sheelamohanachandran - Fotolia

Supply chain trends for 2021 include reshoring, digitization

The diversifying of manufacturing, including reshoring to the U.S. and the adoption of new technologies, will be top supply chain trends in 2021, according to industry experts.

No one predicted 2020 would be the year when supply chain trends would shoot to the top of everyone's watch list.

Then came the COVID-19 pandemic, which disrupted manufacturing and supply chains around the world. Auto production in South Korea was halted when parts suppliers in Wuhan, China, closed their doors. Supply and demand for consumer goods like toilet paper were stretched in unusual ways when everyone started buying in bulk. Manufacturers had to adjust their production rates almost overnight when demand for products either cratered or went through the roof, or they had to quickly pivot and alter their lines from making one product to another.

There's no doubt that 2021 will also influence supply chain trends, as companies continue to deal with the new realities. Here's what some supply chain experts and professionals believe will be the most important trends to keep an eye on in 2021.

Time for innovation in the supply chain

Just as 2020 was the year of disruption, 2021 will be the year of establishing new norms, said Dana Gardner, president and principal analyst at Interarbor Solutions, an independent enterprise industry research and analysis firm in Gilford, N.H.

Dana Gardner

Dana Gardner

Gardner: For companies that are in supply chain and logistics, what used to work and what was good enough in the past for supply chain resiliency have been blown out of the water. There have been huge discrepancies in how companies have either done well or suffered terribly by how well they were prepared for [COVID-19]. A lot of that had to do with how digital you are; how agile you are; if you are tied into older platforms, systems and methods; if you are a very siloed organization; if you didn't have the ability to react to the remote workforce requirements right away. Those businesses have suffered, and we haven't seen the evidence of that scarring fully developed yet.

So not only will 2021 be the year that we have to be looking at innovation, but we're also going to be looking at the destruction caused by the disruption. A lot of the companies and a lot of the methods and ways of doing business of the past that were failures are not entirely evident yet. There's been a lot of public sector support, and the stimulus, which has given companies a long runway. But ultimately it's when that stimulus runs out and they have to stand up and be self-sustaining businesses that we'll see the real discrepancy between the companies that were prepared and able to react quickly and those that weren't.

Manufacturing will move back to U.S.

Reshoring, or the returning of manufacturing to the U.S., will increase in 2021, according to Rosemary Coates, executive director of the Reshoring Institute. Based in Los Gatos, Calif., the Reshoring Institute is a nonprofit research firm that focuses on global manufacturing and supply chain issues.

Rosemary Coates

Rosemary Coates

Coates: Companies are now evaluating their global strategy [on manufacturing]. It isn't about if companies should manufacture in Indiana or in Shanghai; it's about having a more strategic view so that you have multiple plants. It may be China plus one, or Vietnam plus the U.S., or Vietnam, Mexico and the U.S. It's making a strategic decision to minimize and mitigate your risk by having alternate manufacturing locations. That's a different trend than what we saw 15 years ago when these companies were moving offshore. There's a rethinking of that strategy and mitigating the risk around the world by having multiple manufacturing locations or multiple sources.

There's a lot of emphasis being placed on helping and facilitating manufacturing in the U.S. There are things like Buy USA [federal] policies, requiring buyers to purchase goods that are made in the U.S. unless they absolutely can't find them or there's a huge gap in cost competitiveness. But it's been loosely enforced for a long time. President Joe Biden has made it front and center and said we're not only going to enforce it, but we're going to support and enhance it. There are also key infrastructure things, like modernizing airports and ports, that Biden has clearly identified as part of his strategy. So I think we're going to see a lot of emphasis placed on manufacturing within the next couple years.

More investment in supply chain resiliency, stability

The movement of manufacturing out of concentrated areas in China will increase in 2021, and digital transformation initiatives will be stepped up, said Eskander Yavar, partner and national manufacturing advisory services leader at BDO Digital, a technology research and consulting firm in New York.

Eskander Yavar

Eskander Yavar

Yavar: The idea of relocation or reshoring is unique to the U.S., but it continues to be a big priority for U.S. manufacturers. We don't believe there's going to be a mass exodus out of the Chinese supply chain, because there are still very compelling business drivers there from a costs and labor perspective. But we do see other countries in Asia Pacific and West Asia raising their hands and grabbing a piece of that business -- India, Thailand, Vietnam, Malaysia.

