Getty Images

Fallout continues over IRS ID.me facial recognition login

Taxpayers and privacy advocates continue to protest the move by the government agency. The agency may be rethinking its reliance on ID.me's biometric technology.

Backlash fueled by concern about biased facial recognition technology and technical glitches is building against the new IRS policy requiring taxpayers to log in with ID.me, a third-party biometric technology vendor, to access tax services.

Taxpayers who want to receive the Child Tax Credit or tax transcripts must now upload a selfie to ID.me to log in. By summer, after the 2021 tax season filing deadline, the IRS plans to stop accepting existing online accounts and require all taxpayers to use new accounts verified through ID.me.

Some taxpayers who have already used the ID.me system have experienced problems uploading selfies, and privacy advocates are stepping up protests against the IRS' use of the software.

Meanwhile, amid criticism that facial recognition technology can often be racially biased, the Treasury Department appears to be reconsidering the IRS' use of the ID.me software entirely.

In response to a query from TechTarget, the IRS pointed to a Jan. 28 Bloomberg report saying the agency and the Treasury Department are looking for alternatives to ID.me.

Also, in a prepared statement, the IRS said taxpayers can still make tax payments from a bank account, credit card or other means without having to use facial recognition technology or registering for an IRS account.

Protests and criticism grow

Despite a previous statement from ID.me that it uses the less prone to bias one-to-one face match as opposed to one-to-many face match, the vendor revealed in a recent blog post that it does, indeed, used the controversial one-to-many system as a final internal verification step to prevent fraud.

Privacy advocates and civil rights activists have also launched a petition calling on the IRS not to use facial recognition login systems for tax purposes.

While the criticism appears to be getting the attention of the IRS, some are skeptical that the agency will roll back the decision to require taxpayers to provide the government with images of their faces.

"It's a bureaucrat basically making a decision, and sometimes they get stubborn, and they will just push and push," said Ernest Tomkiewicz, a certified public accountant in Cambridge, Mass., adding that the IRS move could lead to other government agencies to start requiring facial recognition for their services.

Meanwhile, Tomkiewicz said his older, tech-unsavvy clients are deeply suspicious of the selfie system out of fear of personal data and identity theft and have decided to not file their taxes online this tax season. He said he expects younger clients to file their taxes at the last minute and prolong having to log in with ID.me as long as possible.

Multiple face scans

For many taxpayers, the usability of the ID.me website is also problematic.

Jennifer Stedman, a 45-year-old from Madison, Wisc., said that she has used ID.me in the past for other services, but using it to get information about and apply for the Child Tax Credit was different.

She said she had to scan her face multiple times because the photo the system took didn't match the ID photo she submitted.

"It was pretty confusing," Stedman said. "It didn't go through right away. It would say that you didn't do your scan right or something like that."

And then, about two weeks after going through the ID.me process and scanning her face, when she went back to check her account, it made her go through the process again.

"I figured after I did it once that I wasn't going to have to do it again," she added.

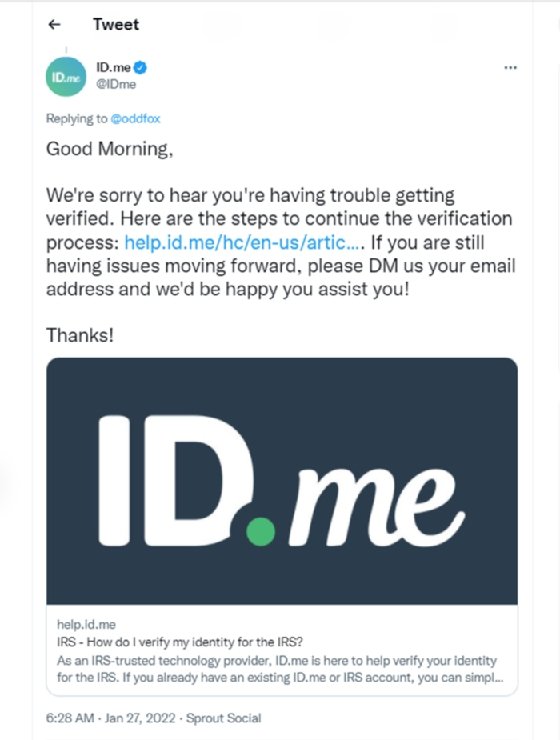

In an indication that logging into IRS accounts with ID.me can be difficult, the CEO of the biometric identification vendor responded earlier this week to several tweets from Twitter users saying they had been trying to log in to their accounts for hours.

Alternatives to facial recognition

Whether or not the Treasury Department reconsiders using ID.me, the main issue is getting fraud under control, said James Lewis, an analyst at the Center for Strategic and International Studies.

He said that while using facial recognition with ID.me is one way to do it, there may be other, better methods.

"[The IRS] might have rushed into the deal with ID.me faster than they want," he continued. "They can't continue to let tax fraud grow and so they need some solution and better identification of taxpayers as part of that."

Whatever system IRS eventually settles on will have to use some biometric recognition or better credentials, he said.

"We need something that's convenient for taxpayers and that can work online, and that points to some kind of digital solution, like facial recognition."

Fear of the technology

Lewis argued that fears surrounding facial recognition have been unfounded, and people need to be educated about how the technology works.

"There's always been problems with people being afraid of the effect of using biometric identifiers and we need to reduce that fear because every other developed country in the world uses it and we're falling behind," he said.

While it is possible to skip the ID.me verification process, and file taxes on paper, Tomkiewicz said the IRS usually scrutinizes paper returns more because there are more chances for errors.

In 2020, about 195.2 million returns and forms were filed online, making up 81.3 % of all filings, according to the IRS.

Compounding a backlog

The IRS last month urged taxpayers to use "extra caution" to avoid delays in refunds this season and said taxpayers "should file electronically with direct deposit if at all possible; filing a paper tax return this year means an extended refund delay."

At the same time, the agency is burdened with a backlog of 10 million unprocessed returns from last year, a problem largely caused by budget constraints and short staffing from diverting resources to process stimulus payments during the COVID-19 pandemic, according to a 2021 report to Congress by the Taxpayer Advocate Service.

Tomkiewicz said he foresees that the IRS will have quite a bit of trouble trying to deal with the problems associated with taxpayers required to log in with ID.me to access their tax accounts.

"It is a bit ambitious to be doing this when they still have … old tax returns and correspondences," he said. "It's going to cause a bit of a backlog and ... some hard feelings because they're going to figure they can get things done quick and it doesn't happen that way."

Dig Deeper on AI technologies

-

![]()

Post Office offered bailout to cover £104.4m IR35 tax bill linked to Horizon IT scandal

-

![]()

Tokens, trust and TEFCA: Navigating IAS and HIPAA risk

-

![]()

Decade-long IR35 dispute between IT contractor and HMRC prompts calls for off-payroll revamp

-

![]()

IR35 reforms: PAC concerned HMRC’s ‘tough’ enforcement is harming contractors