What is a robo-advisor? Everything to know before using one

A robo-advisor is a virtual financial advisor powered by artificial intelligence (AI) that employs an algorithm to deliver an automated selection of financial advisory services. Typically offered by brokerage firms, such as Charles Schwab, Fidelity Investments and E-Trade, robo-advisors are a type of expert system optimized for financial services, specifically for investing and portfolio management advice.

A robo-advisor is one example of a software robot, not a physical robot. However, the software supporting robo-advisors functions similarly to the AI that might drive a robot. Investors communicate with their robo-advisors through smartphone apps or over the web. Due to the automation involved in the process, robo-advisory services are typically available at a lower cost compared to traditional investment management options.

How do robo-advisors work?

There are more than 200 different robo-advisor services available, and opening a robo-advisor account is similar to opening a bank or brokerage account.

Most robo-advisors follow this basic work structure:

- When new clients register for robo-advisor services, they must complete a brief questionnaire containing demographic and cognitive questions. Usual questions include the client's age, gender, income, investing goals, liabilities, current assets and degree of risk appetite and risk tolerance. These data points are used for asset allocation in a portfolio and to predict how a person responds to stock market ups and downs.

- Robo-advisors use an algorithm and sophisticated software to process these responses and create a diversified portfolio of exchange-traded funds (ETFs) or index funds. Typically, a financial or investment professional selects the investing options.

- Once the funds are invested, the software automatically rebalances the portfolio to ensure it remains close to the target allocation.

- Some robo-advisors offer live consultations or access to a licensed human financial planner who can help prioritize objectives and make suggestions for achieving them. Users can connect to their investment accounts to monitor progress, make changes or continue pursuing their objectives.

Robo-advisors can make customers money

The following are some ways robo-advisors help customers and investors make money:

- Robo-advisor software can choose stocks for portfolios according to the balance desired by clients and provide limited financial advice. Similar to other expert systems, robo-advisors use AI technologies in conjunction with a knowledge base to simulate the judgment and behavior of an experienced human with specialist-level knowledge in a particular field. Financial institutions can save money by employing virtual assistants to deal with relatively simple requests and pass on more complex requests to human advisors. Human agents often use robo-advisors to respond more quickly to customer requests. Given that financial advisors are typically well paid, the software is relatively inexpensive to acquire and maintain. Many in the financial sector also see robo-advisors as a means of getting investing advice to the masses, with associated cost savings.

- It's also thought that robo-advisors could promote financial literacy because investors might take more time to explore portfolio options without feeling pressured to decide, which might happen when dealing with a human.

- Robo-advisors can provide access to certain investment products that might not be easily available to individual investors, such as institutional-grade funds. This access can enhance potential returns by enabling customers to invest in higher-quality assets.

- Robo-advisors automatically rebalance portfolios to maintain the desired asset allocation, helping capture gains and minimize losses while aligning with the investor's goals and risk tolerance.

Types of robo-advisors

Depending on their level of technical capabilities, scope or revenue model, robo-advisors can be divided into the following three categories.

Robo-advisors based on technical competency

These robo-advisors are classified as either simplistic or comprehensive.

Simplistic robo-advisors use traditional profiling to build a portfolio. Potential investors are required to complete a brief questionnaire to assess their risk appetite. The investor's goal while building a portfolio is taken into consideration when evaluating this information.

This article is part of

What is enterprise AI? A complete guide for businesses

Comprehensive robo-advisors use AI and data to gain a deeper understanding of the investor profile and forecast behavior in addition to the typical risk profile questionnaire. The data informs the robo-advisor about the user's current net worth, commitments, spending patterns and behavior in various settings and circumstances, while the AI learns about the user and the best investment for their profile.

For instance, INDmoney, which is a full-stack personal finance platform, uses machine learning to instantly offer customers highly tailored advice in real time.

Robo-advisors based on the revenue stream

While some robo-advisors receive a commission from the product's manufacturer, others charge investors an advising fee. The former poses a conflict of interest because its pricing might affect its recommendations. But the latter is free from any such conflicts because it doesn't rely on the manufacturer for its revenue. Hence, the investor is its only allegiance. The advising fee might range from 10 to 50 basis points -- a standard measure for interest rates and other financial aspects -- while an advisor normally charges a commission of 100 basis points.

Robo-advisors based on the scope

Based on the extent of their functionality, scope-based robo-advisors can be classified in several ways. While some robo-advisors might only offer advice on mutual funds, the majority can guide investors on a wide range of financial products and assets.

How much do robo-advisors cost?

Robo-advisors often have low or no minimum investment requirements, making them an attractive option for individuals and accessible to a wider range of investors.

The cost of using a robo-advisor typically includes two main components: management fees and expense ratios for the underlying investment funds.

Here's a breakdown of the costs:

- Management fees. Most robo-advisors charge an annual management fee ranging from 0.25% to 0.50% of assets under management, which is significantly lower than the typical fee of around 1% charged by traditional financial advisors.

