Insurer's machine learning use case: Changing driver behavior

Machine learning tools can be put to use for more than targeted marketing and product recommendations. Auto insurer HiRoad is using them to help create safer drivers.

A typical machine learning use case might involve recommending products or serving up targeted advertisements to people on websites.

However, one car insurance company wants to take data science a step further and use it to change people's behavior. That's Providence, R.I.-based HiRoad Assurance Co., a subsidiary of insurer State Farm that has built machine learning models to help promote better driving practices by its customers.

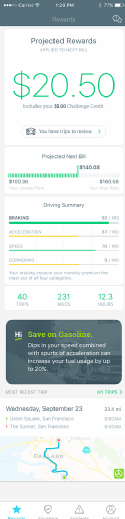

Rather than assessing drivers' past history and assigning them rates based on their presumed risk, HiRoad asks customers to download an app that tracks their driving habits to their smartphones. Data points, like average speed, braking distance and cornering speed feed into machine learning algorithms that assess each driver's risk and then assign people rates based on the risk factors. The rates are reset each month based on the previous month's driving.

When customers open the app, they can see how specific driving habits are affecting their rates and see changes they can make that will help lower their rates. Jason Sanchez, HiRoad's vice president of analytics, said this shows how powerful data science can be.

Reducing risky driving habits

"There are a lot of things machine learning enables that can be used for good," Sanchez said. "You can get one level deeper."

Of course, HiRoad isn't using its data science chops for purely humanitarian reasons. When customers reduce risky driving habits, they get in fewer accidents, which means fewer insurance claims. The company saves money when the number of customers making claims drops. Still, Sanchez said this machine learning use case is an example of how data science can shake up industries in ways that benefit everyone.

"There's a push to counteract this issue of collisions and traffic fatalities, and we want to be a part of that," Sanchez said. "[Data science] lets you intelligently improve your product. It lets you make confident incremental improvements."

To train its models, HiRoad, which currently operates only in Rhode Island, tapped into State Farm's bank of historical driving data. Its data scientists were able to define actions that led to accidents based on claims histories, and then teach machine learning algorithms to look for those actions in the driving habits of HiRoad's customers.

Collecting data on drivers' trips

The app collects data from each driver's trips and then sends the data back to HiRoad's servers at the end of the trip to be analyzed and scored. Sanchez said this session-based model helped eliminate the complications that can come from trying to do real-time scoring. The algorithms score drivers' habits and send feedback to customers to help them see what actions specifically made their scores change.

Machine learning has already caused major disruption in other industries. Uber shook up transportation with its data science-driven app that efficiently connects drivers with passengers. Airbnb did something similar in the hospitality space. Now, Sanchez hopes HiRoad's machine learning use case can change how auto insurance companies operate.

"Machine learning enables us to add features to our app that make our product possible," he said. "Without that, the whole business wouldn't be possible."