Getty Images/iStockphoto

Intel rolls out AI chips amid financial turmoil

Intel ships AI chips Xeon 6 and Gaudi 3 while analysts ponder how the company's severe cash shortage will transform its business over the next several years.

Intel has shipped its latest data center processor and AI accelerator, demonstrating it can get critical products to customers while wrestling with historic financial setbacks that obscure its future.

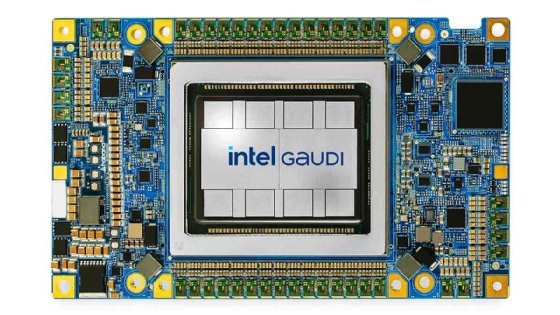

This week, Intel released its Gaudi 3 AI accelerator and its highest-performing Xeon 6 CPU to server manufacturers for delivery to customers. Intel provided details on the products in June and brought them to market on schedule.

The product shipments came several days after reports that Qualcomm had approached Intel to propose a friendly takeover and Apollo Global Management had offered to make an equity-like investment of as much as $5 billion in the company. Bloomberg and The Wall Street Journal reported the developments, quoting anonymous sources.

Intel is weighing all options as it wrestles with financial setbacks ranked as among the worse in its 56-year history. Intel's market cap is a third of what it was four years ago, and its share price is down roughly 60% as the company heads toward its third consecutive year of declining sales.

Analysts expect Intel to survive the turmoil, but the question on their minds is less about product releases and more about how the company's severe cash shortage will transform it. Future investors will expect Intel to shed assets unrelated to its core business, which is designing and manufacturing chips for data center servers and PCs.

"The value that I believe people are looking to unlock from Intel is not a growth opportunity," said David Nicholson, chief research officer at The Futurum Group. "It's an optimization opportunity. How much fat can we cut and still preserve the muscle? What would that muscle be worth over time?

"I see the vultures circling in that regard."

Non-core products that Intel designs and manufactures include network adapters and controllers and Wi-Fi and Bluetooth chips. In 2023, Intel spun off its programmable solutions group that makes field-programmable gate arrays for customizable hardware.

Xeon6, Gaudi address market demand

Xeon 6 and Gaudi 3 take Intel in the direction it needs to go within the fast-growing AI market, dominated by cloud providers buying Nvidia's high-priced GPUs to train generative AI models, analysts said.

Over the next few years, analysts expect that dynamic to change. Enterprises will buy servers with standalone AI accelerators and CPUs with neural processing units (NPU) to run small AI models focused on specific tasks, such as predictive analytics in advanced manufacturing and natural language document search within enterprises.

The Futurum Group forecasts that the use of CPUs for AI processing in data centers will increase by 28% annually through 2028 to $26 billion. Processor architectures that integrate multiple chips, including CPUs, GPUs and NPUs, will grow 31% annually to $3.7 billion.

Intel's product direction is in line with those trends, which could attract investors, analysts said. A takeover is less likely because the buyer would want to make severe cuts, such as spinning off Intel's foundry business, which had an operating loss of $7 billion in 2023.

Reviving Intel's foundry business is behind the $8.5 billion the federal government awarded the company under the Chips Act, an effort to rebuild domestic chip manufacturing. Federal regulators would look closely at dramatic changes to the business.

"I don't think anybody at this point really wants to have all of Intel," said Jack Gold, principal analyst at consulting firm J. Gold Associates.

Whatever form Intel takes to become financially healthy will take several years, so no one should expect a quick solution, said IDC analyst Shane Rau.

"The best for Intel, the best for the semiconductor market, the best for Wall Street, is patience," Rau said. "This has to play out, and we shouldn't be in a hurry for a resolution."

Antone Gonsalves is an editor at large for TechTarget Editorial, reporting on industry trends critical to enterprise tech buyers. He has worked in tech journalism for 25 years and is based in San Francisco.