- Expense ratios. In addition to management fees, investors also must pay the expense ratios of the funds included in their investment portfolios. Many robo-advisors use low-cost exchange-traded funds, which typically charge less than 0.10% per year

Some platforms can have additional fees for premium services, such as access to financial advisors or advanced features. For example, a premium tier might involve a one-time planning fee and a monthly subscription.

Advantages and limitations of robo-advisors

Robo-advisors have made prudent financial planning and investment management available to all people, not just the wealthy. The following are some advantages and limitations of robo-advisors.

Advantages of robo-advisors

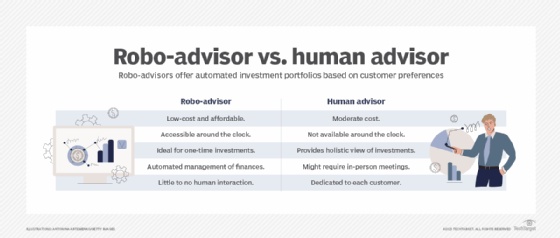

- Low cost. Robo-advisors are an inexpensive alternative to traditional financial advisors. Online platforms can provide the same services for a low advisory fee by removing or limiting the need for human involvement. Robo-advisors generally charge low portfolio management fees and offer a range of services.

- Accessibility. When compared to human advisors, robo-advisors are typically more accessible because they offer a platform that's available around the clock, all year round. Investors can access robo-advisors from anywhere at any time using an internet connection.

- No financial expertise is required. Robo-advisors are an excellent choice for beginners in investing. Even without the financial expertise required to make wise investment decisions, a person can start investing quickly.

- Time savings. Robo-advisors are a great option for people who don't have the time for investment management and would prefer to put their portfolios on autopilot. Once a robo-advisor account and automated deposits are set up, there's little to no interaction needed from the investor.

- Comprehensive services. Robo-advisors provide a wide range of services that handle all aspects of financial planning. These services include retirement accounts, tax-strategy plans and portfolio rebalancing. The robo-advisor can manage the portfolio, ensure the investor is on track to accomplish their financial goals and lower any liabilities -- all from one platform.

- Less capital required. When using robo-advisors, it costs far less money to begin investing and one can start with minimal assets. For example, one popular robo-advisor, Betterment, waives the minimum amount of money required to open an account for its basic offering.

- Efficiency. Before robo-advisors, if someone wanted to execute a transaction, they would call or meet with a financial advisor, explain their needs and then wait for the advisor to execute their trades. All of this can now be completed by pressing just a few buttons.

- Educational resources. Many robo-advisors offer educational resources and advisory services to help investors better understand their portfolios and market dynamics. These tools simplify complex financial concepts, covering topics such as asset allocation, risk management and market trends to help users make more informed decisions about their financial futures.

Limitations of robo-advisors

- Nonspecific investment options. If a person has specific ideas, they can't tell their robo-advisor to buy a particular stock they want to invest in. Instead of giving specific information, it might, for instance, offer a wide range of possibilities or ask a potential investor whether they want to take risks or be conservative. As a result, robo-advisors might not be ideal for those who want to make their own financial decisions for wealth management.

- Insufficient for complicated financial needs. Robo-advisors are a good starting point for people who have a small account and no prior investment knowledge. However, people looking for more advanced services, such as estate planning, tax management, trust fund administration or retirement planning, might find robo-advisors insufficient for their financial needs.

- Limited access to human advisors. Some robo-advisors solely provide human support for technical and account-related issues, leaving no one to address inquiries about a person's investments. Others use a hybrid methodology that lets them consult with investment advisors. However, in most cases, a user might be required to maintain a minimum account balance or pay higher management costs, and even then, a specialized advisor might not be available.

- Incomplete view of financial assets. The robo-advisor can recommend and manage an account based on the information it has, but it won't have a complete view of the client's various assets and investments. While some systems let users connect all of their financial accounts, they might still not receive the same amount of individualized guidance as they would from a financial advisor who understands the complexity of their financial situation.

- Lack of empathy. Robo-advisors have come under fire for lacking complexity and empathy given their limited human interaction and existing technical capabilities.

- Variability in performance. While robo-advisors seek to optimize returns through diversification and algorithm-driven strategies, their performance can fluctuate with market conditions. Investors typically have less control and insight into their investments compared to when they're working with a traditional advisor.

Regulations of robo-advisors

The legal standing of robo-advisors is the same as for human advisors. They're required to register with the U.S. Securities and Exchange Commission (SEC) and are bound by the same rules and laws regarding securities as conventional broker-dealers. However, on March 27, 2024, the SEC amended its rules to push certain robo-advisors to register with the Commission, marking a stricter approach to regulating digital investment services. For example, under the new rule, businesses must operate a fully interactive website that provides ongoing digital investment advice to multiple clients. Static content or one-way communication channels are not sufficient to qualify for registration.

Most robo-advisors are also members of the Financial Industry Regulatory Authority (FINRA). Anyone can use BrokerCheck, which is a free tool FINRA provides to investors to help them research robo-advisors just as they would a human advisor.

Many robo-advisors are also fiduciaries, meaning they are legally required to prioritize the best interests of their clients when offering investment advice. This obligation is in accordance with the Investment Advisers Act of 1940, which sets out the duties of loyalty and care that advisors must uphold.

