chart of accounts (COA)

What is chart of accounts (COA)?

A chart of accounts (COA) is a financial, organizational tool that provides an index of every account in an accounting system.

This provides an insight into all the financial transactions of the company. Here, an account is a unique record for each type of asset, liability, equity, revenue and expense. A COA includes many subcategories for each account.

What is the purpose of a chart of accounts?

In practice, the COA serves as the foundation for a company's financial record-keeping system. It provides a logical structure that facilitates the addition of new accounts and the deletion of old accounts.

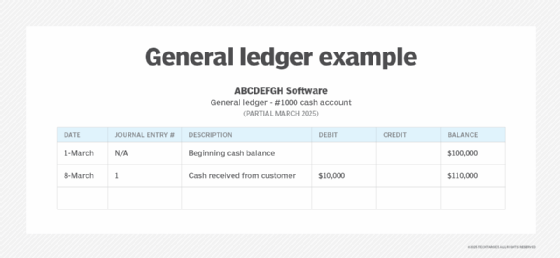

The organization of accounts within the COA varies from company to company. It usually consists of the accounts that a company has identified and made available for recording transactions in its general ledger. This can be done with accounting software.

For ease of use, a COA contains the list of accounts' names, brief descriptions, account type, account balance and account codes for each sub-account.

Sample chart of accounts

To better understand this, consider your personal financial statement. Let's say you have a checking account and a savings account. You regularly use your checking account for your day-to-day expenses. Further, you also use two credit cards regularly.

Your financial statement will provide details of the cash flow (i.e., credit and debit balance). This includes your monthly income, expenses and debt. The same, when produced for a company, is the COA.

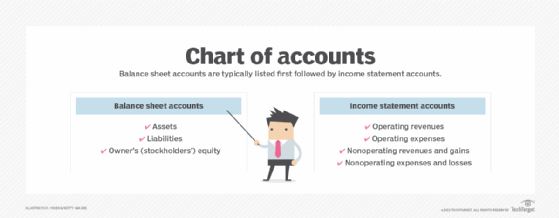

Within the COA, accounts will be typically listed in order of their appearance in the financial statements. Typically, balance sheet accounts, including current assets and current liabilities, are listed first.

This is followed by the income statement, which includes revenue and expense accounts. This can be further divided into operating expenses, operating revenues, nonoperating expenses and nonoperating revenues.

A COA for a small business might have the following sub-accounts:

Asset accounts:

- Cash

- Savings account

- Prepaid expenses

- Accounts receivable

- Real estate

Liabilities accounts:

- Accounts payable

- Accrued liabilities

- Income tax payable

- Depreciation

Creating a chart of accounts

A chart of accounts will likely be as large and as complex as a company itself. An international corporation with several divisions may need thousands of accounts, whereas a small local retailer may need as few as one hundred accounts.

An important purpose of a COA is to segregate expenditures, revenue, assets and liabilities so viewers can quickly get a sense of a company's financial health. A well-designed COA not only meets the information needs of management, it also helps a business to comply with financial reporting standards.

A company has flexibility in creating a COA that suits its needs. Within the categories of operating revenues and operating expenses, for instance, accounts might be further organized by business function or by company divisions. They need to be mindful of the Generally Accepted Accounting Principles and the Financial Accounting Standards Board, however.

Companies should also ensure that the COA format remains the same over a period of time. Changes to a COA in the short term can make it challenging to analyze the difference in a company's financial health over the long term.

See financial consolidation, enterprise resource planning, financial controller, accounts receivable, Accounts payable, financial reporting and ERP finance module.