Eugenio Marongiu - Fotolia

How one company thinks chatbots and AI can change insurance

Insurance agency management company In-Fi is hoping AI chatbots can streamline homeowner insurance applications and bring the process in line with customers' expectations.

Homeowner insurance isn't generally the most exciting topic, but one company is hoping that a combination of chatbots and AI can help bring a new level of interest to the typically conservative industry.

"I don't have a lot of really exciting insurance conversations, but this is exciting," said Jon Chasteen, a partner at insurance agency management company In-Fi. "We need to make things quicker, more interactive. The ability to automate the experience of data gathering, which is so cumbersome, it's exciting."

Using a bot to simplify applications

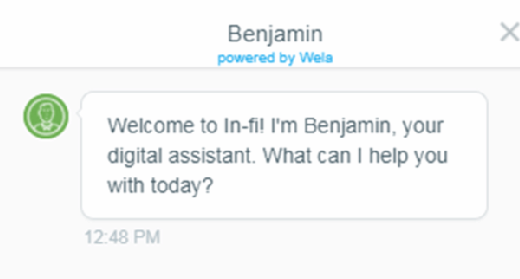

In-Fi works with local banks and other financial institutions that issue mortgages to help them set up an insurance company. In-Fi then manages the insurance entity on behalf of the financial institution. The company recently introduced a new customer service chatbot built on a platform from software vendor Wela Strategies Inc.

The bot, which Wela calls Benjamin, gathers data to smooth the application process for applicants. It combs through publicly available data sources on sites like Zillow, CoreLogic and municipal databases to automatically populate sections of the home insurance application. It also uses this data to recommend coverage options to applicants.

The bot has machine learning technology that enables it to become more natural in conversations with people -- right now, it primarily takes direction from customers without engaging in much conversation. It also develops a more comprehensive understanding of what people need in insurance as it makes recommendations and receives feedback on whether those recommendations were useful to customers.

"We did this to create scalability and efficiency," Chasteen said. "We're confirming information rather than presenting [applicants] with a blank page."

Insurance must adapt to tech trends

According to Chasteen, adopting technology like chatbots and AI is the direction in which the insurance industry needs to move. Too often, insurance companies simply follow the old ways of doing things, which typically involve pushing a lot of data gathering onto customers.

But people are getting used to new ways of doing things in other areas of their lives. AI technology is increasingly automating how people discover new products, get directions to places and manage their email inboxes. Insurance providers need to adopt similar approaches in order to stay relevant in this world, Chasteen said.

"We've got to recognize that the world is changing," he said. "People just buy things differently."

At the same time, Chasteen said he's cognizant of the need to keep humans in the loop. Selecting homeowner insurance can be a complex process, and today's chatbots and AI technology are still fairly limited in their sophistication. They aren't yet able to handle every question or concern that a customer might deal with during the process.

In-Fi keeps a team of human agents on hand to deal with the more complex issues that may arise during the process. The Benjamin chatbot primarily just helps with rote data collection. This combination of AI-powered technology handling basic tasks and humans taking care of the more complicated jobs is a good approach given where the technology is today, Chasteen said.

"We're not trying to remove the human element from buying a complex financial product," he said. "We're trying to get to a place quicker where someone can have a good understanding of their options and have a more meaningful conversation."