your accounting or ERP package as well. Most of them have budgeting modules, though there could be an extra fee for activating them. The modules make it easy to load data from the accounting or ERP files into the budget files. The advantages are working with a single vendor and this easier loading of budget data. The disadvantage is that the budgeting software may not be as good as software from specialized vendors.

You can also take advantage of the cloud. If the budgeting package is not going to reside on a single desktop with Excel, then it must run on a server somewhere to be effective. All the software and data should reside in the cloud; that way, users only need desktop machines and simple Web connectivity to access them.

About the author:

Barry Wilderman has more than 30 years of experience as an industry analyst, researcher and consultant at such companies as META Group, Lawson Software, SalesOps Analytics, and McKinsey and Company. He is currently president of Wilderman Associates. Contact him at [email protected] and on Twitter at @BarryWilderman.