What is a top barrier to fruitful server refresh cycle negotiations?

Successfully countering server vendor sales tactics requires forecasting hardware and maintenance needs. Lacking a solid, consolidated forecast can be a recipe for failure.

It may seem like server vendors have all the power when it comes to negotiating server refresh and renewals, but it doesn't have to be that way. Organizations can take control of the deal-making timeline by implementing what IT consultancy ClearEdge Partners calls a "buyer's playbook" in conjunction with a 12- to 18-month quarterly forecast.

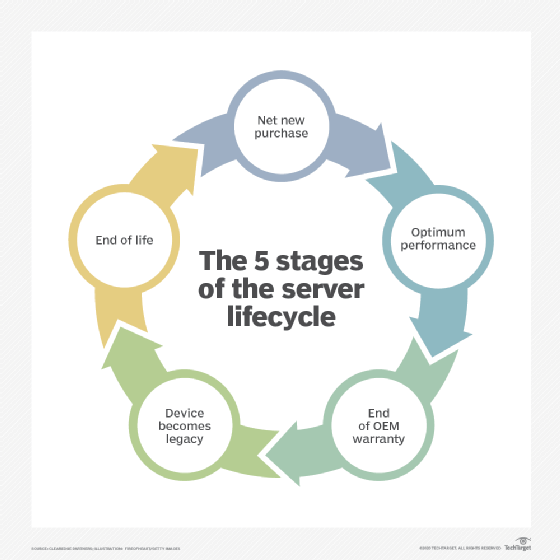

The forecast, in particular, is essential to successful server hardware and maintenance refresh and renewals, ClearEdge analysts Danilo Milevsky and Atish Patel emphasized during the webinar Moments of Truth in the Server Lifecycle. In fact, forecasting is the most important tool you can have in your arsenal at negotiation time, during any of the five stages of the server lifecycle, they said.

Server refresh cycle deal-making best practices

At each of these stages -- net new purchase, optimum performance, end of the OEM warranty, device becomes legacy and end of life -- server vendors have ingrained sales tactics involving bundling, rushing purchases and pushing early upgrades that they use to get customers to buy more than they need, often for more than they should be paying. That's where the buyer's playbook (a kind of checklist or cheat sheet) and forecast enters the picture.

The buyer's playbook includes three areas of focus -- transparency, demand modeling and configurations -- that correspond directly to and counter the bundling, rushed purchases and early upgrade sales strategies of server suppliers. Forecasting supports all of this through three pillars: quarterly breakdowns; server refresh, upgrades and maintenance details; and the tracking of the previous discounts the server vendor offered.

Considering how important forecasting is to successful server hardware and maintenance refresh and renewals, what is the chief barrier to entering server deal negotiations with a solid 12- to 18-month forecast in hand?

Forecasting alignment key for server refresh cycle negotiations

According to ClearEdge's Milevsky, "alignment [is] easily the No. 1 barrier." That's because an organization will often have multiple forecasts circulating -- none of which are comprehensive. "Your procurement might have a forecast. Your tech team might have a forecast. The business might have a forecast. They all look [at the situation] differently because people have different motivations," he said.

The tech team has its own motivations when creating forecasts, Milevsky added, for example. So, it might not factor in discounts -- at least, not at first -- because what they really care most about are technical requirements. "So, getting those pieces aligned to build a forecast that contains all those three things, those best practices that I laid out [quarterly breakdowns, server refresh, upgrades and maintenance details, and precedent discounts] is the real challenge for companies," he explained.

Forecasting components

ClearEdge analysts say a 12- to 18-month forecast is the most essential thing you can have when negotiating a server deal, at any point during the five stages of the server lifecycle. With that in mind, the consultant firm developed three best practices based on all the deals they've seen and reviewed.

- Quarterly breakdowns. Most server refresh and renewal forecasts ClearEdge have seen are for the next 12 months of knowing what's coming. But you need to get granular (quarterly) so you will know when you need to upgrade and/or purchase new servers by and have a better chance of stretching the timeline at your -- not the server supplier's -- convenience.

- Includes server refresh, upgrades and maintenance data. Often, forecasts don't include these important aspects of the server lifecycle. Having that data in a spreadsheet and at the ready is to your advantage during negotiations with your server vendor.

- Precedent discounts. Keep track of what you get in your discount percentages, especially from your last negotiation round with your server supplier. That way, when a sales representative comes to you offering a lower discount than you got the previous year, you can point it out and demand comparable savings.

Appointing a deal leader who manages the deal-making team and all the moving parts of the negotiation process is important here, he added. The leader would do that by, in part, consolidating the disparate forecasts from throughout the different departments in the organization into a single authoritative forecast.

"That deal leader can come from any different department, whether it's a businessperson, an IT person, or procurement, sourcing -- whatever it is -- finance," for instance, Milevsky noted. "As long as it's someone who is going to consolidate that data and, kind of, be the leader on the team here and get that alignment."

"That's where we see things go well," he concluded.

About ClearEdge Partners

Founded by senior sales executives from large IT suppliers and informed by current market analytics, ClearEdge enables CIOs and their teams to make more competitive IT investments. By combining rigorous inspection and IT financial expertise, they identify risk and opportunity, align internal teams, and maintain leverage throughout the lifecycle of supplier relationships. As a result, their clients maximize the value of their investments by unlocking millions of dollars from legacy spending and redirecting funds toward IT modernization, digital and cloud transformation with confidence and speed.