In terms of technology, we're definitely seeing innovation around the traditional, core back-office ERP systems. But in terms of investment, it's around born-in digital manufacturers, which has been gaining momentum every year. Born-in digital manufacturers are relatively new manufacturers that have fresh operating models and are taking advantage of next-generation technology and automation. The explosion of e-commerce and distribution is about fulfillment from order to shipment in an expedited way. The companies that embrace that technology -- like applying robotics in the digital distribution center -- are driving fulfillment costs 80% lower than their competitors. These companies aren't bound by some of the constraints of a legacy business, which must learn how to adopt technology and then convince their executive teams to make the capital investment. We all know from the pandemic that demand for products has shifted from retail stores to homes and individuals, so we're seeing a lot of innovation in that e-commerce and distribution space.

IoT plays role in strengthening supply chains

The pandemic has disrupted the delivery of everything from toilet paper to COVID-19 vaccines, but IoT devices can play a major role in ensuring the safe and timely delivery of goods, said Ajay Rane, vice president of global business development at Sigfox. Based in Paris, Sigfox created a "0G" global wireless network that connects low-powered IoT devices to the internet and can be used in supply chains to track shipments and monitor conditions of goods in transit.

Ajay Rane

Ajay Rane

Rane: One of the biggest supply chain trends in 2021 will be ensuring critical medical supplies, such as vaccines and PPE [personal protective equipment], not only get to their final destinations quickly but also under appropriate conditions such as temperature and humidity during shipment. Likewise, questions about the food supply chain and whether or not supply chains are ready for the coming waves of increased demand for goods, such as toilet paper, are top of mind after stores ran out quickly back in March.

Technologies like IoT can help overcome these challenges. For example, by attaching IoT devices to shipment containers, vaccine manufacturers can get real-time insights into not only container conditions, like temperature, but also location so that hospitals and pharmacies can be alerted as to when doses will arrive. This same technology can be used to monitor the conditions of food being shipped to ensure minimal food waste and [maximize] shelf-life.

More connected systems via APIs

Rapid changes in the retail landscape are having profound effects on supply chain and logistics, so companies will have to adjust their sourcing and supply chains and implement technologies that allow processes to run with fewer humans involved, according to Minesh Pore, CEO of BuyHive. Based in Hong Kong, BuyHive is a year-old startup that provides applications and services to simplify sourcing and help make supply chains more transparent.

Minesh Pore

Minesh Pore

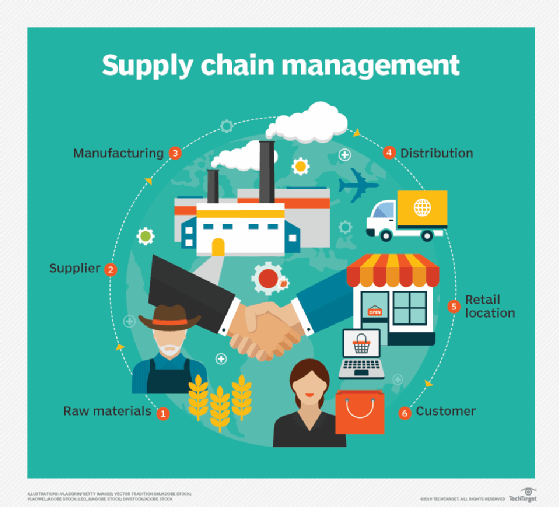

Pore: Supply chains are going to be under pressure to innovate and bring in solutions that enable more transparency, more interactivity and more trust. There will always be products made in China or India or Mexico, so how do you manage the transparency and trust when you cannot travel?

This could happen through technology tools, but we don't know what tools or technologies will be coming out. However, new technologies [introduced] are going to be API-based. Let's say you are in a traditional retail business and you have your CRM or your ERP system, your retail ERP is going to be connected to suppliers' platforms via APIs. Those APIs will help with sourcing products and things like logistics planning. You will have APIs that connect to trade finance companies or banks that provide trade financing, and these will be able to predict the amount of money needed to buy this product and provide trade finance in advance. Previously, your system couldn't talk to the supplier's system or the logistics provider's system, but in the future, there will be APIs that connect these.