Choosing the right accounting software: SMB to enterprise

To find the best enterprise accounting software, businesses must outline specific criteria and compare those criteria against accounting software features and benefits.

If an organization needs enterprise accounting software, what are the important factors that go into the decision-making? And what are the key features and benefits of these platforms?

As with any other significant IT investment, there are certain factors that help management select the best enterprise accounting software. Some of these might be more critical to the company, depending on its circumstances and goals. But evaluating each one carefully helps management make the best choice.

Ease of use

Many people in an organization use accounting software, but not all of them may have a technical background. Ease of use is therefore one of the most important factors when choosing accounting software.

Vendors design these products to lighten the accounting load by automating otherwise manual processes. Product functionality should be intuitive for business users, and financial staffers should be able to quickly get up to speed on features and capabilities. Otherwise, productivity issues could occur during implementation.

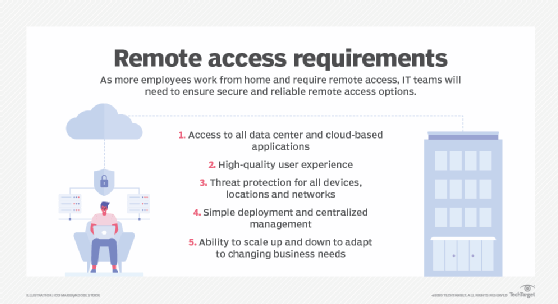

Web-based accounting software should have easy-to-use, browser-based controls and the software should be accessible from virtually anywhere, through any device with a browser and internet access. For companies with multiple locations, remote users should be able to easily manage financial data and records.

Ease of implementation

Accounting software should also be easy to deploy. If not, startup costs might be much higher than anticipated, with the potential for costly delays.

A key question to ask is whether the vendor offers consulting services as part of the implementation, and to what extent. For companies with existing accounting packages, the installation will require a smooth transition from one finance system to another.

Deployment should be rapid so as not to interfere with daily functions, such as accounts payable (AP) and accounts receivable (AR), payroll and other financial processes. You should also ask the vendor how long the implementation will take.

Expansion modules

Enterprise accounting platforms should deliver broad capabilities. In many cases, these come from expansion modules that offer seamless flexibility. Companies are able to add new and more advanced capabilities as they grow or as needs arise.

Every accounting package handles core financial processes, such as general ledger, AR, AP and often payroll. More comprehensive accounting software suites might include companion modules for cash management, currency management, tax management, recurring revenue management, inventory management and deferred revenue accounting.

Integration with existing systems

Accounting software needs to interact with other business systems, so integration is an important factor. This is especially true for companies that plan to use advanced functionality, and even smaller companies that have growing customer bases.

Customer relationship management (CRM) is an example of an application companies might want to integrate with their accounting software. By connecting accounting software with a CRM platform, a complete view of customers can be accessed from within accounting functions. This also enables better collaboration between the finance and sales departments, making integration and collaboration two vital accounting software features and benefits.

Scalability

As with other major business software platforms, scalability is a desirable feature. That means being able to easily change module configurations to increase functionality; add users when additional employees need access to the software; and include more departments, functional areas or entire organizations as the business grows or makes acquisitions.

A key source of scalability today is the cloud, and many vendors offer accounting products such as software as a service (SaaS). More organizations are moving their on-premises accounting processes to the cloud, in part, because it offers flexibility and scalability. In some cases, companies employ hybrid IT environments that include a mix of on-premises, private cloud and public cloud infrastructures.

Security

Accounting data requires the highest degree of security both at rest and when authorized users share it. Otherwise, hackers and other bad actors will find a way to access it, resulting in major problems.

To ensure authorized users only have access to the software and data appropriate to their role in the organization, the accounting software platform should feature strong user-level access controls. In addition, sensitive financial information must be encrypted when stored and transferred. This way, if it does fall into the wrong hands the intruder won't be able to read the data.

Customer support

The level and quality of support provided by an enterprise accounting software vendor is another important area to evaluate. Issues inevitably arise with any complex software platform, and accounting is too important a function to wait for vendors to address issues.

Some vendors deliver their accounting software through a network of channel partners, such as value-added resellers, and these solution providers might be the first line of support when issues surface.

Ensure any partner you'll work with is a trusted advisor and can help with deployment, customization and support services when needed.

Customization and vertical market specialization

How well does the vendor or channel partner understand the industry? Are the accounting software features and benefits tailored specifically to the business? The answers to these questions could determine how well the software and partner can support your business.

Although basic accounting functions are the same regardless of sector, certain industries have unique processes and goals. For example, some accounting software vendors offer product versions tailored for industries such as manufacturing, retail and professional services. These versions offer specialized accounting features and benefits, such as customized reports and a chart of accounts.

Mobile access

Workplace mobile users are ubiquitous, especially given the rise in remote work, and some need access to accounting applications. Any enterprise accounting software under evaluation should support multiple mobile platforms and be accessible from a variety of devices.

That includes financial report templates and dashboards accessible via mobile devices so users can perform tasks and make informed decisions regardless of location. Mobile functionality can extend to areas such as inventory management. For example, mobile barcode scanning can simplify inventory tracking in a warehouse.

Reporting features

Finally, an enterprise accounting software platform should have strong reporting capabilities for internal use and regulatory filings. This might include prebuilt reports and dashboards that can help people in accounting roles more easily interpret results.

Some software products come with templates to enable users to create reports specifically for their company's industry. Users can automatically fill in company data and view reports. Advanced reporting features enable companies to customize reports so they can gain specific insight into their business operations.