ESG data collection: Beginning steps and best practices

Sustainability initiatives won't succeed without quality data. Following an ESG data collection framework and best practices ensures program and reporting success.

Data collection is a critical task for anyone managing a company's ESG initiatives -- but getting it right takes a nuanced understanding of the best processes.

As more companies focus on environmental, social and governance (ESG), they'll need more and better data. An ESG data collection process plays an essential role in operationalizing sustainability initiatives. The right data can show where the enterprise is today and help identify opportunities for improvement. Formalizing the data collection process helps ensure the organization complies with climate disclosure regulations and other ESG reporting needs.

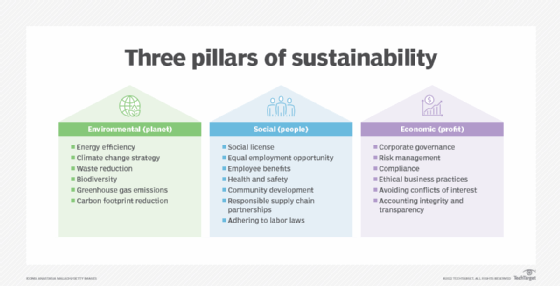

ESG data encompasses a wide array of information, but organizations may prioritize different types of data based on their industry, goals and regulatory requirements.

- Environmental aspects include energy usage, water consumption and waste output. An environmental program might involve collecting emission data between the company and its partners.

- Governance programs might focus on financial systems and contracts. This data includes executive compensation, board diversity and data privacy protections.

- Social factors include living wages and gender pay gaps, training investment, employee demographics and other information commonly contained in HR systems.

"[ESG data] is of utmost importance because it forms the basis of your evaluation, rating and ranking in your publicly available ESG and sustainability reports," said Josh Prigge, founder and CEO of Sustridge, a sustainability consultancy. These ratings and rankings are based on the transparency and quality of the data and whether it has undergone third-party auditing.

What is an ESG data collection process?

A formalized ESG data collection process provides a framework for structured data collection, aggregation, analysis and cleaning, which in turn enables accurate ESG reporting. Inaccurate reporting can lead to regulatory enforcement or litigation.

The data collection process establishes the procedure for how an organization gathers data related to ESG reporting efforts, and ensures the quality of that information. As part of that, the collection process outlines which teams have relevant data, and provides methods for ensuring accuracy and aggregating the data. Depending on the outlined process, teams might manually capture data themselves or use automated tools to help with data collection.

Businesses commonly set up an ESG data collection process because pulling data from various HR, procurement, risk management and compliance systems means a lot of data scraping, and the data is often rife with inconsistencies, said Tom Andresen Gosselin, practice director of ESG and sustainability at Schellman, a compliance consultancy.

Companies are also increasingly facing regulatory pressure for new reporting requirements, such as upcoming SEC climate reporting rules. Gosselin expects to see data reliability and accuracy mandates that require assurance. Organizations must ensure that the data collected is fully traceable; there must be controls at every data transfer, collection, aggregation and calculation point, up and through the final collating of the report.

Benefits of ESG data collection

Standardizing the ESG data collection process requires getting buy-in across the organization. Focusing on the advantages can help make the case.

Internal stakeholders should consider several benefits when making a business case to organize an ESG collection program, said Tyler Thomas, sustainability lead at AArete, a global management and technology consulting firm.

Data accuracy and reliability. A formal ESG data collection process ensures data accuracy and reliability, which provides a solid foundation to make informed decisions and set meaningful sustainability goals. In addition, stakeholders may want to advocate for automation since manual data capture and Microsoft Excel-based processes are prone to errors and inconsistencies.

Effective resource allocation. Collecting relevant ESG data allows companies to allocate resources strategically, which helps optimize the effectiveness of sustainability efforts. This is especially important since ESG programs with limited resources must prioritize initiatives to deliver the most significant environmental and social effects.

Performance monitoring and improvement. Regular ESG data collection allows businesses to measure their current state of sustainability performance. A data-driven approach helps track progress over time, identify areas for improvement and set actionable targets to reduce the organization's environmental effects.

Enhance decision-making. Access to comprehensive ESG data empowers decision-makers to integrate sustainability considerations into various aspects of the business. Organizations can use the data to identify eco-friendly suppliers, evaluate energy-efficient technologies and align the organization's values and long-term objectives with sustainable investments.

ESG data collection steps

Once an organization makes the commitment to collect ESG data, it must implement a process to ensure the collection and quality of necessary ESG data. Experts recommend six steps to get an ESG collection process up and running:

1. Understand the type of data

Organizations must understand the type of data they need before they initiate data collection. Start the process with a materiality assessment to identify the business's significant ESG issues.

