Getty Images/EyeEm

7 benefits of ERP in accounting

ERP and accounting applications operate separately, but ERP systems can deliver valuable financial insights for companies. Learn about the benefits of ERP in accounting.

Accurate accounting is a vital part of any company's operations, and ERP software can benefit companies in various ways that they do not experience with standalone accounting software.

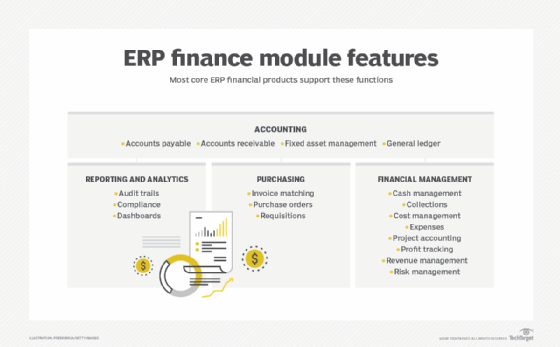

Accounting software focuses on tracking financial transactions, reporting and compliance. Meanwhile, companies use ERP systems to handle various key processes across departments, such as procurement, sales and CRM. Many ERP vendors offer enhanced accounting capabilities via accounting and finance modules. Depending on business requirements, those modules may complement or replace traditional accounting systems.

Here are some of the ways using ERP software for accounting can benefit companies.

1. Data entry automation

ERP systems often include various modules that help automate or streamline data entry processes. Users enter data once, and the data automatically repopulates into forms and tools across the company.

In some cases, an ERP system can help eliminate accounting data entry by using various departments' barcodes and scanning processes to automatically populate various data fields in the system of record and then generate the required forms for a given process.

For example, a procurement team could place an order for the raw materials for a specific product and automatically capture information about the shipper's barcode. Upon receipt, the procurement team scans the barcode to enter the appropriate data into the system of record.

2. Better data management

Standalone accounting tools may struggle to integrate with other applications and the workflow requirements across departments. This limited functionality could result in inefficient workflows, such as employees cutting and pasting numbers between multiple spreadsheets, which can potentially lead to data discrepancies.

ERP systems provide a centralized platform for integrating data from various business processes, which helps improve data sharing across departments such as finance, supply chain management and manufacturing. This consistency can help improve employee collaboration and communication about financial processes.

3. Real-time visibility

ERP software also provides access to information across departments. These insights can improve overall financial operations because the data helps leaders make better-informed decisions.

In contrast to an accounting platform, an ERP system can help users reformulate an existing product or make other changes to the business because it provides better insight into product data from multiple departments.

ERP software can also highlight potential problems, like high labor costs.

4. Improved customer relationships

ERP systems often include CRM modules, which can simplify tracking, reporting and analysis of customer interactions. An ERP's CRM module can give company leaders insight into customer behavior and sales patterns, which can also help them make better business decisions.

For example, ERP data could help company leaders calculate the total cost of servicing a client, industry or region. The software can also help leaders compare the costs of different customer service strategies.

5. Better governance and compliance

Companies may need to customize standalone accounting packages for a particular type of business or region, which can lead to errors or noncompliance.

Some ERP systems support industry-specific features that help organizations automate tax calculations and ensure compliance with industry regulations. Companies can integrate these features into apps and forms, which helps prevent errors and provides an audit trail across various industry-specific processes.

6. Improved cash flow management

Standalone accounting software can provide some insight into cash flow but may not share as much about how inventory levels, contract terms or operational processes affect that cash flow.

ERP systems are often better suited than accounting software for gathering financial data from across different parts of the business. An ERP system makes it easier to assess cash positions, outstanding invoices, and payment schedules and then analyze the cost of operations, inventory levels and contract requirements.

7. Improved asset management

A standalone finance package likely focuses on capturing cost and depreciation but doesn't provide insight into the effects of maintenance or replacement strategies.

However, an ERP system likely includes tools that can help calculate the cost and value of different asset management strategies. For example, a user can assess the cost of different part replacement schedules in terms of human labor and part costs and compare them with failure rates and the cost of equipment failure.