Armin Sestic - Fotolia

ERP vendors get high marks in Panorama report

A substantial majority of ERP customers are satisfied with their ERP vendors, according to a new report from Panorama Consulting. But whether they're realizing the benefits of ERP implementations remains unclear.

Although ERP implementation problems continue to make headlines, most customers are happy with their ERP vendors.

That was one of the conclusions of the 2019 ERP Report, published by Panorama Consulting Solutions. The report surveyed almost 250 ERP customers on ERP software selection and implementation trends from January to February 2019.

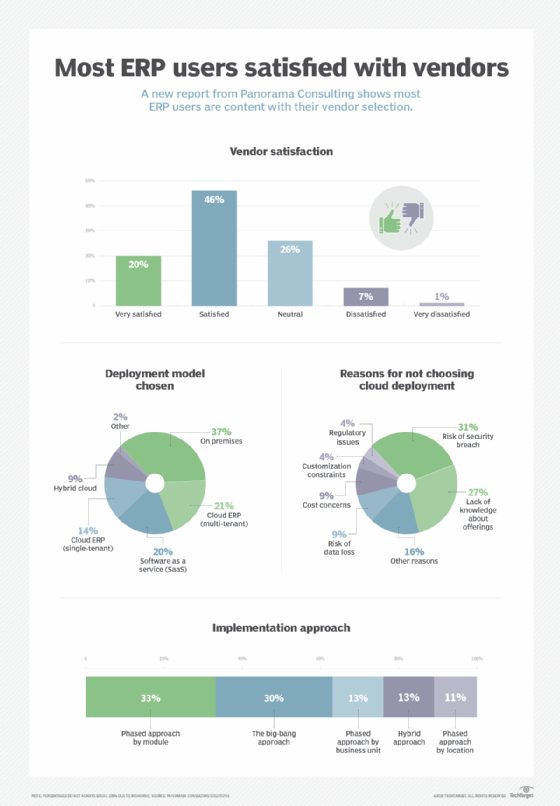

A solid majority of respondents reported they were "satisfied" (46%) or "very satisfied" (20%) with their ERP vendors. Just 7% said they were "dissatisfied," and a scant 1% reported they were "very dissatisfied." The remaining 26% of the respondents were neutral regarding their ERP vendor.

Although the report indicated that customers are happy with their ERP vendors, it's less clear that they are realizing the full benefits of their ERP implementations, according to Vanessa Davison, managing partner of Panorama Consulting, based in Greenwood Village, Colo.

There is often no clear measurement for the expected benefits of an ERP implementation, and some people may not be honest in admitting success or failure, Davison said.

"They don't want to admit to failure, and even when people are happy with their vendor, they're not always looking at the big picture," she said. "Sometimes, they don't realize that they still have some redundancies in the operations side of the house, or they were not able to consolidate some of their manual processes."

Definitions of success differ

The definition of ERP implementation success is different for every company. Some may define success as having simply been able to go live with a new system and retire a legacy system, while others may have more complex expectations that include key performance indicators.

Just implementing a modern ERP system can lead to overall happiness with the new system, Davison said.

"When you are retiring old systems and upgrading to new ones, there are significant improvements in the technology from all the ERP vendors," she said. "It's not just the technology itself, but it's the ability to get smart reporting and real-time data, and those are benefits that everybody sees as a success. As the technology advances, it's these vendors that are allowing the companies to have better visibility and real-time information."

On-premises still the deployment option of choice

Deployment options are an important consideration when selecting an ERP system, according to the report. On-premises deployment remains the most popular implementation option, selected by 37% of respondents. A variety of cloud options were also selected: multi-tenant cloud (21%), software as a service (20%), single-tenant cloud (14%), hybrid cloud (9%) and others (2%).

The continuing strength of on-premises deployments is somewhat surprising, but makes sense for larger organizations, according to Davison.

"Many are still staying on premises, because they're realizing that there's not as much of a cost benefit in the long term between on premises and the cloud because of hosting fees and a host of other costs associated with going to the cloud, especially with single-tenant hosting," she said.

Larger ERP vendors like SAP and Oracle are trying to migrate their large enterprise customers to the cloud, Davison explained, but they face reluctance.

"A lot of the big enterprises believe it's not proven yet, so [they] don't want to be the guinea pig," she said. "The smaller guys are deciding if they want to stay on premises for another couple years, then look to move to the cloud at some point."

Cloudy misconceptions

However, much of the reluctance to move to the cloud is based on misconceptions, particularly about cloud security, according to the report. The risk of a security breach was cited as the main reason why respondents did not choose the cloud (31%). This was followed by lack of knowledge about cloud offerings (27%), cost concerns (9%), risk of data loss (9%), customization constraints (4%), regulatory issues (4%) and other reasons (16%).

"We believe these ERP vendors have all of the security protocols to protect the companies' data, and we haven't seen any security breaches as a practical matter for our clients that have gone to the cloud," Davison said. "Public sector [customers] tend to be the most concerned about security, but they can also face regulatory issues that mean they can't go to the cloud."

Companies' implementation approach is also a vital consideration for an ERP implementation, because the projects are costly, complex and disruptive, according to the report. The three most common implementation approaches are the "big-bang" approach, where a new system is implemented wholesale across the organization; a phased approach that can vary by business unit, functional area of the ERP or location; or a hybrid approach that combines elements of the two.

The most selected deployment option was phased by functional area (33%), followed by big bang (30%), phased by business unit (13%), hybrid (13%) and phased by location (11%). Each approach has its own strengths and weaknesses, and organizations need to understand their specific requirements before deciding which approach works best, Davison said.

The phased by functional area approach may be most popular, because it enables organizations to concentrate on one function at a time, Davison said. But they have to be disciplined to make it work.

"[The phased by functional area] is a little bit easier, to some extent, but organizations have to have other things in place to be able to integrate everything, or they'll be operating two systems at once," she said. "And it can cost a little more than the big-bang approach."