The 2 types of climate risk and how DR teams can prepare

Understanding the two types of climate risk and how to plan for them can help organizations better prepare for disasters and improve their impact on the environment.

Disaster recovery is inherently tied to climate change. Businesses must empower their disaster recovery teams early to navigate climate risks effectively.

As global temperatures rise and more extreme weather events occur in kind, the potential for adverse consequences affecting a business becomes greater. Organizations need to assess this risk to prepare for the related potential consequences.

There are two major categories of climate risk: physical and transitional. Physical risks account for the material effect of climate change on infrastructure, such as increased heating/cooling costs and natural disaster-related damage to data centers. Transitional risks refer to the reputational, legal and market risks an organization faces when reacting to and dealing with the effects of climate change.

Learn more about the two types of climate risk, how to assess climate risk, and some mitigation strategies IT teams and leadership can implement to prepare for the growing climate crisis.

What is climate risk?

In the context of disaster recovery, climate risk is the potential for adverse consequences for organizations and their infrastructure from the impacts of climate change.

Climate risk can also refer to the potential for adverse consequences from human response to climate change. For example, transitioning to carbon-free energy production -- a human response to climate change -- might pose a degree of risk. A consequence of clearing land for a carbon-free wind farm could be the displacement of wildlife habitats in the area.

Disaster recovery teams must be aware of the different types of climate risk and factor the potential for adverse consequences into their disaster recovery planning.

2 types of climate risk

Climate risk is a big umbrella, but the risks businesses face typically fall under two types: physical and transitional.

Physical risk

According to guidance from the Carbon Disclosure Project, physical risk is the potential for adverse consequences from the physical impacts of climate change. For example, a physical risk could be the potential for data loss on servers that are in danger of being destroyed by climate change-induced flooding in the area.

Physical risk can be further broken down into acute and chronic risks. Acute risks are event-driven risks. Using the same example as above, a flash flood is an acute event caused by climate change. Certain areas might be more prone to acute events than others.

Acute events include the following:

- Hurricanes.

- Cyclones.

- Tornadoes.

- Hail.

- Dust storms.

- Heatwaves.

- Wildfires.

- Flooding.

- Droughts.

Chronic risks are risks driven by long-term shifts in climate patterns. Using the example above again, rising sea levels year over year might cause extreme flood events to occur more frequently.

Steadily increasing temperatures is another example of a long-term change that can have physical impacts. For example, a data center that must keep all equipment cool might have increasing energy costs over time due to consistently higher outdoor temperatures, placing growing stress on its cooling systems.

Chronic issues include the following:

- Changes in precipitation patterns.

- Steadily rising global temperatures.

- Water stress.

- Ice melting.

- Land degradation.

- Sea level changes.

- Ocean acidification.

- Climate migration.

Acute and chronic physical risks can be interrelated, but it is useful to think of them separately. Both types of physical risk might require different approaches to address effectively.

Transitional risk

Transitional risk is the potential for adverse consequences organizations might face when adapting to the impacts of climate change. It can also be the transition to a new system with the goal of reducing, mitigating or avoiding the impacts of climate change.

For example, transitioning to a carbon-free energy grid to combat climate change can have adverse consequences on an organization, despite the benefits it can afford for the environment. Businesses must consider this risk equally with physical risk to ensure the organization's stability over time.

Transitional risk can be further broken down into market, policy/legal, reputational and technological risks.

Market risk. This measures the ways in which the market could be affected by climate change. For example, climate change impacts might make it more difficult to source certain materials, which could negatively affect supply and demand.

Policy/legal risk. This measures the ways in which policy actions and decisions made in attempt to adapt to, mitigate or avoid impacts from climate change might affect the organization. For example, a policy decision that requires organizations to shift to lower-carbon energy production within a five-year period could be a huge time and cost sink for a business as it adjusts operations accordingly.

Similarly, legal risk measures the ways in which litigation claims related to the impacts from climate change or the lack of adherence to climate change policies and disclosures might threaten the organization's financial withstanding. For example, what if an organization does not comply with the policy decision to shift to lower-carbon energy production within a five-year period? As a result, it could owe a sizable fee or be required to comply with some other penal action that might negatively affect the organization's bottom line.

Reputational risk. This measures the ways in which customer perceptions of an organization's climate-related actions might negatively affect financials. For example, say a company is slow to transition to clean energy. Customers could view this lack of action negatively, harming the company's reputation and potentially leading to less business and lower profits as a result.

Technological risk. This measures the ways in which technological development related to climate change transitions might negatively affect an organization. For example, climate change might necessitate new technologies, like energy efficient-batteries or renewable energy-powered servers, to be incorporated into products, or cause certain technologies to become outdated. This can lead to increased product competition in the market, higher production costs, longer manufacturing times or a shift in customer demand.

Climate risk management strategies

Understanding the two types of climate risk facing an organization is only the first step to addressing them. Disaster recovery teams and stakeholders across the organization have a few techniques, tools and strategies they can employ to assess and manage physical and transitional risk.

There are generally four phases to managing a climate risk assessment from start to finish: planning the assessment, conducting the assessment, incorporating the results and updating plans as needed.