Most robo-advisor assets are not insured by the Federal Deposit Insurance Corporation as they're investments in securities rather than bank deposits. However, this doesn't automatically imply that clients are unprotected. For instance, the Securities Investor Protection Corporation provides insurance for Wealthfront, a well-known robo-advisor in the U.S.

Robo-advisor services

Robo-advisors offer the following financial services:

- Portfolio management.

- Automated rebalancing of investment portfolios.

- Investment performance tracking.

- Financial planning tools, such as retirement calculators.

- Tax-loss harvesting and other tax-strategy offerings on taxable accounts.

- Goal setting and tracking.

- Personalized investment recommendations.

- Socially responsible investment strategies, such as using principles of environmental, social and governance investing.

- Access to human financial advisors for additional support and guidance.

Most reputable robo-advisors provide competitive costs, diversified portfolios, a range of account settings and easily accessible customer service. However, the robo-advisory market is constantly evolving and it's best to research and compare different providers to find the one that best suits the investor's needs and preferences.

Some providers of robo-advisory services include the following:

- Charles Schwab. Charles Schwab offers Schwab Intelligent Portfolios, which provides a user-friendly platform. The service offers automated investing strategies that build, monitor and automatically rebalance diversified portfolios based on user goals. Opening an account with this platform requires a minimum of $5,000.

- E-Trade. E-Trade provides a range of investing alternatives, such as stocks, bonds, mutual funds and ETFs. This gives investors the freedom to mix up their portfolios and select assets that suit their individual needs and tastes. E-Trade also provides live customer support.

- M1 Finance. M1 Finance combines robo-advisor automation with self-directed brokerage features, enabling users to create customizable stocks and ETFs. With fractional shares, investors can buy high-priced stocks without needing full shares, making them accessible for various budgets.

- Acorns. Acorns is a micro-investing platform that automatically invests a user's spare change from everyday purchases into a diversified ETF portfolio. With a user-friendly app, Acorns caters to beginner investors who want to manage investments on autopilot.

- Fidelity. Fidelity offers a hybrid robo-advisor named Fidelity Go, blending digital investment services with access to human financial planning and coaching. This approach lets investors enjoy both automated features and personalized financial guidance from real advisors. Fidelity doesn't charge any fees if the portfolio balance is under $25,000.

- SoFi. SoFi Invest is ideal for beginner and passive investors. It offers low fees and account minimums. This service provides varying investing options ranging from cryptocurrency to fractional shares to margin trading. While it's a robo-advisor, SoFi also offers access to human financial advisors at no additional cost.

- Vanguard. This is a low-cost option for all types of investors and offers inexpensive ETFs and index products. Vanguard provides two robo-advisor options: Vanguard Digital Advisor, a fully automated platform, and Personal Advisor, a hybrid service that combines automated portfolios with access to human advisors.

- Wealthfront. Using a short questionnaire, Wealthfront creates a personalized portfolio of low-cost index funds. It lets investors customize their portfolios based on specific interests, as well as tax-loss harvesting, which is beneficial for large portfolios in taxed accounts. In addition, Wealthfront provides access to a dedicated team of product specialists who are registered with FINRA and have financial designations ranging from certified financial planner to certified public accountant.

Is a robo-advisor right for you?

Deciding whether a robo-advisor is suitable for an investor's needs depends on several factors. Here are some key factors to consider when deciding if a robo-advisor is the right choice:

- Investment goals. For individuals with clear, long-term investment goals such as retirement, funding education or saving for a home, a robo-advisor can help achieve these objectives through automated, goal-oriented strategies.

- Time commitments. Robo-advisors are perfect for investors seeking a hands-off approach to managing their portfolios. For those who don't have the time or desire to actively monitor their investments, a robo-advisor can automate the entire process.

- Investment knowledge. Robo-advisors are suitable for investing beginners, as they offer a simple and user-friendly way to start investing without requiring them to understand complex financial concepts.

- Cost sensitivity. Robo-advisors typically offer a more cost-effective option compared to traditional financial advisors, which can be appealing for cost-conscious investors. With lower management fees and expense ratios, investors can retain a larger portion of their investment returns.

- Need for human interaction. For those who prefer personal interactions and customized advice from a financial advisor, a hybrid model or a traditional advisor might be a better option, as robo-advisors typically offer limited human support.

- Risk tolerance. Robo-advisors assess an individual's risk tolerance through questionnaires and tailor portfolios accordingly. Therefore, for those comfortable with an algorithm-based approach to risk management, robo-advisors could be a suitable option.

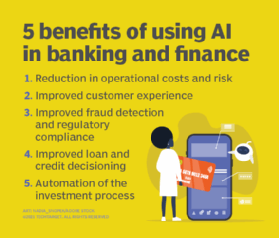

AI has been widely incorporated into the banking and finance industries. Learn how AI tools are revolutionizing financial services and the issues to be aware of. Also, see how Capital One financial services harness machine learning for several use cases and explore top AI and machine learning trends.