BAI2 file format

What is BAI2 file format?

BAI2 file format is a specialized and standardized set of codes used for cash management and bank reconciliations, and introduced by the Bank Administration Institute (BAI). BAI2 files come to an account holder from a bank. The account holder then imports the files to a bookkeeping application and performs bank reconciliation if necessary.

A BAI2 file is a standardized file that enables organizations to reconcile their bank accounts and electronically manage their cash. It is the upgraded version of the original BAI file format. Bank reconciliation is a process that resolves the difference between the balance on a bank statement and the corresponding amount shown in an enterprise's accounting records.

Both the original and upgraded formats were developed by the U.S.-based BAI, a nonprofit organization that provides unbiased information and business intelligence, and comparative analytics tools for the global financial services industry.

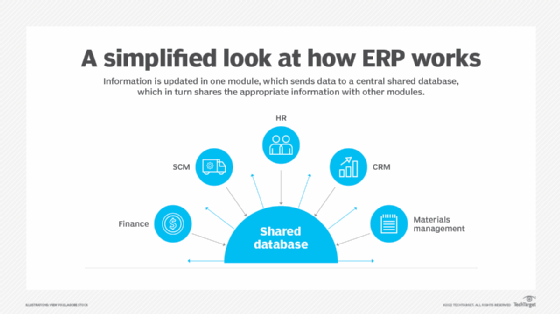

The BAI2 file provides an account holder's bank account information in a standard format. This information includes data about debits and credits, both at the end of the day and intraday. The account holder can then import the file into their transportation management system or ERP application to easily reconcile all the payments made from and receipts that entered their account.

What is a BAI2 format?

The BAI2 format refers to the file format developed by the BAI to simplify reporting of account balance information and to help businesses reconcile their accounts with minimal need for manual checks.

The BAI2 file is machine-readable, meaning it can be read by client systems, such as ERP applications. The receiving application consumes and processes the structured account information included in the file and then initiates its automated account reconciliation process. BAI2 messages are usually generated between 00:00 and 07:00 local time, although the exact times can vary depending on the previous day's transaction volumes in the account holder's account.

BAI2 file format structure

The standardized BAI2 file format includes some mandatory and some optional elements.

The mandatory elements are the following:

- File header. Identifies the file sender and recipient and describes the file structure; a BAI2 file can contain only a single group.

- Group header. Identifies the group of accounts whose information is sent by the same sender; in the BAI2 file, one group may contain several accounts.

- Account identifier. Identifies information specific to a particular account, including account number, currency code, funds type and account activity type (summary and status).

- Account trailer. Marks the end of an account and specifies the account control total and the number of account records (which may include the optional records 16: Transaction Detail Format or 88: Continuation Format).

- Group trailer. Identifies the number of accounts and records in a group and includes the group control total.

- File trailer. Specifies the file control total and the number of accounts and records in the file.

Organizations can opt for consolidated reporting, in which case the BAI2 file may contain more than one group. To create a consolidated report, the customer must customize their account grouping and provide their country and institution code. For account-level reporting, the BAI2 file will contain only one group and one account within the group.

The optional elements in a BAI2 file are as follows:

- Account transaction details. Specifies transaction details, including amount, funds type, customer reference number and transaction type code.

- Continuation. Follows record number 03, 16 or 88, and its purpose is to continue 03 or 16 records.

In most banks, the BAI2 file format uses fixed-length records. All records in a file contain fields that are delimited as per specific rules. The file must also follow rules regarding terminating a record within a file and providing leading zeros within file extracts, as well as rules around field names and data format length.

Who uses BAI2 files?

Many companies in the U.S. use BAI2 files to import their bank account statements into ERP systems so that the files can be used for accounts reconciliation. Most major global banks in the U.S. and outside the states support the BAI2 format, so non-U.S. companies holding accounts at these banks can also use BAI2 for cash management balance reporting and account reconciliation.

However, the BAI2 file has limited usefulness for non-global banks and local banks outside the U.S., so companies holding accounts at these banks generally don't use the BAI2 format.

Benefits of BAI2 files

All organizations need to reconcile their bank accounts and maintain up-to-date knowledge of cash balances. However, manual reconciliation methods can be time-consuming and prone to error, especially if the volume of transactions (payments, receipts, accounts receivables, etc.) is high. Reconciliations can also be difficult to do if bank statements are not provided in a timely manner or if there are issues related to insufficient balance or bounced checks.

The BAI2 file enables accounting teams to simplify reconciliations. It provides all necessary information in a standardized format for ease of understanding and use. Also, the file can be read by financial applications, thus enabling automated reconciliations. One of the most common applications for using BAI2 files involves the transmission of returned-check data by a bank to an account holder, an event that nearly always triggers a call for bank reconciliation. Manual reconciliations can be cumbersome in these situations. With the BAI2 file, there's no need for such manual work.

Another advantage of BAI2 is that most banks in the U.S. have adopted the format, so U.S.-based businesses have the flexibility to use the format for their reconciliation and cash management requirements. Also, companies can continue to use the format even if they move their business account to a different bank.

Learn the differences between ERP vs. accounting software and explore 7 benefits of ERP in accounting.