peshkova - Fotolia

Future of MongoDB could be brighter than other NoSQL engines

Top NoSQL database MongoDB, once thought of as a revolution in data management, has come back to Earth some, but it still has a chance to stay ahead of competitors.

Much of today's data is unstructured; it doesn't fit neatly into relational rows and columns. A one-size-fits-all database won't do.

NoSQL databases, the most ubiquitous of which is MongoDB, were once seen as the most obvious solution to this problem, but they've levelled in popularity recently. The future of MongoDB will be impacted by these broader trends, but there is reason to think it could rise above the sea of NoSQL competitors.

The rise -- and fall -- of NoSQL offerings

The need of businesses to store unstructured data while providing high degrees of scalability, data distribution and availability are drivers behind the growth of NoSQL offerings. NoSQL broadens the range of data store alternatives for IT shops. It allows them to customize a database architecture to meet each application's unique storage and processing requirements.

The inception of NoSQL as a class of products is older than most realize. Neo4j, a NoSQL graph database project, started in 2000 with the first production deployment in 2003. Between 2005 and 2010, a range of NoSQL offerings hit the market, including MongoDB, CouchDB, Cassandra, Redis and HBase.

As NoSQL platforms gained interest, I led a project to build a remote DBA support practice for a NoSQL database. My goal was to select a product that would grow in popularity. And after a lengthy evaluation, I chose MongoDB as the first platform we'd support; it seemed as if its schema-less structure and sharding capabilities would make it a formidable competitor. I also thought that the document storage model of MongoDB would apply to a wide range of application requirements. Most other NoSQL platforms seemed to have a much narrower usage model. The future of MongoDB looked brightest.

Since that time, the NoSQL class of products has closely followed the Gartner Hype Cycle. When the IT community first became interested in NoSQL, numerous industry analysts proclaimed that NoSQL platforms would eventually supplant relational products as the enterprise DBMS of choice. Gartner described this as "The Peak of Inflated Expectations."

Once IT shops started to build and implement applications using NoSQL platforms, they began to understand each product's true capabilities. Like all maturing technologies, industry hype and the IT community's inflated assumptions gave way to more realistic expectations. Product growth rates for most NoSQL offerings fell accordingly.

Even though NoSQL products don't have the overwhelming interest they once did, MongoDB continues to grow market share. According to an article in investor site The Motley Fool, from 2018 to 2019, the platform's Atlas DBaaS product experienced a 400% growth rate -- and the vendor's total revenue grew by 71% to $85.5 million. DB-Engines, a website that ranks the internet popularity of database management systems, ranks MongoDB as the fifth most popular database vendor.

A challenging future for MongoDB

The future of MongoDB won't be an easy one. When you compare market offerings, the vendor with the best technology doesn't always win for market share -- or even survive as a competitor. This is especially true when vendors must go up against products from larger, more entrenched competitors. Database mega-vendors likely won't sit idly by and allow upstart NoSQL platforms to steal their market share.

For example, Amazon launched DocumentDB, a MongoDB-compatible database offering, in 2019. Oracle states that 18c and 19c fully support the document storage model and database sharding. And Microsoft Azure Cosmos DB is a globally distributed, multi-model database service that provides support for the document storage model.

Database management system industry heavyweights, although distracted by various cloud initiatives, will continue to co-opt any technology that challenges them as leaders. They'll ensure that technologies using products like MongoDB will become components of -- not replacements for -- their database offerings. The key to the continued market dominance for these mega-vendors will be their ability to identify and appropriate technologies that will become more widely adopted versus those that will continue as niche offerings.

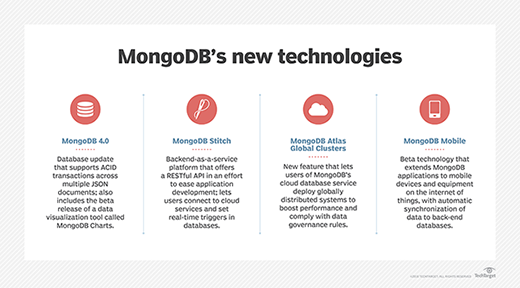

To differentiate its products from competitors, MongoDB must constantly innovate and integrate new features. This constant differentiation will be an absolute requirement -- not a guarantee -- for its survival. Each new release of every database product must contain numerous new features and functionalities.

Database vendors must add new features to remain competitive. Such a competitive marketplace forces all software vendors to maximize their products' inherent feature sets. Constant innovation and integration of new features that differentiate products from other vendors is an absolute requirement for MongoDB to continue to grow.