Planning for climate risk assessment. This phase requires organizations to develop a clear plan for conducting risk assessments as well as collecting and reviewing climate information. A variety of climate risk assessments, screenings and methodologies exist, so aligning on the assessment style that works best for the organization is an important first step. Factors that might affect which style an organization chooses include whether it has in-house climate change expertise, whether it has conducted assessments previously and how quickly the business needs to conduct the assessment.

Generally, businesses won't need to gather their own climate data. Many independent organizations have compiled climate data and made it freely available online. For example, the World Bank Group's Climate Change Knowledge Portal can be a good place to find detailed climate information for different areas.

Conducting climate risk assessment. This phase involves the organization conducting the actual assessment. This process usually includes identifying climate risks; assessing those risks on a framework that measures climate risk hazards, vulnerability and exposure; determining how to address risks; planning how to manage those risks as they evolve; and mapping out how to identify new risks over time.

Incorporating results. This phase involves integrating the results of the assessment into organizational strategies and activities as well as disaster recovery plans. It requires thinking through how the business can address risks organization-wide, as well as encouraging leaders and stakeholders to make sure that the results are part of every aspect of operations.

Implementing and managing plans. This is the implementation phase, where the carefully laid-out plans are put into action and monitored. During this phase, organizations should also evaluate the success of those plans. For example, how well are climate risks being addressed? Based on this evaluation, the organization can identify next steps to ensure the ongoing management of risks.

Climate change impacts can evolve rapidly, so risk management needs to adapt quickly and comprehensively. The entire organization, including the C-suite and the disaster recovery team, must agree and align on climate risk management and mitigation strategies to ensure proper and total execution.

Steps to conduct a climate risk assessment

Here are a few general steps organizations can follow to conduct a climate risk assessment:

- Identify who will be involved in the assessment and assign responsible parties from each business unit and location as necessary.

- Determine the scope of the assessment and set a timeline with clear milestones. This should include determining how the assessment will be carried out; what risk types and scenarios will be considered; and what guidelines, standards and tools the organization will use.

- Create a list of assets and systems that will undergo analysis. This should include the location and number of facilities, resource usage and performance data, product inventory, supply chain information, land usage data, and other relevant assets and systems that could be affected by climate change.

- Gather relevant climate data. This should include current, historical and future climate data.

- Identify risks and opportunities. Based on the climate data collected, what physical and transitional risks are likely to develop? What are the potential consequences of those events, and how could they affect the organization?

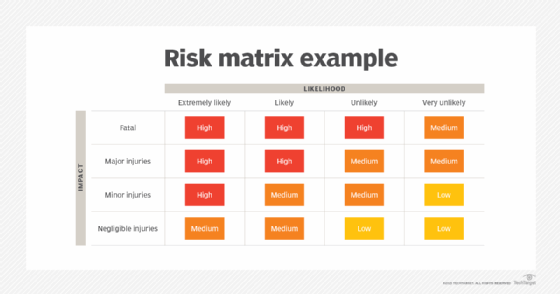

- Analyze and evaluate risks. This should include measuring each risk based on the vulnerability of assets and systems, the level of exposure to the risk, the probability of hazards occurring, the likelihood of the risk increasing over time, the magnitude of losses or impacts on the organization's strategic and financial positioning, and both the quality and quantity of potential impacts related to the risk. Evaluation should also cover how well the organization, its assets and its systems can adapt to and recover from those impacts. Consider if the organization has any strategies in place to protect against each risk, as this might affect what actions need to be taken and when. A risk assessment matrix can help visualize and prioritize risks.

- Determine how to address and monitor risks. This should include identifying how to manage risks as they evolve and how to identify new risks as they emerge.

Climate-related opportunities for improvement

Just as there are different types of climate risk to consider, there are also climate-related opportunities. These opportunities might help level out some of the risks.

According to the Task Force on Climate-Related Financial Disclosures, there are several areas of opportunity related to climate change:

- Resource efficiency. Within efforts to curb emissions, there's an opportunity to reduce overall operating costs by improving resource efficiency, particularly related to energy efficiency. More resource-efficient technologies and processes, such as recycling processes, can directly result in cost savings in addition to being generally better for the environment.

- Energy sources. Switching to low-emission energy source alternatives, such as hydro, nuclear, wind or solar, might provide an opportunity for organizations to save on energy costs. As these technologies evolve and more providers enter the space, costs might decline and fewer barriers to adoption will exist. This might make it easier and more beneficial for organizations to switch to eco-friendly alternatives.

- Products and services. Organizations might find opportunities to improve their competitive positioning by developing products and services that help reduce emissions. Doing so can make their products and services more attractive to eco-friendly clients and customers, as well as improve the organization's reputation in the market.

- Markets. The transition to a lower-carbon global economy might provide opportunities for organizations looking to diversify and access new markets. For example, organizations might be able to collaborate with governments and community groups to help this transition or discover new product opportunities to enable this shift.

- Resilience. The more resilient an organization is to climate change impacts, the better it can respond to climate risks. Organizations that focus on improving resiliency might find opportunities to improve efficiency, enhance production processes and develop new products.

Jacob Roundy is a freelance writer and editor specializing in a variety of technology topics, including data centers and sustainability.