Getty Images/iStockphoto

PC shipments plummet as market boom ends

PC manufacturers shipped fewer than 80 million computers for the first time in seven quarters as low demand and supply chain issues hit the market, IDC reports.

A worse-than-expected drop in worldwide PC shipments indicates the end of the market's pandemic-driven growth, experts said.

Second-quarter shipments of desktops, laptops and workstations slipped by 15.3% year over year, research firm IDC reported this week. After two years of growth, it was the second straight down quarter for the PC market. Deflated enterprise demand was one of several factors that led to the dip, according to industry observers.

"By and large, the COVID-era PC boom has come to an end," IDC analyst Jitesh Ubrani said.

Manufacturers shipped fewer than 80 million PCs for the first time in seven quarters, managing only 71.3 million devices, below the previous quarter's 80.5 million. Despite the decline, the market remains above its pre-pandemic figures. In the second quarter of 2019, manufacturers shipped 65.1 million PCs.

Recession fears have weakened PC demand, with businesses and consumers tightening their belts, Ubrani said. A U.S. Department of Commerce report said household spending grew at the year's lowest rate in May.

Business PC demand hasn't fallen off as quickly. Still, some companies have delayed purchases in the face of economic uncertainty, Ubrani said.

Other businesses are looking for lower-cost computers rather than high-performing, easy-to-manage systems that cost more, said Mark Bowker, analyst at Enterprise Strategy Group (ESG). An ESG survey of 378 corporate IT buyers found that only 21% prioritized low cost. But Bowker expects that percentage to increase significantly, and IDC reported healthy demand for Windows PCs in the low-mid range.

PC saturation is also an issue along with economic worries, Gartner analyst Mikako Kitagawa said. Many companies needing laptops to accommodate remote and hybrid work had already purchased them. As a result, business demand will taper until companies need to replace the PCs they bought earlier in the pandemic. Kitagawa doesn't expect that refresh cycle to begin until 2024.

Supply chain and logistical problems wreaked havoc as well in the second quarter. China locked down dozens of cities in the spring, disrupting the country's manufacturing sector. Also, many PC makers gave up sales when they stopped doing business in Russia following its invasion of Ukraine.

China has reopened its cities, but experts do not think it's enough to change the current PC market trend. IDC expects the decline to continue for the rest of the year.

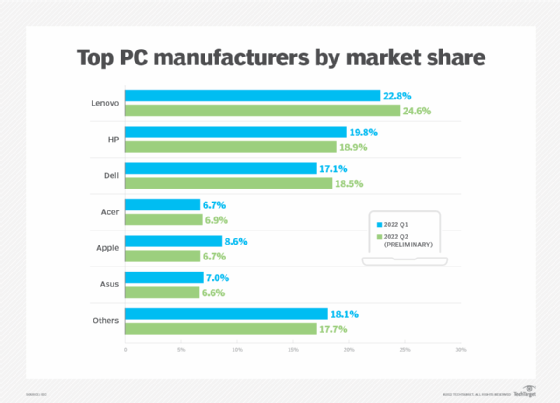

The top three PC manufacturers remained the same from last quarter, according to IDC. Lenovo gained market share, accounting for 24.6% of shipments as opposed to 23.7% in 2021. HP and Dell held 18.9% and 18.5% of the market, respectively.

Acer was fourth, with a 6.9% share.

Apple, which depends on Chinese manufacturers, slipped from fourth place because of a drop in production, IDC said. The company fell into a statistical tie with Asus at fifth, with about 6.7% of the market. Apple will likely rebound in the second half of 2022, according to IDC.

Enterprise Strategy Group is a division of TechTarget.

Mike Gleason is a reporter covering unified communications and collaboration tools. He previously covered communities in the MetroWest region of Massachusetts for the Milford Daily News, Walpole Times, Sharon Advocate and Medfield Press. He has also worked for newspapers in central Massachusetts and southwestern Vermont and served as a local editor for Patch. He can be found on Twitter at @MGleason_TT.