imtmphoto - Fotolia

Which converged infrastructure vendors are businesses considering?

Today's fast-paced business landscape has led enterprises to increasingly turn to convergence vendors. See why, which they are choosing and who leads the market.

However you define it, convergence -- be it converged or hyper-converged and, to a lesser extent, composable -- is quickly finding a home in the data centers of more and more enterprises. Earnings on the part of hyper-converged and converged infrastructure vendors reflect this uptake in converged data center adoption.

According to its analyst firm IDC's Worldwide Quarterly Converged Systems Tracker (September 2019), the overall converged systems market grew 10.9% year over year to $3.9 billion in the second quarter of 2019. Reference systems and integrated infrastructure (your typical converged infrastructure) accounted for 37.5% of revenue year over year with $1.5 billion in sales; integrated platforms 16%, $636 million; and hyper-converged 46.6%, $1.8 billion.

While organizations have more choices than ever for going the converged data center route, market consolidation has strengthened the positions of more established suppliers. Let's explore which hyper-converged and converged infrastructure vendors businesses are considering for their upcoming data center convergence deployments.

Converged infrastructure vendors

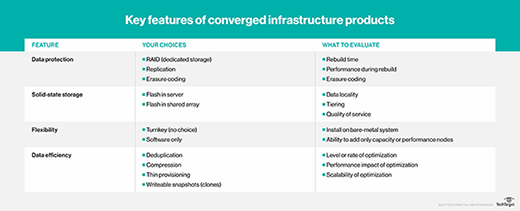

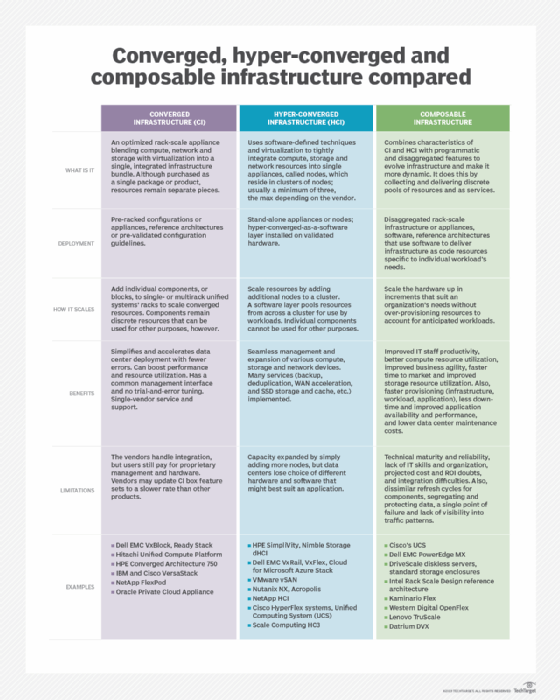

The development of converged infrastructure (CI) started the whole modern data center convergence trend. Essentially, converged infrastructure vendors offer prequalified turnkey appliances and reference architectures with server, storage, networking and so on to make it easier to deploy, manage and maintain data center infrastructure. It does this by decreasing the chances of enterprises running into management and compatibility problems.

Established CI vendors include Cisco Systems, Dell EMC, Hewlett Packard Enterprise (HPE), Hitachi Data Systems, IBM, NetApp, Nutanix, Oracle and Rackspace. Examples of converged infrastructure products include Dell EMC VxBlock and Ready Stack, Hitachi Unified Compute Platform, HPE Converged Architecture 750, IBM PureFlex System, IBM and Cisco VersaStack, NetApp FlexPod, Oracle Private Cloud Appliance and Exalogic, and Rackspace OpenStack.

Hyper-converged infrastructure vendors

Hyper-converged infrastructure is a software-defined infrastructure option that consolidates compute, storage and network resources and hypervisors into appliances that scale from a minimum of three nodes to much higher -- how high depends on the HCI vendor and configuration -- in what's called a cluster. If you need more compute or storage, simply plug another node into the cluster.

IDC reported the top three HCI vendors accounted for close to 50% of the total market by branded revenue and 72% by software. Dell Technologies led the branded category with 29.2% ($533.2 million) of total earnings. No. 2 Nutanix brought in $258.9 million, 14.2%, and Cisco Systems placed third with $114 million, 6.2%.

Gauging the market by HCI software placed VMware on top with $694.1 million in revenue, a 38% share, Nutanix in second with $522 million, 28.6%, and Cisco in third with 6.2%. The previous quarter had HPE coming out ahead of Cisco by a mere 0.1% to place third in both the branded and software categories. Other leading HCI vendors include Datrium, Maxta, NetApp, Nutanix, Pivot3 and Scale Computing.

Examples of hyper-converged products include Cisco Unified Computing System (UCS) and HyperFlex system, Dell EMC VxRail and VxFlex, HPE SimpliVity and Nimble Storage dHC, Microsoft Azure Stack HCI, NetApp HCI, Nutanix NX system and Acropolis, Pivot3 Acuity Datacenter Series, Scale Computing HC3, and VMware vSAN.

Composable infrastructure vendors

Composable infrastructure features aspects of both converged and hyper-converged infrastructures. Except, unlike those two kinds of converged data center technologies, composable disaggregates computer resources across the network and then pools them into discrete categories of compute, storage, memory, etc. This allows administrators to programmatically create server instances quickly or on the fly for specific workloads. Composable infrastructure promises to be more dynamic than either CI or HCI and is, therefore, considered a good option for today's fast-paced business requirements.

Evaluator Group released its Composable Infrastructure Evaluation Guide in July 2019. There, it listed notable composable vendors and products on the market. These include HPE's Synergy platform with an installed base of more than 1,700 customers; Cisco's Unified Computing System, an early example of the technology; and the Dell EMC PowerEdge MX. The report also cited Liqid and its PCIe fabric switch, which composes bare-metal servers with various resources; DriveScale with its diskless servers and standard storage enclosures; and Intel's Rack Scale Design reference architecture.

Other notable composable products include HPE's SimpliVity with Composable Fabric, which brings composability to HPE's HCI system; Kaminario Flex for that vendor's all-flash environments; and Western Digital OpenFlex for avoiding storage and compute overprovisioning and underutilization. Additional examples in this varied converged data center infrastructure category include Lenovo TruScale and Datrium DVX.

Future growth

Expect converged data center adoption to accelerate even further as enterprises look for ways to transform and remain competitive in today's analytics-hungry, faster paced and increasingly competitive digital business environments. Market researcher Technavio projected in April 2019 the global converged infrastructure and HCI market would grow at a compound annual rate of close to 22% between 2019 and 2023, for example. A key driver of this growth, it predicted, would be the increasing demand for an alternative to the cloud. In its "Converged Data Center Infrastructure Market" report released around the same time, Market Research Future forecasted a similar growth rate of 23% for that same period.