Why integrated business planning is relevant -- and how to automate it

ERP systems and CPM software already provide some of the best tools for automating IBP.

Ideally, companies should integrate their business planning across multiple departments within each line of business (which is hard to do) and across lines of business that must work together -- which is even harder. That's exactly what integrated business planning (IBP) was intended to do. Though the concept is hardly new, IBP requires new technology and a renewed commitment by executives to work within and across business units.

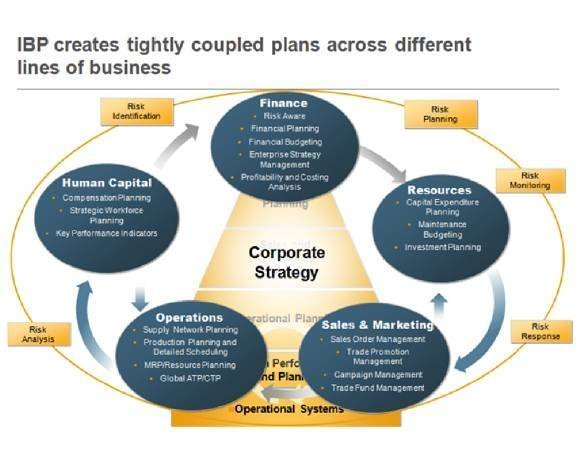

The goal of IBP is to help a company integrate critical business functions, as shown in the diagram. These functions include forecasting demand, procuring raw materials, delivering products to meet the demand, maintaining adequate staffing across departments and providing funds to support every department. The cross-functional nature of the process is why an integrated approach is so important.

Why IBP is relevant

IBP helps sales and operations balance supply and demand. It also gives HR managers the right clues about hiring and training. With IBP, the CFO can fund operations and help manage profitability. Finally, IBP helps all groups have informed discussions about product market strategy, including new product introductions and capital investments.

The CFO must take enormous interest in the various processes that comprise IBP and work closely with line executives.

The 'who' of integrated business planning

Vice presidents of sales and marketing are responsible for managing demand for the product. The CFO will want to understand the accuracy of their sales forecasts because there are consequences if the forecasts are too low (not enough product is being made to meet demand) or too high (there's too much inventory). Clearly, operations needs reliable forecasts from sales. The CFO will also scrutinize the pay structure for sales staff -- their salaries and commissions obviously impact profitability -- and their turnover rates. How long does it take to hire and train new sales reps? What does it cost to train them?

VPs of operations and manufacturing must ensure an adequate supply of goods and services to meet demand. The CFO will want to understand their labor, manufacturing, and procurement costs, as well as the cost of safety stock including raw materials, work-in-progress and finished goods.

The VP of human resources must ensure that there is adequate staffing to meet the sales and operations functions. The CFO will want to know salary structures, what HR does to retain the most talented employees and how successful it is at replacing and training staff.

The VP of strategy is responsible for helping the company maintain a sustainable competitive advantage. The CFO will want to understand the latest strategies, what capital expenditures are required to implement them and how these expenditures impact the budget.

The 'when' of integrated business planning

Best practice is to hold regular monthly meetings at which executives come together to review the sales plan (demand) for the next quarter and how that demand will be met (operations) and funded. The questions to be considered include the following:

- How strong is the demand plan and what short-term changes are required?

- What are the implications for operations?

- What hirings and firings have been made in the last month, and how do they affect productivity assumptions?

- What capital investments should be considered?

- Should new products be introduced?

Automating IBP

A number of vendors provide software that helps to automate IBP. Automation choices typically fall into the following categories:

- Transactional (finance, operations, sales and manufacturing);

- Sales and operations planning (S&OP);

- Enterprise performance management (EPM), including budgeting, planning and strategy; and

- Analytics.

Let's build from the bottom up.

Customer relationship management (CRM) software helps companies manage customers, customer demand, sales compensation and territories management. Consider vendors such as Salesforce.com and SalesLogix. In addition, there are numerous niche vendors (e.g., Varicent [IBM] and Cloud9) that provide specialized planning and transactional capabilities.

S&OP vendors concentrate on the very important problem of balancing demand planning and supply planning, with links to sales, operations and finance. Based on a recent briefing, I found Kinaxis' capabilities impressive. Steelwedge is also a competitor in this space.

In contrast, EPM vendors focus mainly on budgeting, financial planning and strategy. But a number of them are now creating IBP templates. Consider Adaptive Planning, Cogniti, Host Analytics, Prophix and Tidemark, all of which are making forays into IBP.

Enterprise resource planning (ERP) vendors do some or all of what you need for IBP. But don't hesitate to mix and match ERP with best-in-class components. (I call this the "seamless" vs. "unseemly" decision.) Vendors include the largest players -- Infor, Microsoft, Oracle and SAP -- and many more, including Epicor, IFS, Sage, SYSPRO and UNIT4.

Before buying any of these IBP automation tools, CFOs should ask themselves which IBP issues are crucial and which executives participate in solving them. Next, determine how the current software portfolio helps meet IBP requirements. There is likely to be a need to expand the number of executives involved and perhaps to add to the IBP software stack. With people, processes and technology in close alignment, IBP can once again become not only relevant, but indispensable as well.

More on planning and forecasting

- Learn about trends in corporate performance management

- Use CPM software for the 'last mile of finance'

- Understand SaaS financial management software