Then determine the metrics and data to collect for each issue. For help identifying which metrics to track, consult various ESG reporting frameworks, such as the Global Reporting Initiative, Sustainability Accounting Standards Board, International Sustainability Standards Board and Task Force on Climate-Related Financial Disclosures.

2. Identify leaders

After pinpointing the required metrics, identify the individuals in the organization responsible for -- or who will have access to -- the data. Compile a list of subject matter experts or data collectors to work with.

3. Hold a kickoff meeting

Convene a kickoff meeting to introduce the project, explain its importance and discuss the information required from each participant in the data collection process.

"If you can involve top-level leadership like the C-suite to show their support for this initiative, it often aids in data collection, fostering greater engagement across the organization," Prigge said.

4. Follow up

After the kickoff meeting, send each data collector an email specifying the needed data. It is important to work directly with data collectors to answer any questions and clarify ambiguities. If data is incomplete or unavailable, such as the waste data for a building the organization doesn't own, make an estimate based on factors such as square footage or number of employees. Carefully work through any assumptions or estimations required.

5. Set up automation

Explore automated software to streamline the aggregation and reporting process. Automated tools gather and organize large volumes of information from many sources across an organization. They can increase data collection accuracy and reduce the risk of human mistakes. Automated tools often help speed up the data analysis process and improve decision-making.

6. Assess the program

A shift toward automated tools allows teams to focus more on strategy and less on manual data collection. It's important to understand the data to ensure data quality and apply it effectively.

How Zayo installed an ESG program

The ESG program for communications infrastructure provider Zayo Group is led by Mike Nold, executive vice president of corporate development and strategy. In the beginning, he found that people who were best able to collect the data viewed it as a lower priority than other responsibilities. Zayo worked with outside experts at the consulting firms Optera and Bain & Company to help navigate ESG data collection and set up a strategic plan.

"Especially for larger companies with complex environmental and geographic footprints, employing expert third parties could be a necessary and valuable catalyst in the journey," Nold said.

Working with the CEO is important to develop metrics to share across the organization and helps align incentives and prioritization. They determined having a central person or team solely focused on ESG was most effective because it was a cross-company and cross-functional effort.

The team members prioritized which data was critical to collect to ensure they did not get bogged down in nonessential data. They conducted a materiality assessment of their most important metrics through input from employees, customers, investors, industry consultants and their board of directors. They also analyzed current and pending compliance and regulatory requirements as part of the process. It was important to prioritize metrics irrespective of the immediate ability to systematically collect the data for those metrics.

"ESG data collection is complex and a new muscle for most companies," Nold said. "To do it well requires prioritization, aligned incentives, focus and a commitment to achieving excellence as it would for any key strategic initiative."

ESG data collection best practices

When setting up an ESG data collection process, experts recommend several best practices to maximize performance and ensure success:

Use automation. Implement automation to improve efficiency and accuracy. Automation can cover data extraction from external systems, third-party data sources and sustainability surveys.

Centralize efforts and standardize practices. A centralized ESG data management team helps ensure consistency and alignment across the organization. This team oversees data collection, analysis and reporting processes. It can also define consistent methodologies and metrics, enhance data comparability and ensure data integrity.

"ESG data usually lives across numerous departments, who are used to managing data in various ways, and standardizing the ESG data capture is crucial for having consistent insights," Thomas said.

Create regular data validation and verification processes. Periodically validate and verify ESG data to maintain data accuracy and reliability. Comprehensive practices include internal audits and external checks to enhance credibility, which demonstrates a commitment to transparency and accountability.

Focus on data security and privacy. Some ESG data, such as employee records or customer information, is sensitive. Strong data protection can safeguard data from unauthorized access.

Create a single source of truth (SSOT). Look for tools to help create an SSOT dashboard. A dashboard can provide a comprehensive view of the organization's ESG metrics, which enables stakeholders to access real-time data and track ESG performance against sustainability goals. It can display KPIs, trends and targets in a user-friendly format.

Include references. It is important to ensure auditors or regulators can reverse engineer any emissions reports, Gosselin said. Include original references to any calculations based on public data used to extrapolate and estimate effects.

Work with the audit team. Ensure the internal audit aligns with the reliability and accuracy tests of data sets they might not be familiar with, Gosselin said.

George Lawton is a journalist based in London. Over the last 30 years he has written more than 3,000 stories about computers, communications, knowledge management, business, health and other areas that interest him.